Food Lion 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Financial assets: Financial assets are initially recorded at fair value plus transac-

tion costs that are directly attributable to the acquisition or issuance of the finan-

cial assets. Subsequent measurement depends on the purpose of the instrument.

Investments held to maturity are maintained at amortized cost less any impair-

ment losses. After initial recognition, available-for-sale investments are measured

at fair value with gains and losses from changes in fair value recognized directly

in equity until they are either disposed or impaired. Impairment losses and foreign

exchange gains and losses relating to debt securities are charged to the income

statement. Upon disposal of available-for-sale investments, cumulative gains

or losses previously recognized in equity are charged to the income statement.

Purchases and sales of financial assets are accounted for at settlement date.

• Financial liabilities and equity: Financial liabilities and equity instruments are

classified according to the substance of the contractual arrangements entered

into. An equity instrument is any contract that evidences a residual interest in

the assets of the Group after deducting all of its liabilities.

• Financial liabilities: Financial liabilities are initially recorded at fair value less

transaction costs directly attributable to the issuance of the financial liability.

After initial recognition, financial liabilities are measured at amortized cost,

unless they are hedged and the hedging relationship qualifies for hedge account-

ing, in which case the value is adjusted to reflect changes in the fair value of the

hedged risk. Associated finance charges, including premiums and discounts are

amortized or accreted to finance costs using the effective interest method and

are added or subtracted from the carrying amount of the instrument. Issuance,

purchases and sales of financial liabilities are accounted for at settlement date.

Convertible notes and bonds are compound instruments, consisting of a liability

and equity component. At the date of issuance, the fair value of the liability

component is estimated using the prevailing market interest rate for similar non-

convertible debt. The difference between the proceeds from the issuance of the

convertible debt and the fair value of the liability component of the instrument

represents the embedded option to convert the liability into equity of the Group

and is recorded in equity. Interest expense on the liability component of the

convertible note or bond is calculated by applying the prevailing market interest

rate for similar non-convertible debt. The difference between this amount and the

interest paid is added to the carrying amount of the convertible bond or note.

• Derivative instruments: Delhaize Group uses foreign exchange forward contracts,

interest rate swaps, currency swaps and other derivative instruments to manage

its exposure to interest rates and foreign currency exchange rates. Interest rate

swaps are accounted for as fair value hedges when the hedge is expected to be,

and is determined to be, actually highly effective throughout the financial report-

ing periods for which the hedge was designated. The gain or loss from remeasur-

ing the hedging instrument at fair value is recognized in profit or loss, and the

gain or loss on the hedged item attributable to the hedged risk is recognized

in profit or loss by adjusting the carrying amount of the hedged item. Foreign

exchange forward contracts and currency swaps are generally not designated as

hedges and the gain or loss from remeasuring the hedging instrument is recog-

nized in profit or loss, naturally offsetting the gain or loss arising on remeasuring

the underlying instrument at the balance sheet exchange rate. Delhaize Group

does not currently apply cash flow hedge accounting and net investment hedge

accounting.

• Treasury shares: Shares of the Group purchased by the Group or companies

within the Group are included in equity at cost (including any costs directly

attributable to the purchase of the shares) until the shares are cancelled, sold or

otherwise disposed. Consideration received upon disposition of treasury shares

is included in shareholders’ equity.

• Receivables and payables: Amounts receivable and payable are recorded at

amortized cost (which in practice equals nominal value), less a provision for

any doubtful amount receivable. Amounts receivable and payable in a currency

other than the currency of the subsidiary are valued at the exchange rate on

the balance sheet date.

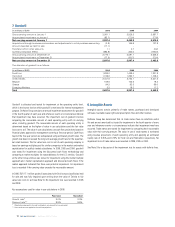

Inventories

Inventories are valued at the lower of cost on a weighted average cost basis or

net realizable value. Inventories are written down on a case-by-case basis if the

anticipated net realizable value declines below the carrying amount of the inven-

tories. Net realizable value is the anticipated selling price less the estimated costs

necessary to make the sale. When the reason for a write-down of the inventories

has ceased to exist, the write-down is reversed.

Cash and Cash Equivalents

Cash and cash equivalents include cash and deposits with an original maturity of

three months or less. Negative cash balances are reclassified to liabilities.

Income taxes

Income tax expense represents the sum of the tax currently payable and deferred

tax. Tax currently payable is based on the taxable profit of the year under applica-

ble tax law and includes taxes related to prior years recorded in the current year.

Taxable profit differs from profit before tax as reported in the income statement

because it excludes items of income or expense that are taxable or deductible in

other years and items that are never taxable or deductible. The liability for current

tax is calculated using tax rates that have been enacted or substantively enacted

on the balance sheet date.

Deferred tax liabilities and assets are established for temporary differences between

the carrying amount and the tax basis of assets and liabilities (including finance

leases) and are subsequently adjusted to reflect changes or substantially enacted

changes in tax rates expected to be in effect when the temporary differences reverse.

Deferred tax liabilities are recognized for taxable temporary differences arising on

investments in subsidiaries, associates and interests in joint ventures, except where

the Group is able to control the reversal of the temporary difference and it is probable

that the temporary difference will not reverse in the foreseeable future. Deferred tax

assets are included in the consolidated accounts only to the extent that it is probable

that future taxable profit will be available against which the deductible temporary

differences, the unused tax losses and unused tax credits can be utilized.

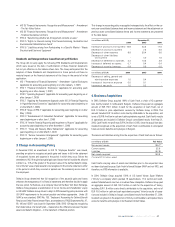

Provisions

Provisions are recognized when the Group has a present legal or constructive

obligation as a result of past events, it is more likely than not that an outflow of

resources will be required to settle the obligation, and the amount can be reliably

estimated.

• Closed store costs: Upon the closing of a store, a provision is recorded for

the present value of any estimated lease liabilities, including contractually

required real estate taxes, common area maintenance and insurance costs,

net of anticipated subtenant income. When severance costs are incurred

in connection with a store closing, a liability for the termination benefits is

recognized at the communication date for the estimated settlement amount.

The adequacy of the closed store provision is dependent upon the economic

conditions in which closed stores are located which will impact the Group’s

ability to realize estimated sublease income.

Provisions for closed store costs, including lease liabilities and severance

costs, are included in other operating expenses or result from discontinued

operations, as appropriate. Store closing provisions are reviewed quarterly to

ensure that accrued amounts appropriately reflect the outstanding commit-

ments and that additional expenses are accrued or amounts that are no longer

needed for their originally intended purpose are reversed.

The value of owned property and equipment related to a closed store is

reduced to reflect the recoverable value based on the Group’s previous experi-

ence in disposing of similar assets and economic conditions at closing. The

/ ANNUAL REPORT 2006 65