Food Lion 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• IAS 39 “Financial Instruments: Recognition and Measurement” - Amendment

- The Fair Value Option

• IAS 39 “Financial Instruments: Recognition and Measurement” - Amendment

- Financial Guarantee Contracts

• IFRIC 4 “Determining whether an Arrangement contains a Lease”

• IFRIC 5 “Rights to Interests arising from Decommissioning, Restoration and

Environmental Rehabilitations Funds”

• IFRIC 6 “Liabilities arising from Participating in a Specific Market - Waste

Electrical and Electronic Equipment”

Standards and Interpretations Issued but not yet Effective

The Group did not early apply the following IFRS Standards and Interpretations

which were issued at the date of authorisation of these financial statements

but not yet effective on the balance sheet date. The Group anticipates that the

adoption of these Standards and Interpretations in future periods will have no

material impact on the financial statements of the Group in the period of initial

application:

• IAS 1 “Presentation of Financial Statements” - Amendment - Capital Disclosures

(applicable for accounting years beginning on or after January 1, 2007)

• IFRS 7 “Financial Instruments: Disclosures” (applicable for accounting years

beginning on or after January 1, 2007)

• IFRS 8 “Operating Segments” (applicable for accounting years beginning on or

after January 1, 2009)

• IFRIC 7 “Applying the Restatement Approach under IAS 29 Financial Reporting

in Hyperinflationary Economies” (applicable for accounting years beginning on

or after March 1, 2006)

• IFRIC 8 “Scope of IFRS 2” (applicable for accounting years beginning on or after

May 1, 2006)

• IFRIC 9 “Reassessment of Embedded Derivatives” (applicable for accounting

years beginning on or after June 1, 2006)

• IFRIC 10 “Interim Financial Reporting and Impairment of Assets” (applicable for

accounting years beginning on or after November 1, 2006)

• IFRIC 11 “Group and Treasury Share Transactions” (applicable for accounting

years beginning on or after March 1, 2007)

• IFRIC 12 “Service Concession Arrangements” (applicable for accounting years

beginning on or after January 1, 2008)

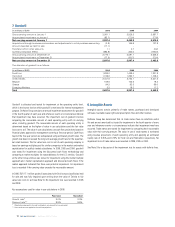

3. Change in Accounting Policy

In December 2004, an amendment to IAS 19 “Employee Benefits” was issued,

providing an option to recognize actuarial gains and losses in full in the statement

of recognized income and expense in the period in which they occur. Before the

amendment, IAS 19 required actuarial gains and losses that fell outside the allowed

corridor (i.e., 10% of the greater of the present value of the defined benefit obliga-

tion or the fair value of plan assets) to be recognized in the income statement, either

in the period in which they occurred or spread over the remaining service lives of

the employees.

Delhaize Group determined that full recognition of the actuarial gains and losses

enhances the transparency of its financial statements and therefore decided to apply

the new option. Furthermore, as a company listed on the New York Stock Exchange,

Delhaize Group prepares a reconciliation of its net income and shareholders’ equity

to US GAAP. Delhaize Group strives to align its IFRS accounting policy decisions with

US GAAP requirements to the extent possible and where appropriate. Under US

GAAP, a new standard, SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87,

88, 106 and 132(R)” was issued in September 2006. SFAS 158 requires recognizing

the funded status of a benefit plan – measured as the difference between the plan

assets and benefit obligation – in the statement of financial position.

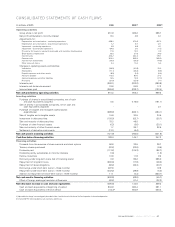

This change in accounting policy was applied retrospectively; the effect on the cur-

rent year consolidated balance sheet and income statement and the adjustment on

previous years consolidated balance sheets and income statements are presented

in the table below:

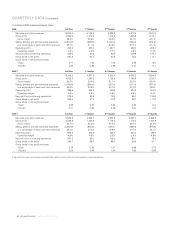

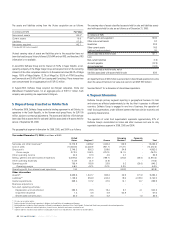

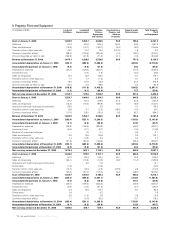

(in millions of EUR) December 31,

2006 2005 2004

Increase of provisions (non-current) 16.8 43.2 17.5

Decrease of provisions (current) - 7.6 6.5

Decrease of other reserves 9.8 20.4 5.6

Decrease of other liabilities

(non-current) - 4.0 1.6

Decrease of deferred tax liabilities 4.4 10.6 2.9

Increase of deferred tax assets 0.7 0.4 0.4

Decrease of minority interests 0.9 0.5 0.5

(in millions of EUR) 2006 2005 2004

Decrease of selling, general and

administrative expenses 1.5 0.4 -

Increase of income tax expense 0.5 0.1 -

Increase of net profit 1.0 0.3 -

4. Business Acquisitions

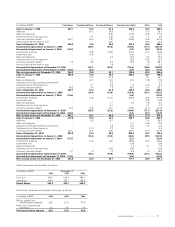

In 2005, Delhaize Group acquired 100% of Cash Fresh, a chain of 43 supermar-

kets mainly located in northeastern Belgium. Delhaize Group paid an aggregate

amount of EUR 159.1 million in cash for the acquisition of Cash Fresh, net of

EUR 1.7 million in price adjustments received by Delhaize Group in 2006. This

amount includes EUR 1.6 million costs directly attributable to the acquisition, and

is net of EUR 6.4 million in cash and cash equivalents acquired. Cash Fresh’s results

of operations are included in Delhaize Group’s consolidated results from May 31,

2005. Cash Fresh’s net profit was EUR 4.3 million in 2005, since the acquisition date.

Goodwill recognized on the acquisition of Cash Fresh is attributable to anticipated

future economic benefits and synergies in Belgium.

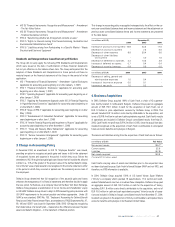

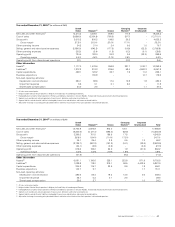

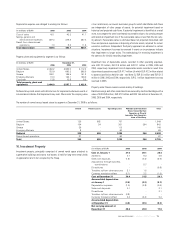

The assets and liabilities arising from the acquisition of Cash Fresh are as follows:

(in millions of EUR)

Fair Value

Non-current assets 195.7*

Current assets 22.9

Liabilities (57.8)

Net assets acquired 160.8

(*) Including EUR 143.3 million in goodwill

Cash Fresh’s carrying value of assets and liabilities prior to the acquisition have

not been disclosed because Cash Fresh followed Belgian GAAP and not IFRS, and

therefore, no IFRS information is available.

In 2004, Delhaize Group acquired 100% of U.S.-based Victory Super Markets

(“Victory”), a company which operated 19 supermarkets, 17 in central and south-

eastern Massachusetts and two in southern New Hampshire. Delhaize Group paid

an aggregate amount of EUR 143.7 million in cash for the acquisition of Victory,

including EUR 1.6 million costs directly attributable to the acquisition, and net of

EUR 10.6 million in cash and cash equivalents acquired. Victory’s results of opera-

tions are included in Delhaize Group’s consolidated results from November 27, 2004.

Goodwill recognized on the acquisition of Victory is attributable to anticipated future

economic benefits and synergies in northeastern United States.

/ ANNUAL REPORT 2006 67