Food Lion 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2006 1

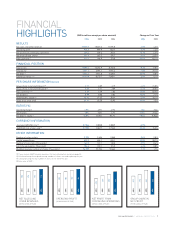

FINANCIAL

HIGHLIGHTS Change vs Prior Year (EUR in millions except per share amounts)

2006 2005 2004 2006 2005

RESULTS

Net sales and other revenues 19,225.2 18,345.3 17,596.8 4.8% 4.3%

Operating profit 946.3 899.9 862.2 5.2% 4.4%

Net profit from continuing operations 425.6 379.6 357.3 12.1% 6.2%

Net profit (Group share) 351.9 365.2 295.7 -3.6% 23.5%

Free cash flow

(1)

215.1 148.9 373.0 44.5% -60.1%

FINANCIAL POSITION

Total assets 9,295.4 10,253.9 8,702.5 -9.3% 17.8%

Total equity 3,561.4 3,596.1 2,874.6 -1.0% 25.1%

Net debt

(1)

2,634.6 2,943.0 2,608.3 -10.5% 12.8%

Enterprise value

(1) (3)

8,725.8 8,170.7 7,849.1 6.8% 4.1%

PER SHARE INFORMATION

(IN EUR)

Group share in net profit (basic)

(2)

3.71 3.89 3.19 -4.6% 21.8%

Group share in net profit (diluted)

(2)

3.55 3.71 3.09 -4.4% 20.0%

Free cash flow

(1)(2)

2.27 1.59 4.03 42.8% -60.5%

Net dividend 0.99 0.90 0.84 10.0% 7.1%

Shareholders’ equity

(3)

36.55 37.65 30.34 -2.9% 24.1%

Share price (year-end) 63.15 55.20 55.95 14.4% -1.3%

RATIOS (%)

Operating margin 4.9% 4.9% 4.9% 1bps 3bps

Net margin 1.8% 2.0% 1.7% -16bps 31bps

Net debt to equity

(1)

74.0% 81.8% 90.7% -7.8ppt -8.9ppt

CURRENCY INFORMATION

Average EUR/USD rate

(4)

0.7964 0.8038 0.8039 -0.9% -

EUR/USD rate at year-end

(4)

0.7593 0.8477 0.7342 -10.4% 15.5%

OTHER INFORMATION

Number of sales outlets 2,705 2,636 2,565 2.6% 2.8%

Capital expenditures 699.9 636.1 494.1 10.0% 28.7%

Number of associates (thousands) 142.5 137.1 138.0 3.9% -0.6%

Full-time equivalents (thousands) 106.6 102.1 101.5 4.4% 0.8%

Weighted average number of shares (thousands) 94,939 93,934 92,663 1.1% 1.7%

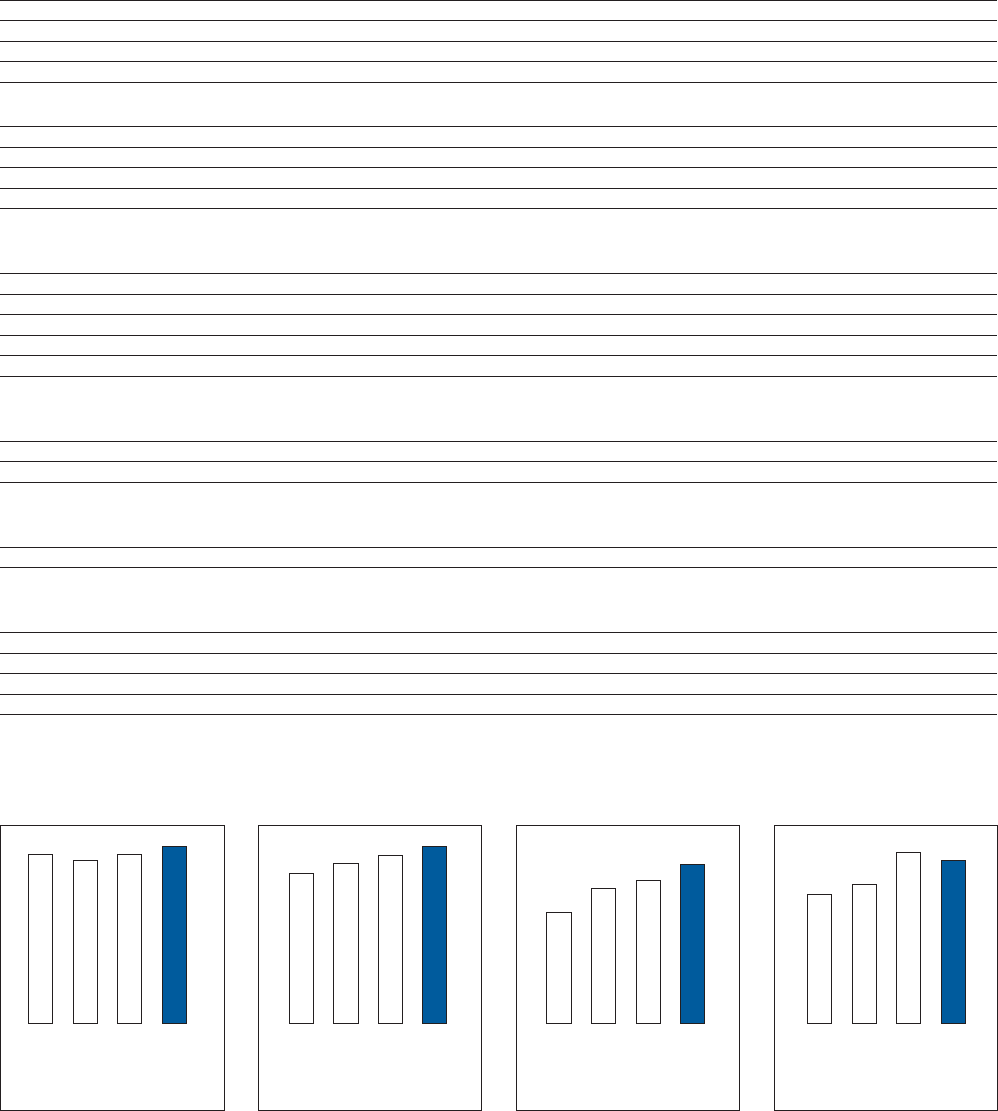

NET SALES AND

OTHER REVENUES

(IN BILLIONS OF EUR)

2004

2005

2003

OPERATING PROFIT

(IN MILLIONS OF EUR)

2004

2005

2003

NET PROFIT FROM

CONTINUING OPERATIONS

(IN MILLIONS OF EUR)

2004

2005

2003

GROUP SHARE IN

NET PROFIT

(IN MILLIONS OF EUR)

2004

2005

2003

2006

(1) These are non-GAAP fi nancial measures. For more information, see box on page 38.

(2) Calculated using the weighted average number of shares outstanding during the year.

(3) Calculated using the total number of shares at the end of the year.

(4) Euro value of USD 1.

18.2

17.6

18.3

19.2

801

862

900

946

294

357

380

426

279

296

365

352

2006

2006

2006