Food Lion 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

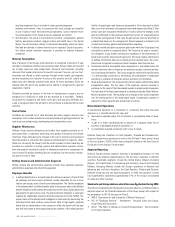

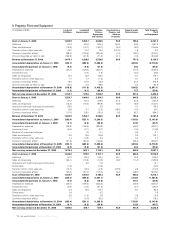

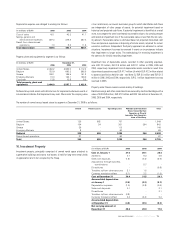

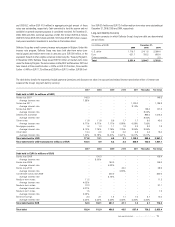

Goodwill is allocated and tested for impairment at the operating entity level,

which is the lowest level at which goodwill is monitored for internal management

purpose. Delhaize Group conducts an annual impairment assessment for goodwill

in the fourth quarter of each year and whenever events or circumstances indicate

that impairment may have occurred. The impairment test of goodwill involves

comparing the recoverable amount of each operating entity with its carrying

value, including goodwill. The recoverable amount of each operating entity is

determined based on the higher of value in use calculations and the fair value

less cost to sell. The value in use calculations use cash flow projections based on

financial plans approved by management covering a five-year period. Cash flows

beyond the five-year period are extrapolated using estimated growth rates. The

growth rate does not exceed the long-term average growth rate for the supermar-

ket retail business. The fair value less cost to sell of each operating company is

based on earnings multiples paid for similar companies in the market and market

capitalization for publicly traded subsidiaries. In 2006, 2005 and 2004, goodwill

was tested for impairment using the discounted cash flows methodology and

comparing to market multiples for reasonableness for the U.S. entities. Goodwill

at the other Group entities was tested for impairment using the market multiple

approach and market capitalization approach and discounted cash flows if the

market approach indicated that there was potential impairment. An impairment

loss is recorded if the carrying value exceeds the recoverable amount.

In 2006, EUR 17.1 million goodwill associated with Delvita was classified as held

for sale and was fully impaired upon writing down the value of Delvita to fair

value less costs to sell (see Note 5). No impairment loss was recorded in 2005

and 2004.

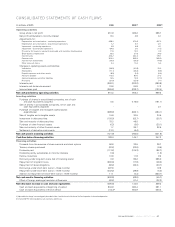

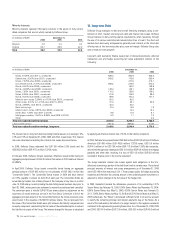

Key assumptions used for value in use calculations in 2006:

Food Lion Hannaford

Growth rate* 2.0% 2.0%

Discount rate** 8.8% 8.8%

* Weighted average growth rate used to extrapolate sales beyond the five-year period.

** After tax discount rate applied to the cash flow projections.

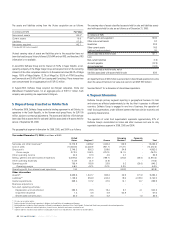

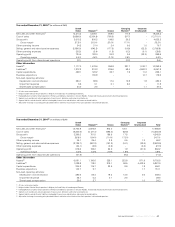

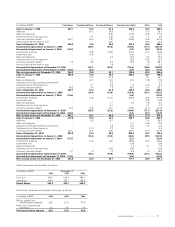

8. Intangible Assets

Intangible assets consist primarily of trade names, purchased and developed

software, favorable lease rights and prescription files and other licenses.

Delhaize Group has determined that its trade names have an indefinite useful

life and are not amortized but tested for impairment in the fourth quarter of every

year and whenever events or circumstances indicate that impairment may have

occurred. Trade names are tested for impairment by comparing their recoverable

value with their carrying amount. The value in use of trade names is estimated

using revenue projections of each operating entity and applying an estimated

royalty rate of 0.45% and 0.70% for Food Lion and Hannaford, respectively. No

impairment loss of trade names was recorded in 2006, 2005 or 2004.

See Note 9 for a discussion of the impairment test for assets with definite lives.

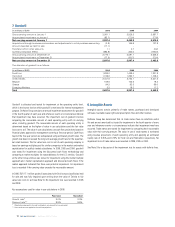

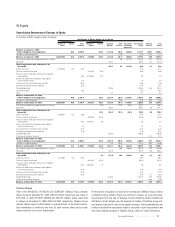

7. Goodwill

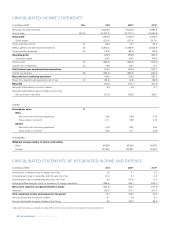

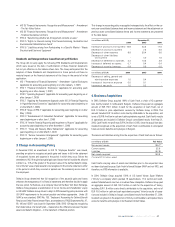

(in millions of EUR) 2006 2005 2004

Gross carrying amount at January 1 3,081.1 2,536.2 2,587.7

Accumulated impairment at January 1 (83.7) (73.4) (77.6)

Net carrying amount at January 1 2,997.4 2,462.8 2,510.2

Acquisitions through business combinations and adjustments to initial purchase accounting (0.9) 165.9 137.8

Amount classified as held for sale (17.1) - -

Transfers to/from other accounts 1.1 4.7 (0.2)

Currency translation effect (282.9) 364.0 (185.0)

Gross carrying amount at December 31 2,775.1 3,081.1 2,536.2

Accumulated impairment at December 31 (77.5) (83.7) (73.4)

Net carrying amount at December 31 2,697.6 2,997.4 2,462.8

The allocation of goodwill is as follows:

(in millions of EUR) 2006 2005 2004

Food Lion 1,282.0 1,429.4 1,231.8

Hannaford 1,159.6 1,293.7 1,109.4

United States 2,441.6 2,723.1 2,341.2

Belgium 159.6 162.5 18.3

Greece 94.2 93.5 86.0

Emerging Markets 2.2 18.3 17.3

Total 2,697.6 2,997.4 2,462.8

/ ANNUAL REPORT 2006

70