Food Lion 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2006 29

OPERATIONS

Food Lion

In 2006, Food Lion continued to reinforce its network, built

around four brands: Food Lion, a full-range low-price

supermarket; Bloom, a convenience-focused store concept

offering customers a wide variety of food products; Bottom

Dollar, a full-range deep discount supermarket with an

attractive store layout; and Harveys, a strong local grocer in

Central and South Georgia.

For the fi rst time in its successful series of market renewals,

Food Lion applied a multi-brand approach when renewing

approximately 80 stores in its Washington, DC market.Twenty-

fi ve Food Lion stores were relaunched; 14 Food Lion stores

were converted into Bottom Dollar and 29 into Bloom, with 11

additional Bloom stores opened in early 2007. Also in 2006,

Food Lion entered a new market – the fi rst one in 15 years

– Greenville-Spartanburg, SC, opening fi ve Bloom stores and

one Food Lion store based on the new prototype created in

2005, which will be used in all new Food Lion stores going

forward.

To support its multi-brand strategy and better match customer

profi les with store concepts, assortments and marketing,

Food Lion continued its customer segmentation work, started

in 2005 (see “In Focus” on p. 13 of this report).

Food Lion further reinforced its assortment. Bloom increased

the variety of its offering with the launch of a Bloom private

label line. The company also continued to roll out organic and

international food sections. At the end of 2006, Food Lion had

235 Nature’s Place, 1,100 Hispanic, 500 Asian and 170 Indian

food sections within its store base.

In order to keep prices low, while at the same time protecting

profi tability, Food Lion continued its efforts in cost management

and excellent execution.

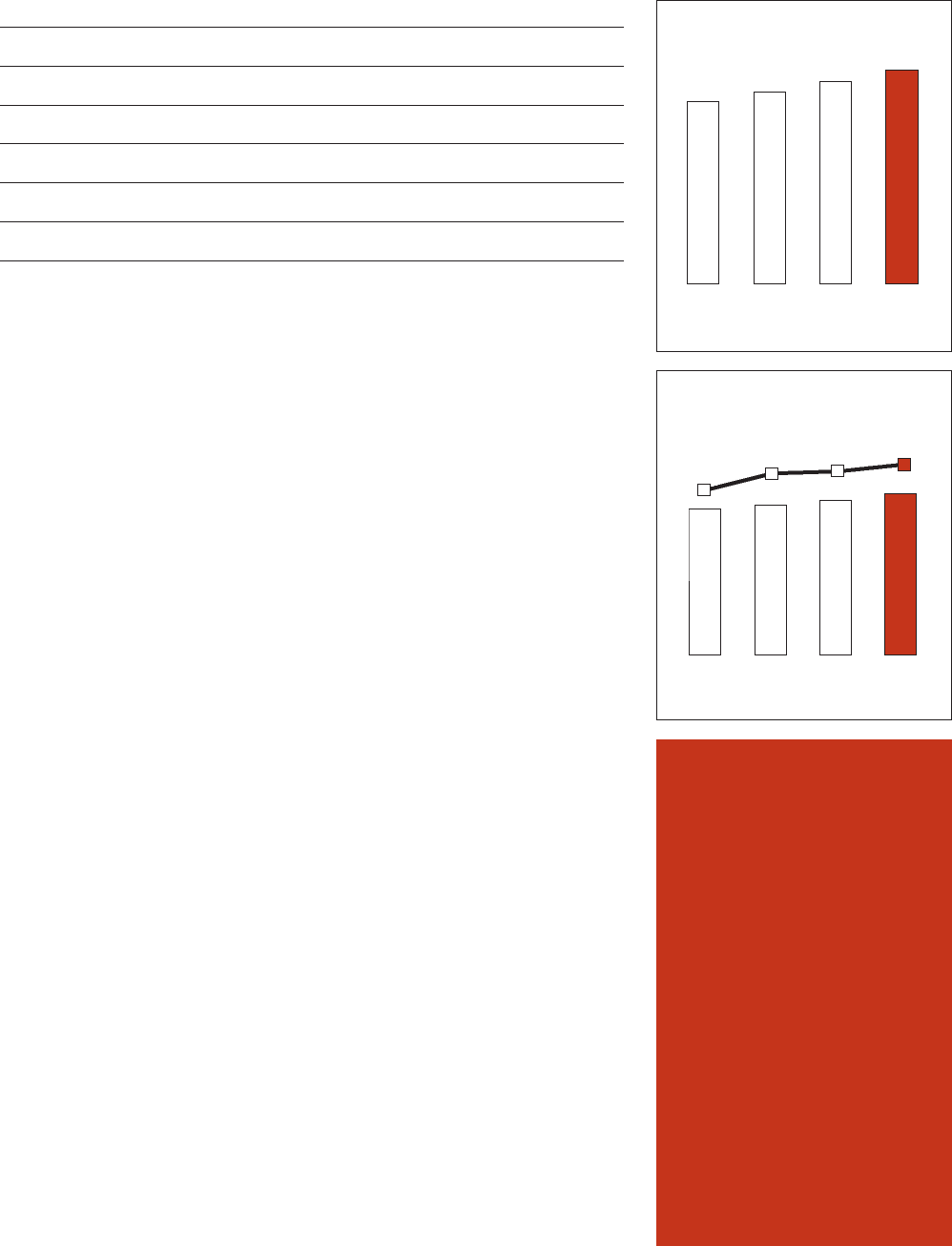

2006 2005 Change

Number of stores 1,549 1,537 +12

Net sales and other revenues* 17,293.2 16,564.4 +4.4%

Operating profi t* 961.0 901.2 +6.6%

Operating margin 5.6% 5.4% +12bps

Capital expenditures* 663.5 571.1 +16.2%

Number of associates 108,883 104,667 +4.6%

OPERATING MARGIN (% OF SALES)

NET SALES AND OTHER REVENUES

(IN BILLIONS OF USD)

15.9 16.6 17.3

5.4 5.6

5.3

2004 2005 2006

NUMBER OF STORES

1,523 1,537 1,549

2004 2005

1,515

2003 2006

OUTLOOK

FOR 2007

OPEN APPROXIMATELY

47 NEW STORES

REMODEL 176 STORES

COMPLETE CONVERSION

OF KASH N’ KARRY TO

SWEETBAY BRAND

RENEW FOOD LION

MARKETS OF NORFOLK

AND MYRTLE BEACH

* In millions of USD

4.7

15.4

2003