Food Lion 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 |Delhaize Group |Annual Report 2001

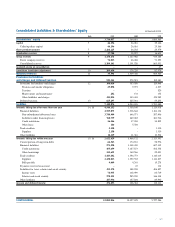

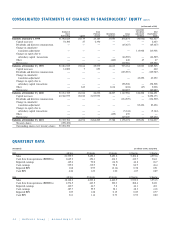

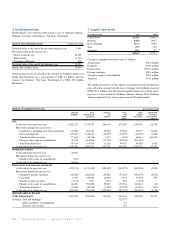

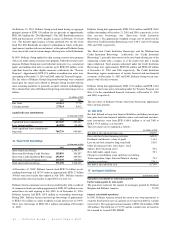

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (note 1)

(in thousands of EUR)

Cumulative

Number of Share Translation Total

Shares Premium Revaluation Group Adjustment Shareholders’

Outstanding Capital Account Reserves Reserves and Other Equity

Balances at January 1, 1999 51,962,625 25,139 23,183 17,053 876,874 (30,932) 911,317

Capital increases 54,300 27 2,396 — — — 2,423

Dividends and directors remuneration — ———(65,427) — (65,427)

Change in cumulative

translation adjustment — — — —— 113,908 113,908

Changes in equity due to

subsidiary capital transactions — — ——(46,589) — (46,589)

Other —— —(440) 440 47 47

Net income —— — — 169,886 — 169,886

Balances at December 31, 1999 52,016,925 25,166 25,579 16,613 935,184 83,023 1,085,565

Capital increases 14,800 7 653 ——— 660

Dividends and directors remuneration — —— — (125,987) — (125,987)

Change in cumulative

translation adjustment —— — —— 43,252 43,252

Changes in equity due to

subsidiary capital transactions — — — — 198,508 — 198,508

Other — 843 — 1,614 (404) (47) 2,006

Net income —— — — 160,687 — 160,687

Balances at December 31, 2000 52,031,725 26,016 26,232 18,227 1,167,988 126,228 1,364,691

Capital increases 40,360,979 20,180 2,237,993 — — — 2,258,173

Dividends and directors remuneration — —— — (134,529) — (134,529)

Change in cumulative

translation adjustment — — —— — 83,426 83,426

Changes in equity due to

subsidiary capital transactions — — — — (5,144) — (5,144)

Other —— — (439) 439 — —

Net income — — — — 149,420 — 149,420

Balances at December 31, 2001 92,392,704 46,196 2,264,225 17,788 1,178,174 209,654 3,716,037

Treasury shares (298,452)

Outstanding shares excl. treasury shares 92,094,252

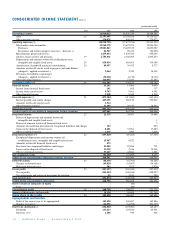

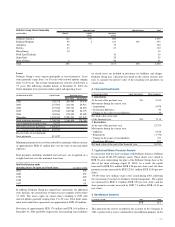

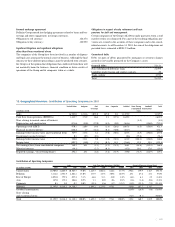

QUARTERLY DATA

(Unaudited) (in millions of EUR, except EPS)

2001 Full Year 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter

Sales 21,395.9 5,452.3 5,453.2 5,496.8 4,993.6

Cash flow from operations (EBITDA) 1,649.2 456.1 414.3 412.7 366.1

Reported earnings 149.4 90.8 (14.9) 46.8 26.7

Cash earnings 339.0 112.9 92.8 86.9 46.4

Reported EPS 1.88 0.99 (0.16) 0.58 0.51

Cash EPS 4.26 1,23 1.00 1.07 0.89

2000 Full Year 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter

Sales 18,168.2 6,223.8 4,460.9 3,932.0 3,551.5

Cash flow from operations (EBITDA) 1,274.5 463.5 300.3 268.6 242.1

Reported earnings 160.7 66.7 7.8 46.1 40.1

Cash earnings 187.7 59.5 38.1 48.3 41.8

Reported EPS 3.09 1.28 0.15 0.89 0.77

Cash EPS 3.61 1.14 0.73 0.93 0.80