Food Lion 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

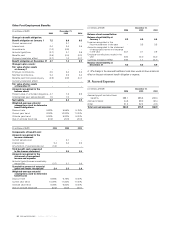

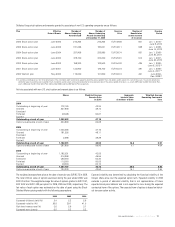

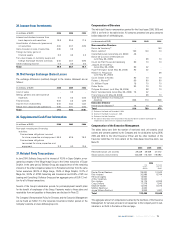

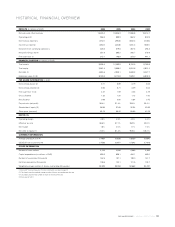

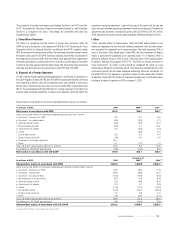

All amounts represent gross amounts before deduction of withholding taxes and

social security levy. They do not include the compensation of the CEO as director

of the Company that is separately disclosed above, employer social security con-

tributions and share-based compensation expense which are separately disclosed

below. For 2005, they include the pro-rata share of compensation of the two

members of Executive Management appointed on September 14, 2005.

(in millions of EUR)

2006 2005

(4)

2004

(4)

CEO Executive Total

Management

Number of persons 1 8 9 10 8

Base pay 0.9 3.3 4.2 4.3 4.0

Annual bonus 0.7 1.9 2.6 2.0 2.6

Other short-term benefits

(1)

0.02

0.2 0.2 0.1 0.1

Total short-term benefits 1.6 5.4 7.0 6.4 6.7

Retirement and

post-employment benefits

(2)

0.3

0.9 1.2 1.1 1.0

Other long-term benefits

(3)

0.7

2.1 2.8 1.8 2.7

Total compensation 2.6 8.4 11.0 9.3 10.4

(1) Other short-term benefits include the use of a company car, as well as employee and dependent life insurance,

welfare benefits and financial planning for U.S. members of Executive Management.

(2) The members of Executive Management benefit from corporate pension plans which vary regionally, including a

defined benefit group insurance plan for European members, that is contributory and based on the individual’s

career length with the company. U.S. members of Executive Management participate in profit sharing plans as

well as defined benefit plans. Figures indicated in the schedule represent the employer contributions to the

plans for defined contribution plans and the employer service costs for defined benefit plans.

(3) Other long-term benefits include the performance cash component of the Long-Term Incentive Plan that was

established in 2003. The grants of the performance cash component provide for cash payments to the grant

recipients at the end of three-year performance periods upon achievement of clearly defined targets, with a

transition period ending in 2006. Amounts indicated represent the amount expensed by the Company during the

reference year, as estimated based on realized and projected performance. Estimates are adjusted every year

and when payment occurs.

(4) The 2005 and 2004 amounts have been adjusted to include a supplemental executive retirement plan for certain

U.S. members of Executive Management.

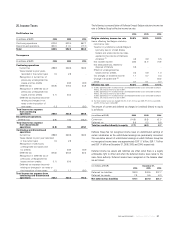

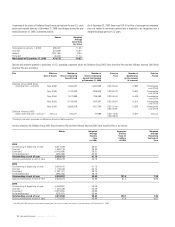

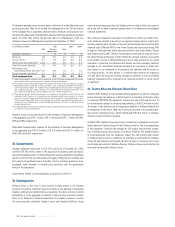

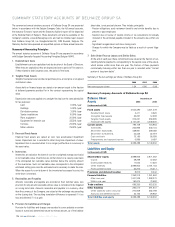

Employer social security contribution for the members of Executive Management

in the aggregate was EUR 1.2 millon, EUR 1.0 million and EUR 1.1 million for 2006,

2005 and 2004, respectively.

Share-based compensation expense for the members of Executive Management

in the aggregate was EUR 3.4 million, EUR 3.3 million and EUR 3.4 million for

2006, 2005 and 2004, respectively.

