Food Lion 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 |Delhaize Group |Annual Report 2001

Deferred taxes are calculated using the liability method on a full provi-

sion basis, thus, taking into account temporary differences between book

and tax values of assets and liabilities in the consolidated balance sheet.

Deferred taxes have two sources: temporary differences in the accounts of

Group companies and consolidation adjustments.

Deferred tax assets are included in the consolidated accounts only to the

extent that their realisation is probable in the foreseeable future.

Within each fiscal entity in the Group, deferred tax assets and liabilities

are offset. Net asset balances are recorded under a separate account of

long term assets.

Translation of Foreign Currencies

The balance sheets of foreign subsidiaries are converted to Euro’s at the

year-end rate (closing rate).

The profit and loss accounts are translated at the average daily rate, i.e.

the yearly average of the rates each working day of the currencies

involved. The differences arising from the use of the average daily rate for

the profit and loss account and the closing rate for the balance sheet is

taken to the “Cumulative translation adjustment” component of equity.

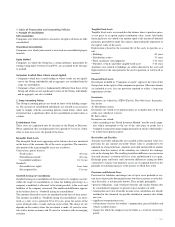

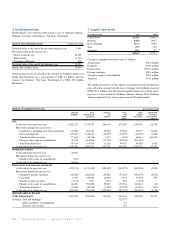

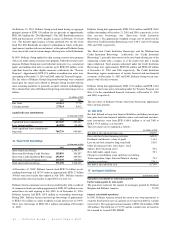

(in EUR) Closing Rate Average Daily Rate

2001 2000 2001 2000

1 USD 1.134687 1.074690 1.116570 1.085001

100 GRD 0.293506 0.293506 0.293506 0.297125

100 CZK 3.128714 2.824499 2.935307 2.809898

100 SKK 2.337537 2.271696 2.309475 2.345469

100 THB 2.557270 2.449932 2.512029 2.704023

100 IDR 0.010808 0.011034 0.010982 0.013014

1 SGD 0.613271 0.612823 0.623480 0.629262

100 ROL 0.003594 0.004098 0.003842 0.004884

3. Scope of Consolidation

Main Changes During 1999. In 1999, Delhaize Group made acquisitions

for an aggregate amount of EUR 226.2 million.

Main Changes During 2000. In 2000, Delhaize Group made acquisitions

for an aggregate amount of EUR 3,830.6 million (including capital con-

sideration).

Main Changes During 2001. In 2001, Delhaize Group made acquisitions

for an aggregate amount of EUR 2,324.1 million (including capital con-

sideration).

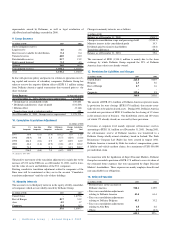

Delhaize America

On April 25, 2001, Delhaize Group and Delhaize America consummated

a share exchange transaction in which Delhaize Group acquired all of the

outstanding shares of Delhaize America which it did not already own.

Delhaize America shareholders exchanged their shares of Delhaize

America common stock for 0.4 ordinary share or American Depositary

Receipt (ADR) of Delhaize Group. As a result of the share exchange,

Delhaize America became a wholly-owned subsidiary of Delhaize Group.

The share exchange resulted in the issuance of 40,181,529 new shares of

Delhaize Group having an aggregate value of EUR 2,250.2 million.

Stock option exercise costs and additional direct costs incurred in con-

nection with the share exchange, principally investment banking, legal

and other professional fees, in the amount of EUR 24.5 million have been

included in the purchase price allocation.

The share exchange with Delhaize America was accounted for using the

purchase method of accounting, as a step acquisition. The purchase price

is allocated to acquired assets and liabilities assumed, based on their esti-

mated fair values at the date of acquisition, and any excess is allocated to

goodwill (as Delhaize Group already owned approximately 45% of

Delhaize America, only the 55% of assets and liabilities that it did not

already own was subject to the purchase price allocation. The existing

45% was maintained at book value). The share exchange resulted in

goodwill of approximately EUR 1.9 billion, which will be amortized over

40 years using the straight-line method. As part of the purchase price allo-

cation, EUR 1,634.7 million representing 55% of the existing goodwill

related to the acquisition of Kash n’Karry and Hannaford by Delhaize

America, was cancelled and transfered to the goodwill recorded in the

share exchange, as this amount represented the minority interest portion

in the existing goodwill.

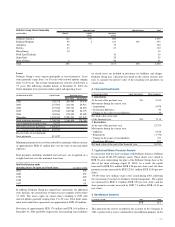

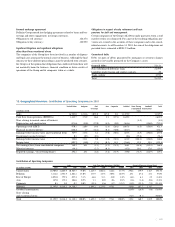

The net purchase price was allocated as follows:

(in millions of EUR)

Goodwill arising on consolidation 1,905

Goodwill arising on consolidation (55% of existing

goodwill on Hannaford and Kash n’Karry) (1,635)

Intangible assets 808

Tangible fixed assets 221

Other assets (55% of rate lock loss, net of tax) (81)

Minority interests 1,538

Provisions for liabilities and deferred taxes (418)

Long-term debt (66)

Short-term obligations 3

Purchase price 2,275

Trofo

In January 2001, Delhaize Group acquired Trofo, a Greek food retailer,

and its fully-owned subsidiary ENA, a Greek food retailer.

Delhaize Belgium

In April 2001, Delhaize Group bought 30% of the transport company

Wambacq Peeters, to bring its ownership interest to 85%.

In April 2001, Delhaize Group acquired Svemark and its fully-owned

subsidiary Regab, both Dutch companies that own a distribution center

located in Zellik used by Delhaize Belgium.

In October 2001, Delhaize Group bought SID, that owns an AD Delhaize

store operated by an independent affiliate.

Super Discount Markets

On November 12, 2001, Super Discount Markets filed for protection

under Chapter 11 of the U.S. Bankruptcy Code and has elected to use

Chapter 11 procedures to effect a liquidation of its business.

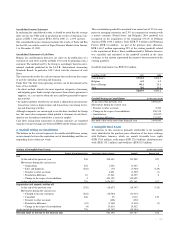

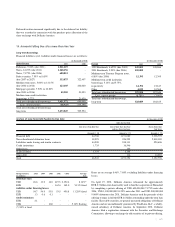

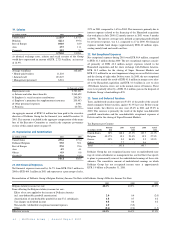

4. Methodology

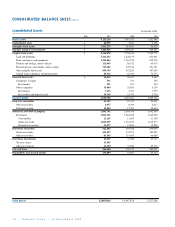

Consolidated Balance Sheet

In analyzing the different asset and liability accounts, it must be remem-

bered that the closing rate for the American dollar used for the conversion

of the balance sheets of the U.S. companies is EUR 1.135 at the end of

2001 compared with EUR 1.075 at the end of 2000, an increase of 5.6%.

In 2001, the accounts of Trofo and ENA are consolidated for the first

time, while the accounts of Super Discount Markets are no longer includ-

ed in the consolidated balance sheet.