Food Lion 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To the extent permitted by law, the Board of Directors is authorized to increase

the share capital after it has received notice of a public takeover bid related to the

Company. In such a case, the Board of Directors is especially authorized to limit

or suppress the preferential right of the shareholders, even in favor of specific

persons. Such authorization is granted to the Board of Directors for a period of

three years from the date of the Extraordinary General Meeting of May 26, 2005.

It may be renewed under the terms and conditions provided by law.

Share Repurchases

As authorized by the Extraordinary General Meeting held on May 26, 2005, the

Board of Directors is authorized to purchase Delhaize Group ordinary shares for a

period of three years expiring in June 2008, where such a purchase is necessary

to avoid serious and imminent damage to Delhaize Group.

In addition, on May 24, 2006, at an Extraordinary General Meeting, the Company’s

shareholders authorized the Board of Directors, in the absence of any threat or

serious and imminent damage, to acquire up to 10% of the outstanding shares of

the Company at a minimum share price of EUR 1.00 and a maximum share price

not higher than 20% above the highest closing price of the Delhaize Group share

on Euronext Brussels during the 20 trading days preceding the acquisition. This

authorization, which has been granted for 18 months, replaces the one granted

in May 2005. Such authorization also relates to the acquisition of shares of the

Company by one or several direct subsidiaries of the Company, as defined by legal

provisions on acquisition of shares of the Company by subsidiaries.

In May 2004, the Board of Directors approved the repurchase of up to EUR 200

million of the Company’s shares or ADRs from time to time in the open market,

in compliance with applicable law and subject to and within the limits of an

outstanding authorization granted to the Board by the shareholders, to satisfy

exercises under the stock option plans that Delhaize Group offers to its associ-

ates. No time limit has been set for these repurchases.

Delhaize Group SA acquired 330,000 Delhaize Group shares (having a par value

of EUR 0.50 per share) in 2006 for an aggregate amount of EUR 21.1 million, rep-

resenting approximately 0.34% of Delhaize Group’s share capital and transferred

25,600 shares to satisfy the exercise of stock options granted to associates of

non-U.S. operating companies. As a consequence, at the end of 2006, the man-

agement of Delhaize Group SA had a remaining authorization for the purchase

of its own shares or ADRs for an amount up to EUR 169.1 million subject to and

within the limits of an outstanding authorization granted to the Board by the

shareholders.

Additionally, in 2006, Delhaize America repurchased 151,400 Delhaize Group

ADRs for an aggregate amount of USD 11.5 million, representing approximately

0.16% of the Delhaize Group share capital as at December 31, 2006 and trans-

ferred 132,787 ADRs to satisfy the exercise of stock options granted to U.S.

management pursuant to the Delhaize America 2000 Stock Incentive Plan and the

Delhaize America 2002 Restricted Stock Unit Plan.

At the end of 2006, Delhaize Group owned 918,599 treasury shares (including

ADRs), of which 437,199 were acquired prior to 2006, representing approximately

0.95% of the Delhaize Group share capital.

Delhaize Group provided a Belgian credit institution with a discretionary mandate

(the “Mandate”) to purchase up to 400,000 Delhaize Group’s shares on Euronext

Brussels between December 15, 2006 and November 24, 2007 in order to satisfy

exercises of stock options held by management of its non-US operating com-

panies. This credit institution makes its decisions to purchase Delhaize Group

shares pursuant to the guidelines set forth in the Mandate, independent of further

instructions from Delhaize Group, and without influence by Delhaize Group with

regard to the timing of the purchases. The credit institution can purchase shares

only when the number of Delhaize Group shares held by a custodian bank falls

below a certain minimum threshold contained in the Mandate. Delhaize Group

anticipates purchasing its own shares from time to time in addition to shares

purchased on its behalf under the Mandate.

