Logitech 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

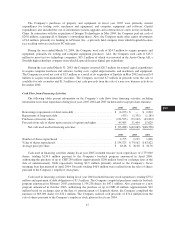

The Company’s purchases of property and equipment in fiscal year 2005 were primarily normal

expenditures for tooling costs, machinery and equipment, and computer equipment and software. Capital

expenditures also included the cost of information systems upgrades and construction of a new factory in Suzhou,

China. In connection with the acquisition of Intrigue Technologies in May 2004, the Company paid net cash of

$29.8 million, acquiring all of Intrigue’s outstanding shares. Also, the Company made other equity investments

of $.6 million, primarily for funding in A4Vision, Inc., a privately held company from which Logitech licenses

face tracking software used in its PC webcams.

During the year ended March 31, 2004, the Company used cash of $24.7 million to acquire property and

equipment, primarily for tooling and computer equipment purchases. Also, the Company used cash of $15.5

million to invest in two technology companies, $15.1 million of which was invested in the Anoto Group AB, a

Swedish high technology company from which Logitech licenses digital pen technology.

During the year ended March 31, 2003, the Company invested $28.7 million for normal capital expenditures

to acquire computer hardware and software, tooling costs, capital improvements, and machinery and equipment.

The Company received net cash of $2.5 million as a result of its acquisition of Spotlife in May 2002 and used $.4

million to acquire non-marketable securities. The Company received $.7 million in proceeds from the sale of

available-for-sale securities and $1.3 million of net cash proceeds from the sale of a non-core business activity in

December 2002.

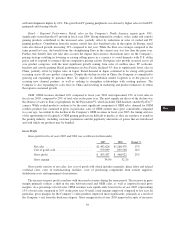

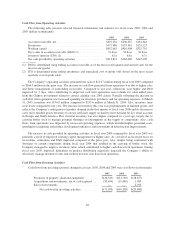

Cash Flow from Financing Activities

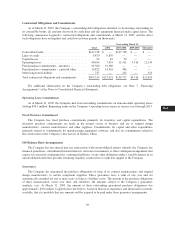

The following tables present information on the Company’s cash flows from financing activities, including

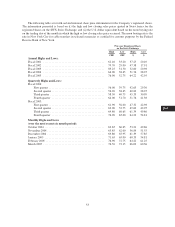

information on its share repurchases during fiscal years 2005, 2004 and 2003 (in thousands except per share amounts):

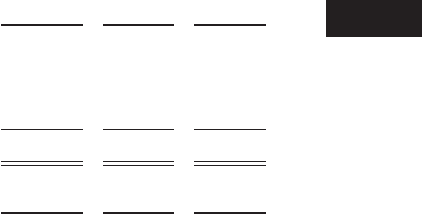

2005 2004 2003

Borrowings (repayments) of short-term debt ........................... $ (4,073) $ — $ 2,822

Repayments of long-term debt ...................................... (475) (1,331) (1,185)

Purchases of treasury shares ........................................ (134,525) (79,162) (63,822)

Proceeds from sale of shares upon exercise of options and rights ........... 45,985 31,404 15,629

Net cash used used in financing activities ......................... $ (93,088) $(49,089) $(46,556)

2005 2004 2003

Number of shares repurchased ...................................... 2,775 2,199 1,836

Value of shares repurchased ........................................ $134,525 $ 79,162 $ 63,822

Average price per share ........................................... $ 48.48 $ 36.00 $ 34.76

Cash used in financing activities during fiscal year 2005 included treasury stock repurchases of 2,775,000

shares, totaling $134.5 million pursuant to the Company’s buyback program announced in April 2004,

authorizing the purchase of up to CHF 250 million (approximately $200 million based on exchange rates at the

date of announcement). Debt repayments totaling $4.5 million primarily related to the Company’s Swiss

mortgage loan that matured in April 2004. Proceeds totaling $46.0 million were realized from the sales of shares

pursuant to the Company’s employee stock plans.

Cash used in financing activities during fiscal year 2004 included treasury stock repurchases totaling $79.2

million and repayment of debt obligations of $1.3 million. The Company completed purchases under its buyback

program announced in February 2003, purchasing 1,534,236 shares for $47.1 million. Also, pursuant to a new

program announced in October 2003, authorizing the purchase of up to CHF 40 million (approximately $32

million based on exchange rates at the date of announcement) of Logitech shares, the Company completed the

purchase of 665,000 shares for $32.1 million. The Company realized cash proceeds of $31.4 million from the

sale of shares pursuant to the Company’s employee stock plans in fiscal year 2004.

47

CG

20-F

LISA