Logitech 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

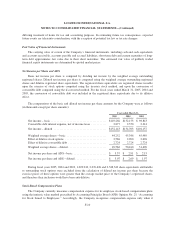

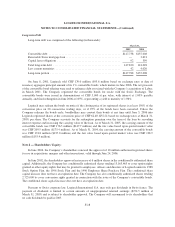

options and for shares issued under the Company’s employee stock purchase plan. The Company is required to

adopt SFAS 123R in the first quarter of fiscal year 2007. The Company is evaluating the requirements of SFAS

123R and expects its impact on the Company’s results of operations will not be materially different from the

amounts currently disclosed pursuant to the pro forma provisions of SFAS 123.

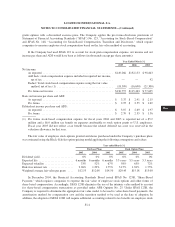

Comprehensive Income

Comprehensive income is defined as the total change in shareholders’ equity during the period other than

from transactions with shareholders. Comprehensive income consists of net income and other comprehensive

income, a component of shareholders’ equity. Other comprehensive income is comprised of foreign currency

translation adjustments from those entities not using the U.S. dollar as their functional currency, unrealized gains

and losses on marketable equity securities and net deferred gains and losses on hedging activity.

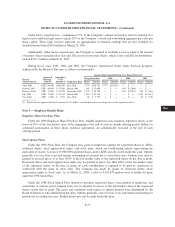

Note 3 — Acquisitions:

Intrigue

In May 2004, the Company acquired Intrigue Technologies, a privately held provider of advanced remote

controls, based in Mississauga, Canada. The acquisition is part of the Company’s strategy to pursue new

opportunities in the living room environment, positioning Logitech at the convergence of consumer electronics

and personal computing in the digital living room.

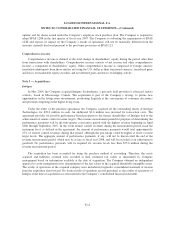

Under the terms of the purchase agreement, the Company acquired all the outstanding shares of Intrigue

Technologies for $29.0 million in cash. An additional $1.6 million was incurred for transaction costs. The

agreement provides for possible performance-based payments to the former shareholders of Intrigue tied to the

achievement of remote control revenue targets. The revenue measurement period for purposes of determining the

performance payments will be the four-quarter consecutive period with the highest revenue beginning in April

2006 through September 2007. In the event remote control revenues during the measurement period reach the

maximum level, as defined in the agreement, the amount of performance payments would total approximately

27% of remote control revenues during that period, although the percentage could be higher at lower revenue

target levels. The aggregate amount of performance payments, if any, will not be known until the end of the

revenue measurement period, which may be as late as fiscal year 2008, and will be recorded as an adjustment to

goodwill. No performance payments will be required for revenue levels less than $55.0 million during the

revenue measurement period.

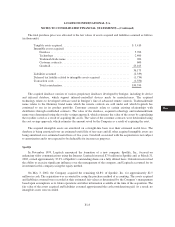

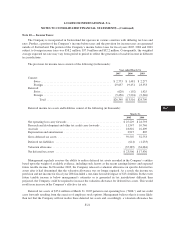

The acquisition has been accounted for using the purchase method of accounting. Therefore, the assets

acquired and liabilities assumed were recorded at their estimated fair values as determined by Company

management based on information available at the date of acquisition. The Company obtained an independent

appraisal to assist management in its determination of the fair values of the acquired identifiable intangible assets.

The results of operations of the acquired company were included in Logitech’s consolidated statement of income

from the acquisition date forward. Pro forma results of operations are not presented, as the results of operations of

Intrigue at the time of acquisition was not material to the Company’s consolidated financial statements.

F-12