Logitech 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

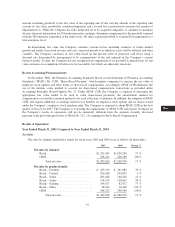

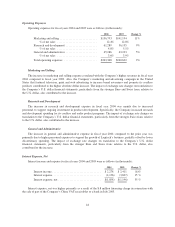

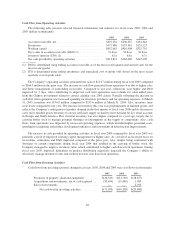

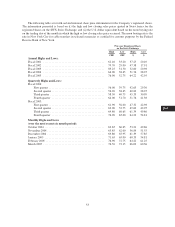

Cash Flow from Operating Activities

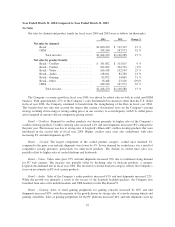

The following table presents selected financial information and statistics for fiscal years 2005, 2004 and

2003 (dollars in thousands):

2005 2004 2003

Accounts receivable, net ............................... $229,234 $206,187 $181,644

Inventories .......................................... $175,986 $135,561 $124,123

Working capital ...................................... $452,663 $410,908 $325,701

Days sales in accounts receivable (DSO) (1) ................ 51days 53days 54days

Inventory turnover (ITO) (2) ............................ 6.1x 6.8x 6.7x

Net cash provided by operating activities .................. $213,674 $166,460 $145,108

(1) DSO is determined using ending accounts receivable as of the most recent quarter-end and net sales for the

most recent quarter.

(2) ITO is determined using ending inventories and annualized cost of goods sold (based on the most recent

quarterly cost of goods sold).

The Company’s operating activities generated net cash of $213.7 million during fiscal year 2005 compared

to $166.5 million in the prior year. The increase in cash flow generated from operations was due to higher sales

and better management of outstanding receivables. Compared to last year, collections were higher and DSO

improved by 2 days. Also contributing to improved cash from operations were refunds for value-added taxes

from the Chinese government related to certain calendar year 2003 claims. Partially offsetting the increase in

cash flow from operations was increased spending for inventory purchases and for operating expenses. At March

31, 2005, inventory was $176.0 million compared to $135.6 million at March 31, 2004. Also, inventory turns

were lower compared to last year. The increase in inventory this year was predominantly in finished goods, and

reflects the Company’s anticipation of product demand in the first quarter of fiscal year 2006 and its decision to

carry more finished goods inventory to ensure sufficient supply on hand to meet demand for key retail accounts

in Europe and North America. Raw material inventory was also higher compared to a year ago, largely due to

carrying buffer stock to manage potential shortages or interruptions in the supply of components. Also, cash

flows from operations was impacted by increased operating expenses, which included higher personnel costs,

spending for marketing and product development initiatives and investments in infrastructure improvements.

The increase in cash provided by operating activities in fiscal year 2004 compared to fiscal year 2003 was

primarily a result of improved working capital management on higher sales. As a result of an increased focus on

receivables, collections and DSO improved compared to the prior year. Also, despite being confronted with

shortages of certain components during fiscal year 2004 that resulted in the carrying of buffer stock, the

Company managed to improve inventory turns, which contributed to higher cash flows from operations. During

fiscal year 2003, logistical difficulties in product distribution negatively impacted the Company’s ability to

effectively manage inventory levels and resulted in lower cash flow from operations.

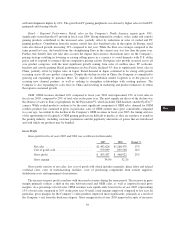

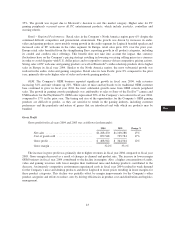

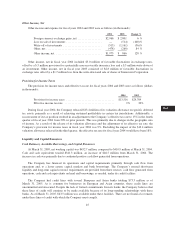

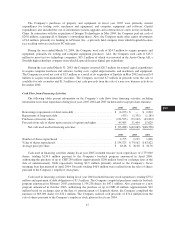

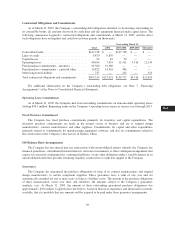

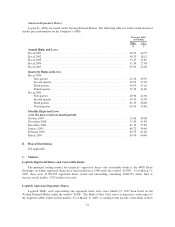

Cash Flow from Investing Activities

Cash flows from investing activities during fiscal years 2005, 2004 and 2003 were as follows (in thousands):

2005 2004 2003

Purchases of property, plant and equipment ......... $(40,541) $(24,718) $(28,657)

Acquisitions and investments, net of cash acquired .... (30,494) (15,490) 1,985

Sales of investments ............................ — — 2,072

Net cash used in investing activities ........... $(71,035) $(40,208) $(24,600)

46