Food Lion 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2006

2

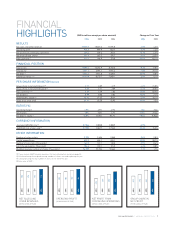

In 2006, Delhaize Group delivered on its strategy to increase sales

momentum while maintaining industry-leading margins. All of

our key operating companies had positive sales momentum,

resulting in the fourth consecutive year of accelerating sales

growth for the Group. At identical exchange rates, sales growth

was 5.5%, a growth rate at the top end of our expectations.

Our strong sales performance in 2006 was driven primarily by

successful commercial initiatives in existing stores, resulting in

comparable store sales growth of 2.7% in the U.S. and 2.8% in

Belgium. Alfa-Beta posted excellent sales growth as well, for

the fi rst time crossing the EUR 1 billion mark. All our operating

companies further strengthened their customer differentiation

through innovations in assortment, convenience and service.

Food Lion, our largest business, implemented the fi rst

initiatives based on its customer segmentation work. Hannaford

successfully launched an innovative in-store nutrition navigation

system called Guiding Stars. Delhaize Belgium signifi cantly

invested in its price position and price image, resulting in strong

market share growth.

Our operating companies also continued the expansion of

our network to 2,705 stores by year-end and their renewal

and conversion work with more than 170 stores remodeled

throughout the Group. Hannaford opened 14 stores, its highest

number ever in a year. Food Lion converted some of its stores in

the Washington, DC market to Bloom and Bottom Dollar through

its fi rst multi-brand market renewal. In Florida, 43 Kash n’ Karry

stores in the key Tampa-St. Petersburg market were converted

into Sweetbay supermarkets. In Belgium, we saw the fi rst two

conversions of Cash Fresh stores to Delhaize banners.

As planned, we managed to keep our operating margin stable at

a strong 4.9% through cost discipline and gross margin support

from lower inventory losses and a better sales mix. This allowed

us to offset the ongoing investments in price competitiveness that

we made at all our operating companies. Our operating profi t

increased by 5.2% at actual and by 5.9% at identical exchange

rates.

This operating performance was supported by our continued

focus on talent development. In 2006, we launched two high-

level programs, the Leadership College and the Skill of the Year

program.

Our higher operating profi t and lower fi nance costs, due to

the redemption of some of our outstanding debt, resulted in

a 12.1% increase in our net profi t from continuing operations.

An impairment charge resulting from the decision to sell our

underperforming Czech business resulted in a -3.6% decrease

of our net profi t (Group share) to EUR 351.9 million. Basic net

earnings per share amounted to EUR 3.71.

Based on our underlying performance, our future plans and our

belief in the Company’s future success, the Board of Directors

will propose to the Ordinary General Meeting in May 2007 to

increase the dividend by 10.0% to EUR 1.32 (or EUR 0.99 net of

25% Belgian withholding tax).

2007 Strategy

In 2007, we will continue our strategy of creating value by

pursuing strong sales growth while maintaining an excellent

operating margin. In order to generate strong top-line growth,

we will continue to focus on our existing sales-building pillars:

concept differentiation, price competitiveness, store and market

renewals and network expansion.

The further differentiation and fi ne-tuning of our commercial

concepts in their respective local markets will remain a key driver

Dear Shareholder,

Dear Shareholder,

LETTER OF

THE CHAIRMAN &

THE CHIEF EXECUTIVE OFFICER