Food Lion 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2006 53

on the Company’s website together with all other relevant

documents.

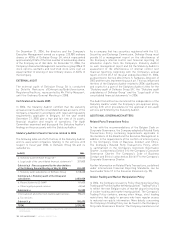

Extraordinary General Meetings of April 25, 2006 and May

24, 2006

The Board called an Extraordinary General Meeting on April

25, 2006. Since the required quorum was not achieved, no

decisions were taken during that meeting, and a second

Extraordinary General Meeting was called with the same

agenda on May 24, 2006. The Extraordinary General Meeting

of May 24, 2006 renewed the powers of the Board with respect

to the acquisition of shares of the Company. The minutes of

the Extraordinary General Meeting of May 24, 2006, including

the voting results, are available on the Company’s website

together with all other relevant documents.

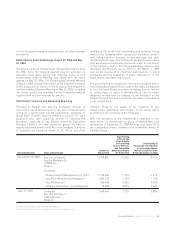

Shareholder Structure and Ownership Reporting

Pursuant to Belgian law and the Company’s Articles of

Association, any benefi cial owner or any two or more persons

acting as a partnership, limited partnership, syndicate or

group (each of which shall be deemed a “person” for such

purposes) who, after acquiring directly or indirectly the

benefi cial ownership of any shares, American Depositary

Receipts (“ADRs”) or other securities giving the right to

acquire additional shares or ADRs of the Company, is directly

or indirectly the benefi cial owner of 3%, 5% or any other

multiple of 5% of the total outstanding and potential voting

rights of the Company which causes such benefi cial owner’s

total voting rights to increase or decrease past any such

threshold percentage, shall, within two Belgian business days

after becoming so benefi cially interested, report its ownership

to the Company and to the Belgian Banking, Finance and

Insurance Commission, as set forth in the March 2, 1989

Law on the disclosure of important participations in listed

companies and the regulation of public takeovers or in the

Royal Decree implementing this law.

Any person failing to comply with the reporting requirements

mentioned above may forfeit all or part of the rights attributable

to such Delhaize Group securities, including, but not limited

to, voting rights or rights to distributions of cash or share

dividends or may even be ordered by the President of the

Belgian Commercial Court to sell the securities concerned to

a non-related party.

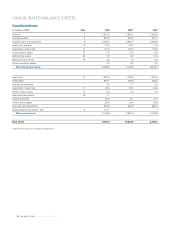

Delhaize Group is not aware of the existence of any

shareholders’ agreement with respect to the voting rights

pertaining to the securities of the Company.

With the exception of the shareholders identifi ed in the

table below, no shareholder or group of shareholders had

declared as of December 31, 2006 holdings of at least 3% of

the outstanding shares, warrants and convertible bonds of

Delhaize Group.

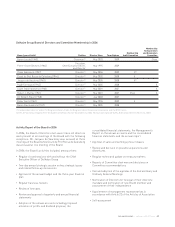

Date of Notifi cation Name of Shareholder

Number of

Shares Held

Shareholding

in Percentage

of the Number

of Outstanding

Shares, Warrants

and Convertible

Bonds According to

the Notifi cation

Shareholding in

Percentage of the Number

of Outstanding Shares,

Warrants and Convertible

Bonds (December 31, 2006)

September 16, 2005 Axa (consolidated)

Avenue Matignon 25

75008 Paris

France

13,209,804 12.55% 12.41%

Including:

- Alliance Capital Management L.P. (U.S.)

(1)

- Axa Rosenberg (United Kingdom)

(1)

- Axa IM (France)

(1)

- Ardenne Prevoyante - Axa (Belgium)

(2)

11,718,406

1,206,132

266,966

18,300

11.13%

1.15%

0.25%

0.02%

11.01%

1.13%

0.25%

0.02%

June 11, 2003 Sofi na SA

Rue des Colonies 11

1000 Brussels

Belgium

3,168,444 3.22% 2.98%

(1) Shares are benefi cially owned by third parties.

(2) Shares are benefi cially owned by shareholder providing notice.