Food Lion 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

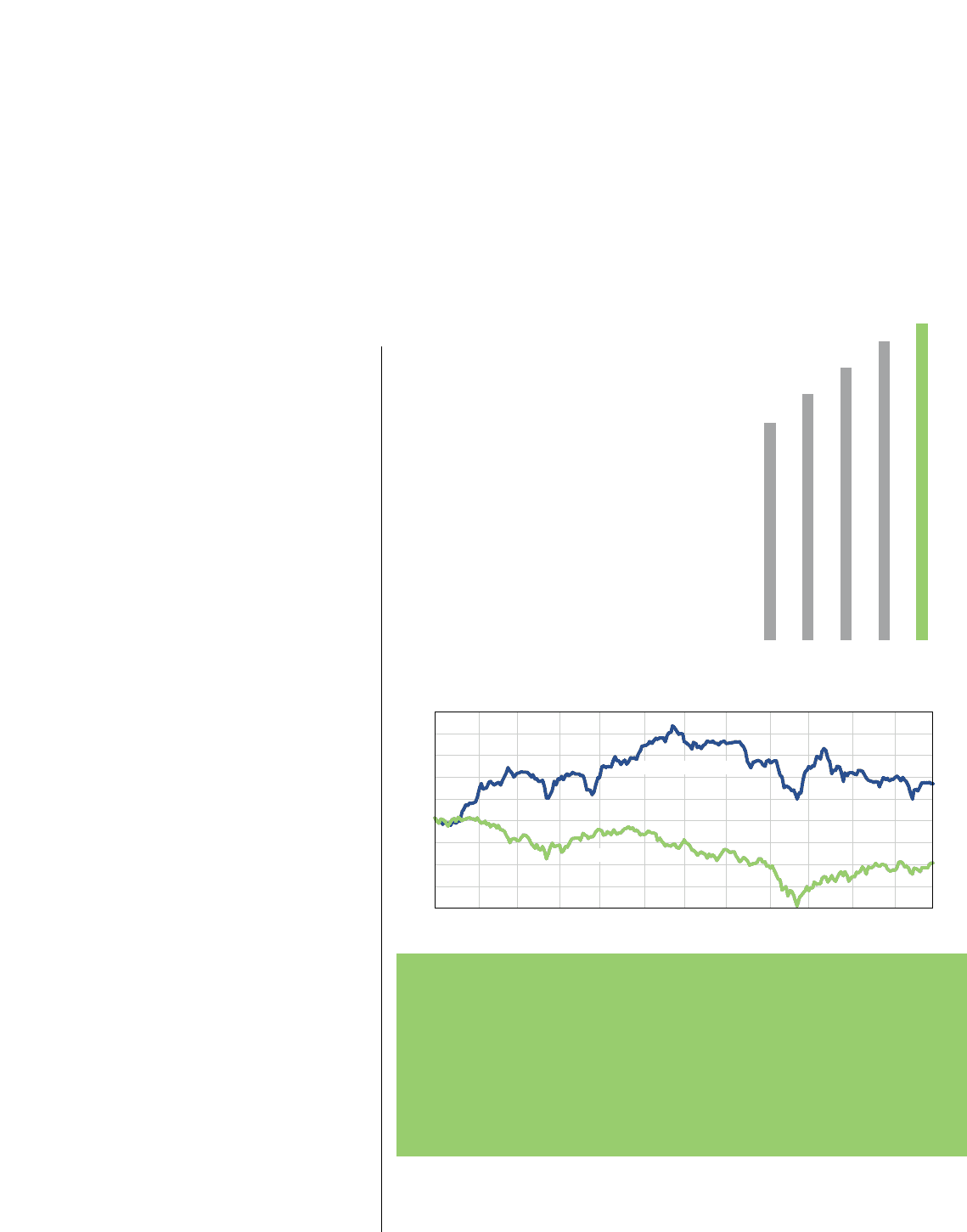

1962, would on December 31, 2001, have

had a value of EUR 11,263. The same

amount, invested in 1962 in the Belgian All

Share index would have resulted in a total

value of EUR 1,291. The compound

average growth rate of the annual total

return on Delhaize Group shares between

1962 and 2001 was 16.8%.

The most important event for Delhaize

Group shareholders in 2001 was the share

exchange with Delhaize America, a

milestone in the Group’s history. The share

exchange with Delhaize America included

the listing of Delhaize Group ADRs on the

New York Stock Exchange, in addition to

the listing of Delhaize Group on Euronext

Brussels since 1962. Delhaize Group

continues to comply with Belgian

disclosure regulations for listed companies

and, since the closing of the share

exchange, with the rules governing foreign

companies listed in the U.S.

In December 2000, the Belgian Association

of Financial Analysts rewarded Delhaize

Group’s investor relations efforts with the

Award for the Best Financial Information.

In 2001, Delhaize Group started quarterly

conference calls available by webcast and

organized its first analysts’field trip. And

in early 2002, the Group launched a

completely renewed corporate website

(www.delhaizegroup.com), that is now an

interactive, day-to-day contact point with,

and information base for, its shareholders.

JFMAMJJASOND

30

35

40

45

50

55

60

65

70

75

Delhaize Group Share

Eurostoxx 50

|23

owth

three strategic objectives: accomplish profitable top-line growth

rate as an international group of local companies.

0.74

0.84

97 98 99 00 01

0.93

1.02

1.08

Net Dividend

(in EUR)

Share Exchange with Delhaize America

On April 25, 2001, Delhaize America’s shareholders approved the proposed share exchange

with Delhaize Group. Until then, Delhaize Group owned approximately 45% of Delhaize

America, its major subsidiary listed on the NYSE. Under the share exchange, one Delhaize

America share was exchanged for 0.40 Delhaize Group ordinary share. Due to the share

exchange, the amount of Delhaize Group shares rose from more than 52 million to more

than 92 million, almost doubling the market capitalization of the Group and resulting in a

free float of approximately 80% of outstanding shares.

Detailed information and contact data for investors can be found from page 85 on.

(in EUR)