Additionally, in 2006 Delhaize America engaged a U.S.-based financial institution

to purchase on its behalf up to 225,000 Delhaize Group ADRs on the New York

Stock Exchange during a period of up to one year beginning August 31, 2006. This

engagement was established to assist in the satisfaction of certain stock options

held by employees of U.S. subsidiaries of Delhaize Group and certain restricted

stock unit awards provided to U.S.-based executive employees. The financial

institution makes its decisions to purchase ADRs under this agreement pursuant

to the guidelines set forth in a related share repurchase plan, independent of

further instruction from Delhaize America. The share repurchase plan may be

terminated by Delhaize America at any time.

Retained Earnings

According to Belgian law, 5% of the statutory net income of the parent company

must be transferred each year to a legal reserve until the legal reserve reaches

10% of the capital. At December 31, 2006, 2005 and 2004, Delhaize Group’s legal

reserve was EUR 4.8 million, EUR 4.7 million and EUR 4.7 million, respectively,

and was recorded in retained earnings. Generally, this reserve cannot be distrib-

uted to the shareholders other than upon liquidation.

The Board of Directors may propose a dividend distribution to shareholders of

up to the amount of the distributable reserves of the parent company, including

the profit of the last fiscal year. The shareholders at Delhaize Group’s Ordinary

General Meeting must approve such dividends.

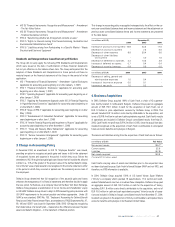

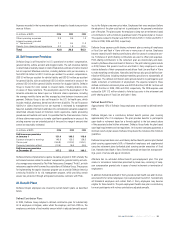

Other Reserves

“Other reserves” include a deferred loss on the settlement of a hedge agreement

in 2001 related to securing financing for the Hannaford acquisition by Delhaize

America. The deferred loss is being amortized over the life of the underlying debt

instruments. “Other reserves” also include actuarial gains and losses on defined

benefit plans and unrealized gains and losses on securities available for sale.

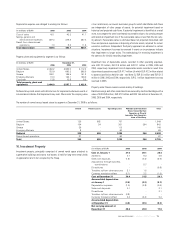

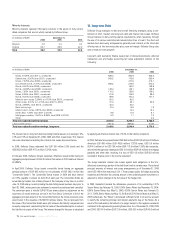

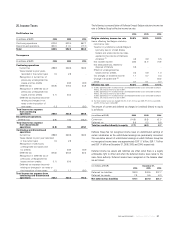

(in millions of EUR) December 31,

2006 2005 2004

Deferred loss on hedge:

Gross (36.4) (46.1) (46.1)

Tax effect 13.8 17.5 17.5

Actuarial loss on defined

benefit plans:

Gross (16.1) (32.2) (9.3)

Tax effect 5.5 11.3 3.3

Amount attributable to

minority interest 0.8 0.5 0.5

Unrealized loss on

securities held for sale:

Gross (0.3) (0.3) (0.3)

Tax effect 0.1 0.1 0.1

Total other reserves (32.6) (49.2) (34.3)

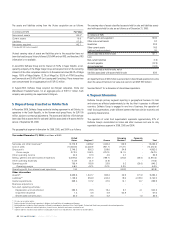

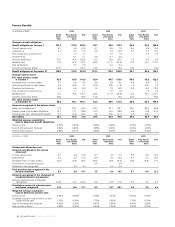

Cumulative Translation Adjustment

The cumulative translation adjustment relates to changes in the balance of assets

and liabilities due to changes in the functional currency of the Group’s subsidiar-

ies relative to the Group’s reporting currency. The balance in cumulative transla-

tion adjustment is mainly impacted by the inflation or deflation of the U.S. dollar

to the euro. The cumulative translation adjustment balance is as follows:

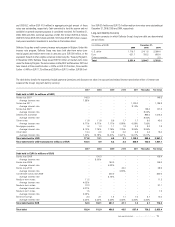

At December 31 USD Companies Other Companies Total

(in millions of EUR)

2004 (1,115.2) 9.8 (1,105.4)

2005 (675.0) 10.1 (664.9)

2006 (1,045.7) 20.0 (1,025.7)

/ ANNUAL REPORT 2006 77