Food Lion 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|61

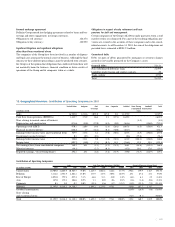

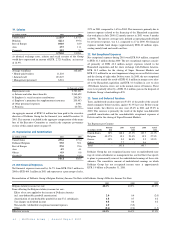

Deferred taxation increased significantly due to the deferred tax liability

that was recorded in connection with the purchase price allocation of the

share exchange with Delhaize America.

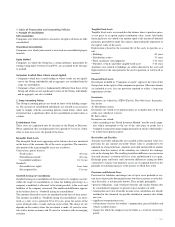

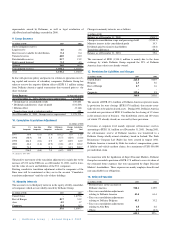

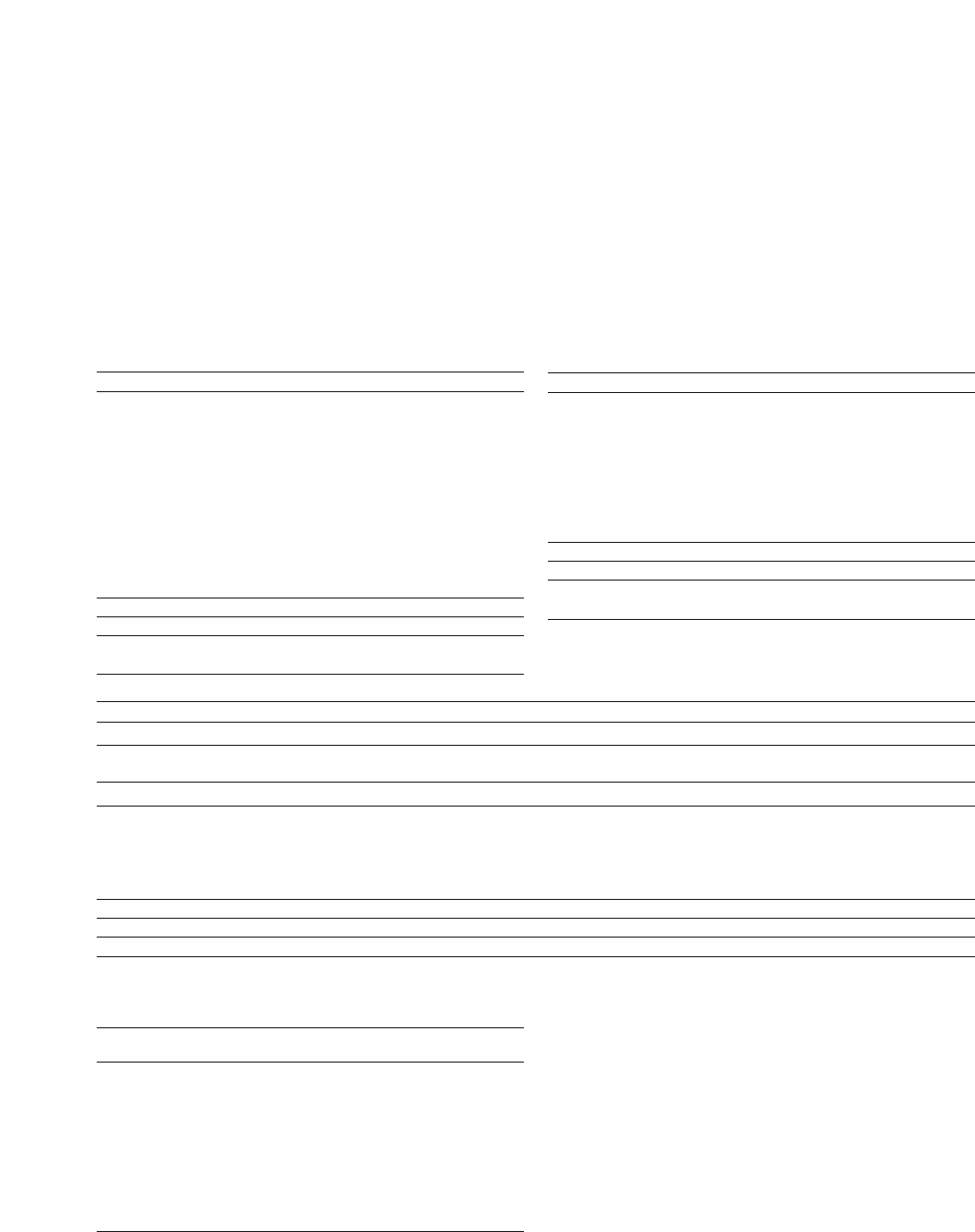

14. Amounts Falling Due after more than One Year

Long-term Borrowings

Financial liabilities (excl. liabilities under financial leases) are as follows:

