Food Lion 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

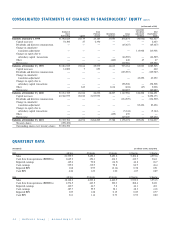

60 |Delhaize Group |Annual Report 2001

supermarkets owned by Delimmo, as well as legal revaluation of

Alfa-Beta land and buildings recorded in 2000.

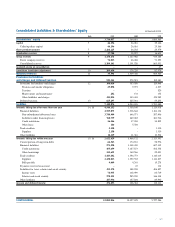

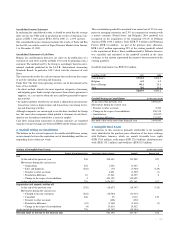

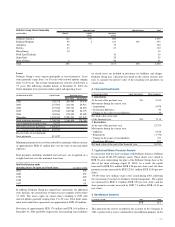

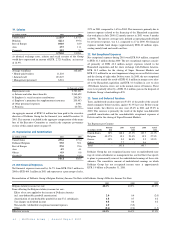

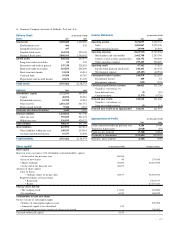

9. Group Reserves

(in millions of EUR) 2001 2000

Parent company reserves

Legal reserve 4.6 2.6

Reserves not available for distribution 0.4 0.4

Untaxed reserves 44.0 44.0

Distributable reserves 15.7 15.2

Profit carried forward 9.3 4.3

Subtotal 74.0 66.5

Consolidated reserves 1,104.2 1,101.5

Total 1,178.2 1,168.0

In line with previous policy and practice in relation to operations involv-

ing capital and reserves of subsidiary companies, Delhaize Group has

taken to reserve the negative dilution effect of EUR 5.1 million arising

from Delhaize America capital transactions that occurred prior to the

share exchange.

Group Reserves (in thousands of EUR)

As of December 31, 2000, Group reserves represented: 1,167,988

• Group share in consolidated results 149,420

• Dividends and directors’share of profit (134,529)

• Dilution effect (5,144)

• Transfer from taxed revaluation surplus 439

As of December 31, 2001, Group reserves represented 1,178,174

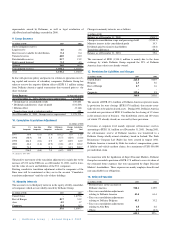

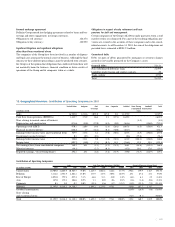

10. Cumulative Translation Adjustment

(in millions of EUR)

Year U.S. Euro Zone Other Difference Change Cumulative

Companies Companies Companies on Results over the Total

Year

1997 (*) 30.6 (5.1) (3.4) (10.2) 11.9 11.9

1998 (38.9) 0.4 1.3 (5.7) (42.9) (31.0)

1999 104.2 (0.1) 0.9 8.9 113.9 82.9

2000 46.6 (1.6) (0.9) (0.8) 43.3 126.2

2001 73.5 - 9.1 0.9 83.5 209.7

216.0 (6.4) 7.0 (6.9) 209.7

(*) cumulative 1977-1997

The positive movement of the translation adjustment is mainly due to the

increase of 5.6% in the USD rate as of December 31, 2001, used to trans-

late the value of assets and liabilities of the U.S. companies.

Existing cumulative translation adjustment related to companies of the

Euro zone will be maintained as they are in the account “Cumulative

translation adjustment” until the sale of these holdings.

11. Minority Interests

This account covers third party interests in the equity of fully consolidat-

ed companies which are not wholly owned by Delhaize Group.

(in millions of EUR) 2001 2000

United States -1,475.6

Rest of Europe 30.7 31.9

Asia 4.5 1.7

Corporate 0.4 0.5

35.6 1,509.7

Changes in minority interests are as follows:

(in millions of EUR)

Balance as of December 31, 2000 1,509.7

Changes in consolidation scope and percentage held (1,534.1)

Minority interest in the consolidated profit 19.3

Dividends paid to minority shareholders (18.4)

Translation difference 59.1

Balance as of December 31, 2001 35.6

The movement of EUR (1,534.1) million is mainly due to the share

exchange by which Delhaize Group acquired the 55% of Delhaize

America shares that it not already owned.

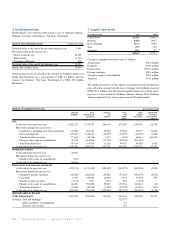

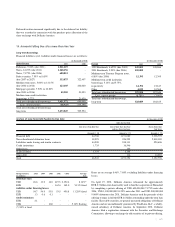

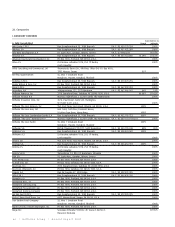

12. Provisions for Liabilities and Charges

(in millions of EUR) 2001 2000

United States 221.4 344.9

Belgium 2.3 3.6

Rest of Europe 4.7 1.6

Asia --

Corporate 139.6 3.5

368.0 353.6

The amount of EUR 221.4 million at Delhaize America represents main-

ly provisions for store closings (EUR 187.0 million), that consist essen-

tially of rents to be paid on leased assets. During 2001, Delhaize America

recorded new provisions of EUR 8.5 million for the closing of 12 stores

in the normal course of business. One distribution center and 189 stores

(of which 179 already closed) are covered by these provisions.

Provisions at corporate level mainly represent self-insurance reserves

amounting to EUR 118.1 million as of December 31, 2001. During 2001,

the self-insurance reserve of Delhaize America was transferred to a

Delhaize Group wholly-owned subsidiary based in Ireland. The Pride

Reinsurance Company Ltd (Pride) has been created in August 2001.

Delhaize America is insured by Pride for workers’compensation, gener-

al liability and vehicle accident claims, for a maximum of USD 500,000

per individual claim.

In connection with the liquidation of Super Discount Markets, Delhaize

Group has recorded a provision of EUR 17.8 million to cover its share of

the estimated future expenses that were guaranteed by Super Discount

Markets’shareholders. These expenses are mainly employee benefits and

non-cancellable lease obligations.

13. Deferred Taxation

(in millions of EUR) 2001 2000

• Deferred taxes in the accounts of

Delhaize America 528.1 125.9

• Taxes on consolidation adjustments

relating to Delhaize America 43.4 61.4

• Taxes on consolidation adjustments

relating to Delhaize Belgium 45.3 33.2

• Taxes on consolidation adjustments

relating to Alfa-Beta 6.8 4.8

• Others 1.7 (0.3)

625.3 225.-