Food Lion 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

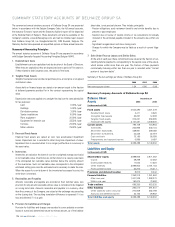

ON THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2006

PRESENTED TO THE ORDINARY GENERAL MEETING OF

DELHAIZE BROTHERS AND Co “THE LION”

(DELHAIZE GROUP) SA

To the Shareholders

As required by law and the company’s articles of association, we are pleased to

report to you on the audit assignment which you have entrusted to us. This report

includes our opinion on the consolidated financial statements together with the

required additional comments and information.

Unqualified audit opinion on the consolidated financial statements

We have audited the accompanying consolidated financial statements of Delhaize

Group SA (“the company”) and its subsidiaries (jointly “the group”), prepared in

accordance with International Financial Reporting Standards as adopted by the

European Union and with the legal and regulatory requirements applicable in

Belgium. Those consolidated financial statements comprise the consolidated

balance sheet as at 31 December 2006, the consolidated income statement, the

consolidated statement of recognized income and expense and the consolidated

statement of cash flows for the year then ended, as well as the summary of

significant accounting policies and other explanatory notes. The consolidated

balance sheet shows total assets of EUR 9,295.4 million and a consolidated profit

(group share) for the year then ended of EUR 351.9 million.

The board of directors of the company is responsible for the preparation of the

consolidated financial statements. This responsibility includes among other

things: designing, implementing and maintaining internal control relevant to the

preparation and fair presentation of consolidated financial statements that are

free from material misstatement, whether due to fraud or error, selecting and

applying appropriate accounting policies, and making accounting estimates that

are reasonable in the circumstances.

Our responsibility is to express an opinion on these consolidated financial

statements based on our audit. We conducted our audit in accordance with

legal requirements and auditing standards applicable in Belgium, as issued by

the “Institut des Reviseurs d’Entreprises/Instituut der Bedrijfsrevisoren”. Those

standards require that we plan and perform the audit to obtain reasonable

assurance whether the consolidated financial statements are free from material

misstatement.

In accordance with these standards, we have performed procedures to obtain

audit evidence about the amounts and disclosures in the consolidated financial

statements. The procedures selected depend on our judgment, including the

assessment of the risks of material misstatement of the consolidated financial

statements, whether due to fraud or error. In making those risk assessments,

we have considered internal control relevant to the group’s preparation and fair

presentation of the consolidated financial statements in order to design audit

procedures that are appropriate in the circumstances but not for the purpose of

expressing an opinion on the effectiveness of the group’s internal control. We

have assessed the basis of the accounting policies used, the reasonableness of

accounting estimates made by the company and the presentation of the consoli-

dated financial statements, taken as a whole. Finally, the board of directors and

responsible officers of the company have replied to all our requests for explana-

tions and information. We believe that the audit evidence we have obtained

provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements give a true and fair view of

the group’s financial position as of 31 December 2006, and of its results and its

cash flows for the year then ended, in accordance with International Financial

Reporting Standards as adopted by the EU and with the legal and regulatory

requirements applicable in Belgium.

Additional comments and information

The preparation and the assessment of the information that should be included in

the directors’ report on the consolidated financial statements are the responsibil-

ity of the board of directors.

Our responsibility is to include in our report the following additional comments

and information which does not change the scope of our audit opinion on the

consolidated financial statements:

• The directors’ report on the consolidated financial statements includes the

information required by law and is in agreement with the consolidated

financial statements. However, we are unable to express an opinion on the

description of the principal risks and uncertainties confronting the group, or

on the status, future evolution, or significant influence of certain factors on

its future development. We can, nevertheless, confirm that the information

given is not in obvious contradiction with any information obtained in the

context of our appointment.

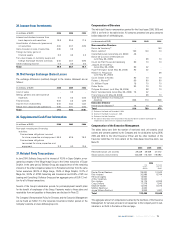

• As mentioned in note 3 to the financial statements, “Change in Accounting

Policy”, the company has changed its accounting policy with respect to

the recognition of actuarial gains and losses relating to post-employment

defined benefit plans following the issuance of IAS19 Employee Benefits

- Amendment - Actuarial Gains and Losses, Group Plans and Disclosures

which provides for an option to recognize actuarial gains and losses in full

through equity in the statement of recognized income and expense (SoRIE) in

the period in which they occur. This change in accounting policy was applied

retrospectively. The effect on the consolidated balance sheets and income

statements is disclosed in note 3 to the financial statements ‘Change in

Accounting Policy’.

March 14, 2007

The Statutory Auditor

DELOITTE Bedrijfsrevisoren / Reviseurs d’Entreprises

BV o.v.v.e. CVBA / SC s.f.d. SCRL

Represented by Philip Maeyaert

/ ANNUAL REPORT 2006

102