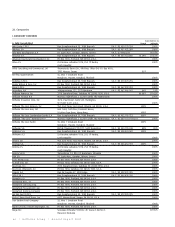

(in thousands of EUR)

United States 2001 2000

Debenture, 9.00% (due 2031) 1,021,219 -

Notes, 8.125% (due 2011) 1,248,156 -

Notes, 7,375% (due 2006) 680,812 -

Debt securities, 7.55% to 8.05%

(due 2007 to 2027) 333,075 322,407

Medium-term notes, 5.00% to 14.15%

(due 2002 to 2016) 123,105 246,060

Mortgages payable, 7.50% to 10.20%

(due 2003 to 2016) 45,205 51,093

Medium-term credit institution

borrowings 6.77% -21,430

Total non-subordinated borrowings 3,451,572 640,990

Less: current portion (18,525) (135,396)

Total non-subordinated borrowings,

long-term 3,433,047 505,594

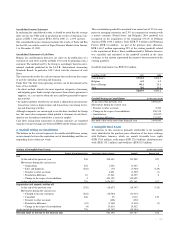

(in thousands of EUR)

Europe 2001 2000

1999 Eurobonds, 4.625% (due 2009) 149,002 148,866

2001 Eurobonds, 5.50% (due 2006) 150,000 -

Medium-term Treasury Program notes,

6.80% (due 2006) 12,395 12,395

Medium-term credit institution

borrowings, 5.14% and 5.75%,

respectively 14,392 15,817

Other 4,035 10,568

Total non-subordinated borrowings 329,824 187,646

Less: current portion (1,735 ) (3,461)

Total non-subordinated borrowings,

long-term 328,089 184,185

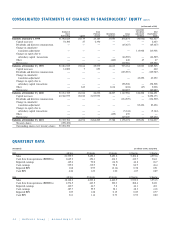

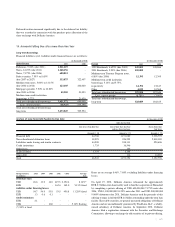

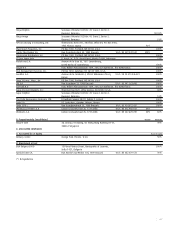

Analysis of Long-Term Debt Payable by Due Date (in thousands of EUR)

Debts by Due Date

Due in Less than One Year Due in More than One Year Due in More than

and Less than Five Years Five Years

(Account n° 42) (Account n° 17) (Account n° 17)

Financial debt 64,768 1,191,080 3,338,795

Non-subordinated debenture loans 18,525 926,255 2,818,189

Liabilities under leasing and similar contracts 44,508 248,133 520,606

Credit institutions 1,735 16,546 -

Other loans - 146 -

Trade creditors 1,775 2,158 -

Other debt - 116 14,003

Total 66,543 1,193,354 3,352,798

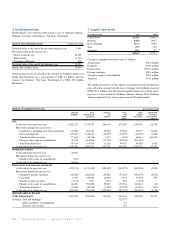

Foreign Currency 2003 2004 2005 2006 >2006 Average

(in millions) Rate

Debenture loan

USD 26.6 13.0 14.0 619.5 2,352.4 8.14%*

EUR - - - 162.4 149.0 5.13% fixed

Liabilities under financing leases

USD 54.7 54.9 53.8 53.5 458.8 11.28% fixed

EUR 1.3 0.6 0.1 - - -

Credit institutions

EUR 2.1 - - - - -

CZK - 460 - - 5.14% floating

(*) 90% is fixed

Rates are on average 8.46%, 7.88% excluding liabilities under financing

leases.

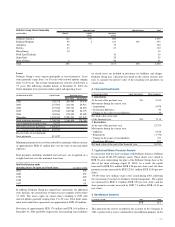

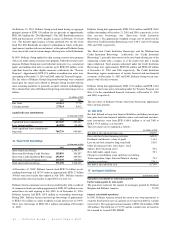

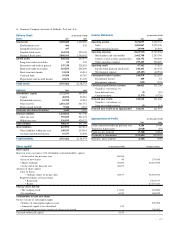

On April 19, 2001, Delhaize America refinanced the approximately

EUR 2.7 billion term loan facility used to fund the acquisition of Hannaford

by completing a private offering of USD 600,000,000 7.375% notes due

2006, USD 1,100,000,000 8.125% notes due 2011 and USD 900,000,000

9.000% debentures due 2031. Delhaize America used the proceeds of this

offering to repay in full the EUR 2.6 billion outstanding under the term loan

facility. These debt securities are general unsecured obligations of Delhaize

America and are unconditionally guaranteed by Food Lion, LLC, a wholly-

owned subsidiary of Delhaize America. In September 2001, Delhaize

America filed a registration statement with the Securities and Exchange

Commission, allowing to exchange the old securities of its private offering.