Food Lion 2001 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|85

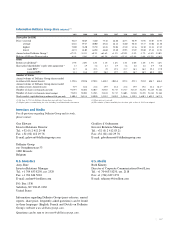

SHAREHOLDER INFORMATION

Delhaize Group shares trade on Euronext Brussels under the symbol

DELB. American Depository Receipts, each of them representing one

Delhaize Group ordinary share, are listed on the New York Stock

Exchange under the symbol DEG.

Information on Delhaize Group’s share price can be found on the websites

of Delhaize Group (www.delhaizegroup.com), Euronext Brussels

(www.euronext.com) and the New York Stock Exchange (www.nyse.com).

Detailed information on trading activity and share prices can also be found

in the financial section of most major newspapers.

One operating company of Delhaize Group is also listed: Alfa-Beta is list-

ed on the Athens Stock Exchange (www.ase.gr) under the symbol BASIK.

Type of Delhaize Group Shares

Delhaize shares are either bearer shares, in denominations of 1, 10, 25

and 100 shares, or registered shares. On request, a shareholder may

convert bearer shares into registered shares and vice versa. The own-

ership of registered shares can be transferred by informing the

Company and returning the certificate of record in the shareholder

register to the Company (to the attention of Chantal Delaite, Delhaize

Group, rue Osseghemstraat 53, 1080 Brussels).

Equity Indices

On December 31, 2001, Delhaize Group’s shares were included in the

following major stock indices: BEL20, Euronext 100, Dow Jones

Stoxx 600, MSCI Europe and FTSE Eurotop 300.

On March 2, 2002, the weight of Delhaize Group shares in the BEL20

index became 668 (6.7%) Delhaize Group shares instead of the for-

mer amount of 303 (3.0%). Delhaize Group shares represent the

fourth largest constituent in the index.

On December 28, 2001, the weight of Delhaize Group shares in the

Euronext 100 index was 0.32%. Delhaize Group shares represent the

66th largest constituent in the index.

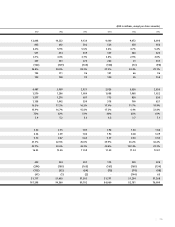

Share Performance in 2001

At the end of 2001, a Delhaize Group share was worth EUR 58.45,

which is 15.4% higher then one year earlier (EUR 50.65). In the same

period, the Euronext 100 index decreased 19.7%, the BEL20 index

was down 8.0%, and the Belgian All Shares (BAS) Return index lost

4.9%. The FTSE Eurotop 350 Food and Drug Retailers Index

decreased 8.5% in 2001.

In 2001, Delhaize Group shares traded on Euronext Brussels at an

average price of EUR 61.28 and an average trading daily volume of

205,037 shares. The share reached its intra-day peak on June 25 (EUR

72.00) and had its highest closing price on June 22 (EUR 71.75). On

January 11, the share reflected its lowest value (EUR 48.72) and had

its lowest closing price (EUR 49.00).

Delhaize Group ADRs have been listed on the New York Stock

Exchange since April 26, 2001. Between April 26, 2001 and

December 31, 2001, the price of Delhaize Group’s ADRs increased

from USD 50.60 to USD 51.00, an increase of 0.8%. In 2001, the

average daily trading volume was 39,610 ADRs.

Dividend

At the general meeting of shareholders on May 23, 2002, the Board

of Directors will propose to shareholders the approval of a gross div-

idend of EUR 1.44 per share, before deduction of withholding tax of

25%, resulting in a net dividend of EUR 1.08. This dividend repre-

sents an increase of 5.9% over the prior dividend. The payout-ratio

for 2001 amounts to 39.2%.

The dividend of EUR 1.08 will be payable against coupon no. 40

beginning on May 27, 2002. This payment will be made at the regis-

tered office of the Company (rue Osseghemstraat 53, 1080 Brussels)

as well as at the counters of the following financial institutions:

- Banque Artesia, boulevard du Roi Albert II 30-B2, 1000 Brussels

- BBL, avenue Marnix 24, 1050 Brussels

- Fortis Banque, rue Montagne du Parc 3, 1000 Brussels

- KBC, avenue du Port 2, 1080 Brussels

- Banque Degroof, rue de l’Industrie 44, 1040 Brussels

The payment of the dividend to the ADR holders will be made

through The Bank of New York.

Financial Calendar

Press release - 2002 first quarter results May 7, 2002*

Final date for depositing shares

for the general meeting of shareholders May 16, 2002

General meeting of shareholders May 23, 2002

Dividend becomes payable for the financial year 2001 May 27, 2002

Press release - 2002 second quarter results August 1, 2002*

Press release - 2002 third quarter results November 7, 2002*

* You are kindly invited to listen in to the webcast of the related con-

ference call. See www.delhaizegroup.com for further details.

Information for ADR Holders

On April 26, 2001, the ADSs (American Depositary Shares), each

representing one ordinary share of Delhaize Group, began trading on

the New York Stock Exchange under the symbol DEG. ADSs are evi-

denced by American Depositary Receipts (ADRs). The Delhaize

Group ADR program is governed by a Deposit Agreement binding

upon Delhaize Group, The Bank of New York and the holders of

ADRs. This program is administrated by:

THE BANK OF NEW YORK

Investor Relations

P.O. Box 11258

Church Street Station

New York, N.Y. 10286-1258

U.S.A.

Toll free tel # for U.S. callers: 1-877-853-2191