Logitech 2005 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

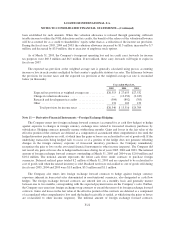

Compensation expense is recognized over the vesting period when the exercise price of an option is less

than the fair market value of the underlying stock on the date of grant. Compensation expense of $92,000 was

recorded in fiscal year 2003 for such option grants. This amount was accrued as a liability when the expense was

recognized and subsequently credited to additional paid-in capital upon exercise of the related stock option. No

compensation expense was recognized in fiscal years 2005 and 2004, and no further compensation expense will

be recognized in future periods related to these historical grants.

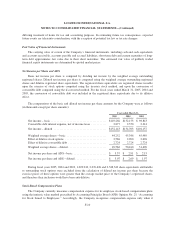

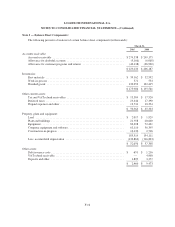

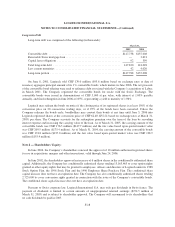

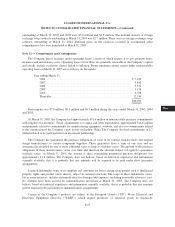

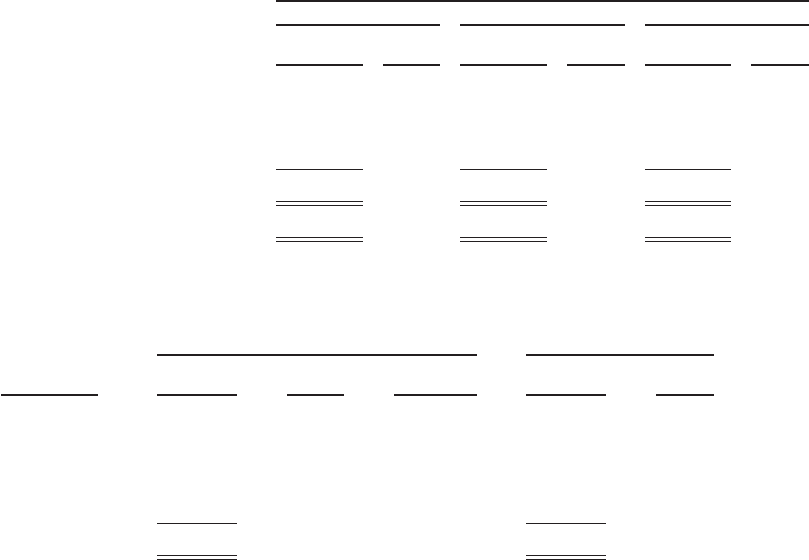

A summary of activity under the stock option plans is as follows (exercise prices are weighted averages):

Year ended March 31,

2005 2004 2003

Number

Exercise

Price Number

Exercise

Price Number

Exercise

Price

Outstanding, beginning of year .......... 7,164,098 $26 7,737,136 $21 7,787,950 $17

Granted ............................. 1,296,730 $47 1,249,880 $33 1,581,725 $31

Exercised ........................... (1,828,678) $21 (1,577,644) $16 (1,301,845) $ 9

Cancelled or expired ................... (157,819) $36 (245,274) $34 (330,694) $30

Outstanding, end of year ................ 6,474,331 $32 7,164,098 $26 7,737,136 $21

Exercisable, end of year ................ 2,780,590 $25 3,291,734 $19 3,612,857 $13

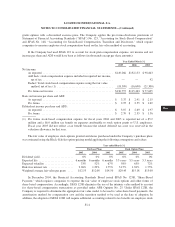

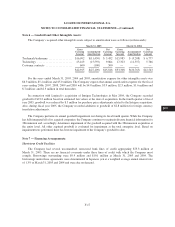

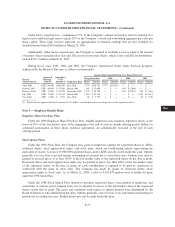

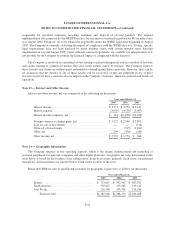

The following table summarizes information regarding stock options outstanding at March 31, 2005

(exercise prices and contractual lives are weighted averages):

Options Outstanding Options Exercisable

Range of

Exercise Price Number

Exercise

Price

Contractual

Life (years) Number

Exercise

Price

$ 4 – $20.99 1,210,303 $10 4.4 1,054,119 $ 8

$21 – $30.99 1,411,473 $27 6.8 656,725 $28

$31 – $35.99 1,817,282 $33 7.7 571,356 $34

$36 – $45.99 1,215,973 $44 8.4 255,840 $40

$46 – $68.99 819,300 $50 8.2 242,550 $49

$ 4 – $68.99 6,474,331 $32 7.1 2,780,590 $25

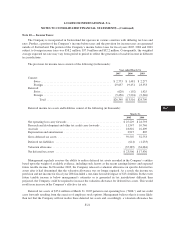

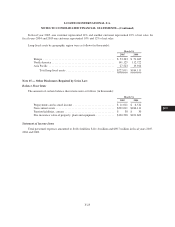

Defined Contribution Plans

Certain of the Company’s subsidiaries have defined contribution employee benefit plans covering all or a

portion of their employees. Contributions to these plans are discretionary for certain plans and are based on

specified or statutory requirements for others. The charges to expense for these plans for the years ended March

31, 2005, 2004 and 2003, were $4.7 million, $5.1 million and $3.4 million.

Defined Benefit Plan

One of the Company’s subsidiaries sponsors a noncontributory defined benefit pension plan covering

substantially all of its employees. Retirement benefits are provided based on employees’ years of service and

earnings. The Company’s practice is to fund amounts sufficient to meet the requirements set forth in the

applicable employee benefit and tax regulations. Net pension costs for the years ended March 31, 2005, 2004 and

2003 were $1.2 million, $.9 million and $.4 million. The plan’s net pension liability at March 31, 2005 and 2004

was $2.5 million and $1.6 million.

F-20