Food Lion 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

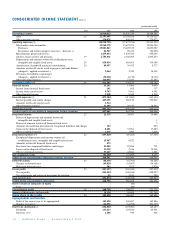

expense, the interest coverage rate was 3.8

(4.7 in 2000).

In 2001, net exceptional results of EUR

96.4 million (EUR 70.6 million, net of taxes

and minority interests) were recorded

primarily due to one-time merger costs

related to the share exchange with Delhaize

America and to the acquisition of Hannaford

(EUR 16.6 million, net of taxes and minority

interests), the closing of the Atlanta-based,

60% joint venture Super Discount Markets

(EUR 34.5 million) and the closing of eight

Delvita stores and an asset impairment

charge for seven other Delvita stores (EUR

19.1 million).

Total income taxes increased by 31.6% to

EUR 191.8 million due to higher operating

profitability. The effective tax rate was

53.2% in 2001, compared to 36.3% in 2000

because of non-deductible goodwill

amortization related to the Hannaford

acquisition and the share exchange with

Delhaize America, and the non-deductible

exceptional charges for the closings of Super

Discount Markets and Delvita stores. The

effective tax rate before goodwill

amortization and exceptional expenses was

38% (35.8% in 2000).

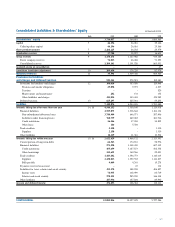

Due to the share exchange with Delhaize

America, minority interests in the results

decreased from EUR 95.5 million in 2000 to

EUR 19.3 million in 2001. This amount

represents primarily the minority interest

portion of Delhaize America results prior to

the share exchange in April 2001.

In 2001, Delhaize Group earned EUR 339.0

million before goodwill amortization and

exceptional income, a 80.6% increase

compared to the EUR 187.7 million in 2000.

The U.S. operations contributed 87.4% to

Delhaize Group’s cash earnings, the

Belgian operations 25.1%, the other

European activities –2.0% and the Asian

operations –1.1%. Corporate had a negative

contribution of –9.4%. Cash earnings per

share rose by 18.2% to EUR 4.26 (EUR

3.61 in 2000). At identical exchange rates,

cash earnings per share rose 15.0%.

Delhaize Group’s increase in cash earnings

per share was due to continued sales growth

and significant margin improvements both in

the U.S. and Belgian operations.

In 2001, Delhaize Group’s net earnings

after goodwill amortization and exceptional

expenses were EUR 149.4 million, or EUR

1.88 per share based on the weighted

average number of shares during the year,

compared to a total of EUR 160.7 million or

EUR 3.09 per share in 2000. At identical

currency rates, net earnings decreased 9.8%

in 2001. The decline was related to higher

financial expenses, amortization of goodwill

and exceptional charges. Return on equity

decreased from 15.3% in 2000 to 13.3% in

2001 due to increased shareholders’equity

associated with the share exchange with

Delhaize America.

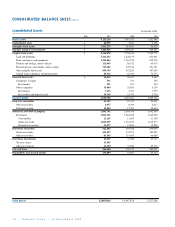

Balance Sheet (p. 50) |Delhaize

Group’s total assets increased by 16.2% to

EUR 12.1 billion as a result of investments

in existing activities and acquisitions. The

share exchange with Delhaize America

resulted in an increase of goodwill and

intangibles by EUR 1.2 billion to EUR 4.9

billion. Other major asset changes in 2001

included the acquisition of the Greek food

retail company Trofo, which was

consolidated beginning January 1, 2001, and

44 |Delhaize Group |Annual Report 2001

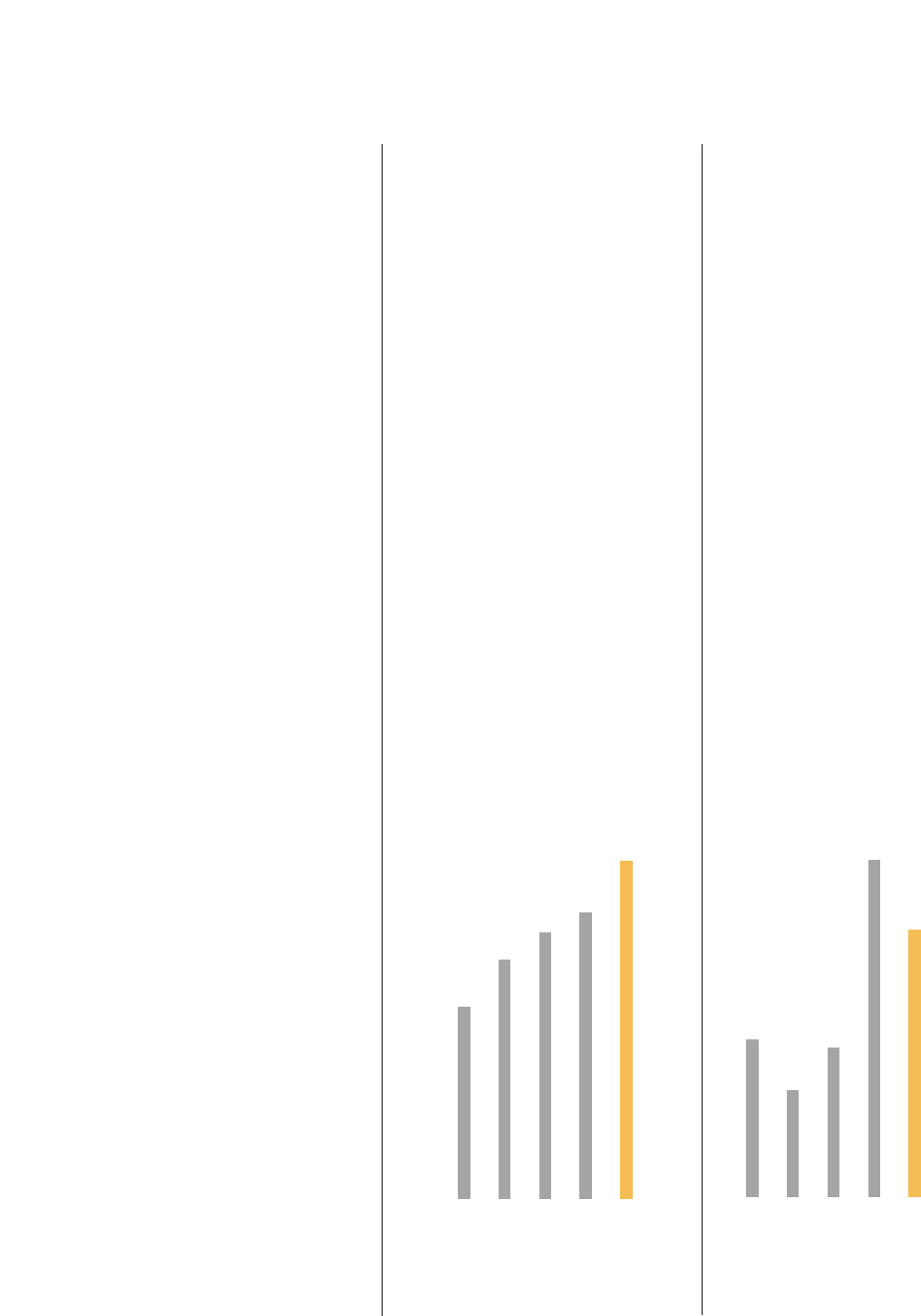

2.42

3.02

97 98 99 00 01

Cash Earnings per Share

(in EUR)

3.36 3.61

4.26

75%

51%

97 98 99 00 01

Net Debt to Equity

71%

160%

127%