Food Lion 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

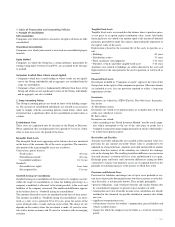

Currency Risk

Because a substantial portion of its assets,

liabilities and operating results are

denominated in U.S. dollars, Delhaize

Group is exposed to fluctuations in the

value of the U.S. dollar against the Euro.

In line with its risk policy, the Group does

not hedge this U.S. dollar translation

exposure.

In 2001, a variation of one USD cent in the

exchange rate of the EUR would have

caused cash earnings of Delhaize Group to

vary by 1% or EUR 3.3 million. During the

period 1994-2001, sales of the Group

increased annually on average by 12.9%, of

which 9.0% was at identical exchange rates

and 3.9% was due to currency fluctuations.

Cash earnings of Delhaize Group increased

annually on average by 21.1% during the

period 1994-2001, of which 17.6% was at

identical exchange rates and 3.5% was due

to currency fluctuations.

A significant transaction risk for the Group

due to variations in currencies is the

payments of dividends by the operating

companies to the parent company.

Additional currency exposure arises when

the parent company or Delhaize Group’s

financing companies finance the Group’s

subsidiaries in their local currency. Such

intra-Group cross-currency lending is fully

hedged through the use of foreign

exchange forward contracts or currency

swaps. Delhaize Group’s subsidiaries

borrow, in most of cases, directly in local

currencies. As a result, fluctuations in

Delhaize Group’s balance sheet ratios

resulting from changes in currencies are

generally limited.

Interest Rate Risk

The Delhaize Group interest rate risk

management objectives are to limit the

effect of interest rate changes on earnings

and cash flows and to lower borrowing

costs. For that purpose, Delhaize America

entered in late 1999 into agreements to

hedge against a potential increase in

interest rates prior to the planned long-term

bond offering related to the Hannaford

acquisition (as explained earlier in this

chapter).

At the end of 2001, 81% of the net debt of

the Group was fixed for a period of at least

one year. As a consequence, a variation in

short-term interest rates would not have

affected the Group’s interest expenses

materially. At the end of 2001, there was no

major hedge to fix interest rates

outstanding within Delhaize Group.

Delhaize Group manages its debt and

overall financing strategies using a

combination of short, medium and long-

term debt. The Group finances its daily

working capital requirements, when

necessary, through the use of its various

committed and uncommitted lines of credit

and commercial paper programs. These

short- and medium-term borrowing

arrangements generally bear interest at the

inter-bank offering rate of the originating

country plus a margin, or at the market rate

plus a margin at the borrowing date.

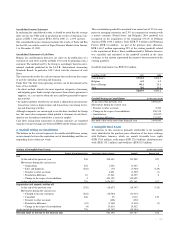

Liquidity Risk

Liquidity risk is the risk of being unable to

meet all present and future financial

obligations as they come due. One of

Delhaize Group’s major objectives is to

maintain funding availability through any

economic or business cycle. Management

closely monitors the amount of short-term

funding and mix of short-term funding to

total debt, the overall composition of total

debt and the availability of committed credit

facilities in relation to the level of

outstanding short-term debt. The Group’s

policy is to finance its operating subsidiaries

through a mix of retained earnings, third-

party borrowings and loans from the parent

and Group financing companies, whichever

is most appropriate for the particular country

and business concerned.

At the end of 2001, short-term borrowings of

Delhaize Group were EUR 571.3 million.

Delhaize America had a USD 500 million

syndicated credit facility and Delhaize “Le

Lion” parent company a EUR 500 million

commercial paper program. In addition,

Delhaize Group had, through its different

companies, more than EUR 500 million

committed bilateral credit facilities in the

U.S. and Europe.

On December 31, 2001, Moody’s Investors

Service had a Baa3 rating on Delhaize

America. Standard & Poor’s indicated a

BBB minus rating. These ratings enable

Delhaize America to access a wide range of

debt financing, including bonds and

committed bank facilities.

|47