Food Lion 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 |Delhaize Group |Annual Report 2001

Stock Based Compensation

Under Belgian GAAP, compensation expense related to stock options is

not recorded. Under US GAAP, Delhaize Group has elected to follow the

accounting provisions of Accounting Principles Board Opinion (APBO)

No. 25, Accounting for Stock Issued to Employees, for grant of shares,

stock options and other equity instruments. This resulted in the recording

of compensation expense relating to Delhaize America’s restricted stock

plans and Delhaize Group’s stock option plans. The share exchange with

Delhaize America resulted in a new measurement date for the Delhaize

America’s stock option and restricted stock plans. A result, a one-time,

non-cash compensation expense of EUR 13.1 million pre-tax was record-

ed under US GAAP.

Treasury Shares

Under Belgian GAAP, treasury shares are classified in the balance sheet

caption “Short-term investments” and are subject to a valuation

allowance when the share price at the reporting date is lower than the

acquisition price. Under US GAAP, treasury shares are deducted from

shareholders’equity in the captions “Capital” and “Additional Paid in

Capital” and are maintained at cost.

Other Items

Other items include adjustments to record differences between Belgian

GAAP and US GAAP for interest cost capitalization, software develop-

ment cost capitalization, accounting for derivative transactions and

accounting for a highly inflationary country (Romania). An adjustment is

also recorded to reflect the difference in the basis for Belgian GAAP and

US GAAP on the gain recorded on the disposition of an investment in

2000.

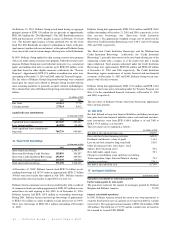

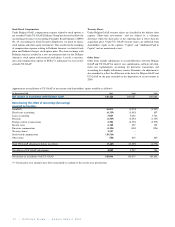

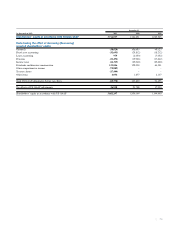

Approximate reconciliation to US GAAP of net income and shareholders' equity would be as follows*:

(in thousands of EUR) 2001 2000 1999

Net income in accordance with Belgian GAAP 149,420 160,687 169,886

Items having the effect of increasing (decreasing)

reported net income:

Goodwill 10,673 (2,070) (2,357)

Fixed asset accounting (6,339) (5,893) 807

Lease accounting 3,029 5,002 3,761

Pensions (1,569) (2,293) (1,307)

Foreign currency transactions 2,504 (8,353) (5,575)

Income taxes 6,168 452 345

Directors remuneration (1,106) (949) (926)

Treasury shares 1,517 - -

Stock based compensation (19,514) - -

Other items (786) 845 480

Total US GAAP adjustments before tax effects (5,423) (13,259) (4,772)

Tax effects of US GAAP adjustments 4,049 3,247 740

Net income in accordance with US GAAP 148,046 150,675 165,854

(*) Certain prior year amounts have been reclassified to conform to the current year presentation.