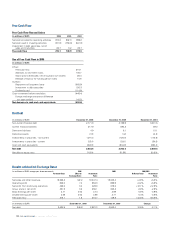

38. Commitments

Purchase obligations amounted to EUR 187.0 million as of December 31, 2006,

of which EUR 99.5 million relate to the acquisition of property, plant and equip-

ment and intangible assets. Purchase obligations include agreements to purchase

goods or services that are enforceable and legally binding on the Company and

that specify all significant terms, including: fixed or minimum quantities to be

purchased; fixed, minimum or variable price provisions; and the approximate

timing of the transaction.

Commitments related to lease obligations are disclosed in Note 18.

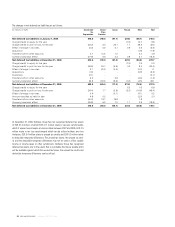

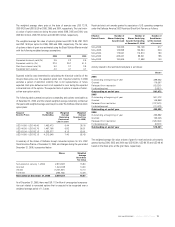

39. Contingencies

Delhaize Group is from time to time involved in legal actions in the ordinary

course of its business. Delhaize Group is not aware of any pending or threatened

litigation, arbitration or administrative proceedings, the likely outcome of which

(individually or in the aggregate) it believes is likely to have a material adverse

effect on its business or financial statements. Any litigation, however, involves

risk and potentially significant litigation costs, and therefore Delhaize Group

cannot give any assurance that any litigation now existing or which may arise in

the future will not have a material adverse effect on its business or consolidated

financial statements.

We continue to experience tax audits in jurisdictions in which we conduct busi-

ness, which we consider to be part of our ongoing business activity. In particular,

we have experienced an increase in tax audit and assessment activity during both

financial years 2006 and 2005 in the United States and Greece and during 2006

in Belgium. Although some audits have been settled in the United States, Greece

and Belgium during 2006, Delhaize Group expects continued tax audit activity in

the United States and Belgium in 2007. While the ultimate outcome of tax audits

is not certain, we have considered the merits of our filing positions in our overall

evaluation of potential tax liabilities and believe we have adequate liabilities

recorded in our consolidated financial statements for exposures on these mat-

ters. Based on our evaluation of the potential tax liabilities and the merits of

our filing positions, we also believe it is unlikely that potential tax exposures

over and above the amounts currently recorded as liabilities in our consolidated

financial statements will be material to our financial condition or future results

of operations.

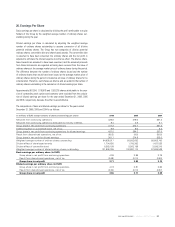

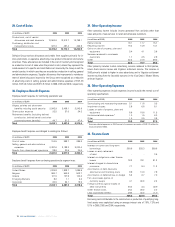

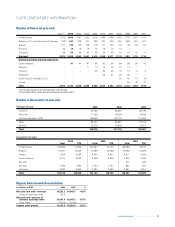

40. Events After the Balance Sheet Date

In March 2007, Delhaize Group reached a binding agreement to sell Di, its Belgian

beauty and body care business, to Parma Gestion, a subsidiary of Distripar which

is owned by CNP/NPM. The agreement foresees the sale of the operations of Di

for consideration, subject to contractual adjustments, of EUR 33.4 million in cash.

The impact of the divestiture on the ongoing profitability of Delhaize Belgium will

be immaterial. At the end of 2006, the Di network consisted of 90 company-oper-

ated and 42 franchised stores, which contributed EUR 95.5 million to Delhaize

Group’s net sales and other revenues.

In March 2007, Delhaize Group announced it is planning to implement cross-guar-

antees between Delhaize Group SA and Delhaize America. The cross-guarantees

of the companies’ financial debt obligations will support the continued integra-

tion of Delhaize group and increase its financial flexibility. The implementation

of cross-guarantees must not negatively impact the credit ratings and outlook

of Delhaize America and is conditional on obtaining a credit rating for Delhaize

Group SA from Moody’s and Standard & Poor’s at least as strong as the current

credit rating and outlook of Delhaize America. Delhaize America currently has the

only credit rating within Delhaize Group.

/ ANNUAL REPORT 2006

96