Logitech 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7. Mandatory Offer and Change of Control Provisions

7.1 Mandatory Offer

Swiss law requires that any shareholder who acquires more than 33

1

⁄

3

% of the voting rights of a Swiss

company whose shares are listed in whole or in part in Switzerland is required to make an offer to acquire all

listed equity securities of the company at a minimum price. Logitech International S.A.’s Articles of

Incorporation do not remove this requirement. The Articles do not increase the participation threshold above

which an offer must be made. Consequently, any person having acquired more than a third of the Company’s

voting rights will be required to make an offer for all outstanding shares of the Company.

7.2 Change of Control Provisions

Logitech’s Executive Officers generally have Change of Control Severance Agreements with Logitech.

Under the terms of these agreements, if the Executive Officer’s employment is involuntarily terminated or they

are demoted within 12 months after a change in control of Logitech, the executive would receive his or her base

salary, annual and quarterly bonuses, and payment of health benefits for up to a year following the termination,

as well as 100% vesting of all unvested stock options. In the case of a demotion, the Executive Officer would be

required to remain employed for a period of time (generally 12 months) in order to receive these benefits.

There are no agreements providing for payment of any consideration to any non-executive Director upon

termination of his services with the Company.

8. Auditors

8.1 Duration of Mandate and Term of Office of the Independent Auditors

Under the Company’s Articles of Incorporation, the shareholders appoint the Company’s independent

auditors each year at the Annual General Meeting. Re-appointment is permitted.

The Company’s Independent Auditors are currently PricewaterhouseCoopers S.A., or PwC, Lausanne

branch, 45, Avenue C.F. Ramuz, P.O. Box 1172, CH-1001, Lausanne, Switzerland. PwC assumed its first audit

mandate for Logitech in 1988. They were reappointed as the Company’s statutory and group auditors in June

2004. Since fiscal year 2000, the responsible principal audit partner has been Michael Foley.

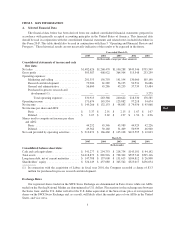

8.2/3 Audit Fees

In addition to the audit services PwC provides with respect to Logitech’s annual audited consolidated

financial statements and other filings with the Securities and Exchange Commission, PwC has provided non-

audit services to Logitech in the past and may provide them in the future. Non-audit services are services other

than those provided in connection with an audit or a review of the financial statements of the Company. The

Audit Committee of the Board of Directors determined that the rendering of non-audit services by PwC was

compatible with maintaining their independence.

During fiscal year 2005, PwC performed the following non-audit services that were approved by the Audit

Committee: tax planning and compliance advice, advising on potential acquisitions and other transactions,

consultations regarding stock-based compensation, expatriate tax services and the implementation of Section 404

of the Sarbanes-Oxley Act.

CG-23

CG

20-F

LISA