Logitech 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

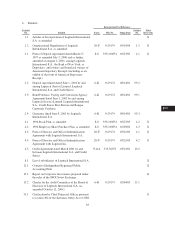

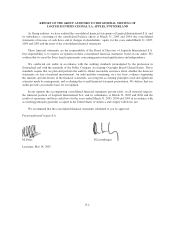

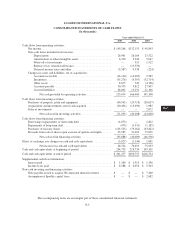

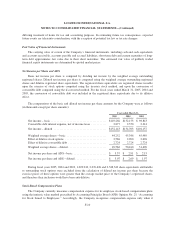

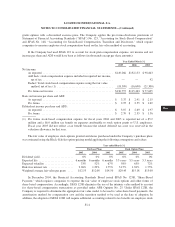

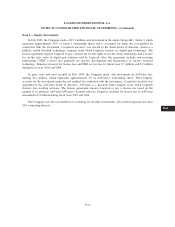

LOGITECH INTERNATIONAL S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year ended March 31,

2005 2004 2003

Cash flows from operating activities:

Netincome ................................................ $149,266 $132,153 $ 98,843

Non-cash items included in net income:

Depreciation ........................................... 26,041 26,164 25,522

Amortization of other intangible assets ...................... 6,320 5,240 5,047

Write-off of investments .................................. — 515 1,512

Release of tax valuation allowance .......................... — (13,350) —

Deferred income taxes and other ........................... (3,587) 9,338 (224)

Changes in assets and liabilities, net of acquisitions:

Accounts receivable ..................................... (14,140) (14,085) 2,565

Inventories ............................................. (35,276) (5,307) (32,714)

Other assets ............................................ 8,675 749 (4,356)

Accounts payable ....................................... 30,373 9,812 27,807

Accrued liabilities ....................................... 46,002 15,231 21,106

Net cash provided by operating activities ................. 213,674 166,460 145,108

Cash flows from investing activities:

Purchases of property, plant and equipment ....................... (40,541) (24,718) (28,657)

Acquisitions and investments, net of cash acquired ................. (30,494) (15,490) 1,985

Sales of investments ......................................... — — 2,072

Net cash used in investing activities ..................... (71,035) (40,208) (24,600)

Cash flows from financing activities:

Borrowings (repayments) of short-term debt ...................... (4,073) — 2,822

Repayments of long-term debt ................................. (475) (1,331) (1,185)

Purchases of treasury shares ................................... (134,525) (79,162) (63,822)

Proceeds from sale of shares upon exercise of options and rights ...... 45,985 31,404 15,629

Net cash used in financing activities ..................... (93,088) (49,089) (46,556)

Effect of exchange rate changes on cash and cash equivalents ............ (3,027) (1,144) 1,681

Net increase in cash and cash equivalents ................ 46,524 76,019 75,633

Cash and cash equivalents at beginning of period ...................... 294,753 218,734 143,101

Cash and cash equivalents at end of period ........................... $341,277 $294,753 $218,734

Supplemental cash flow information:

Interest paid ................................................ $ 1,560 $ 1,515 $ 1,336

Incometaxespaid ........................................... $ 6,588 $ 6,056 $ 5,343

Non-cash investing and financing activities:

Note payable issued to acquire 3Dconnexion minority interest ........ $ — $ — $ 7,400

Assumption of Spotlife capital lease ............................ $ — $ — $ 2,682

The accompanying notes are an integral part of these consolidated financial statements.

F-5

CG

20-F

LISA