Dollar Tree 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

thereof thereafter and the Term Loan B tranche requires quarterly amortization payments of 0.25% of the original principal

amount thereof after the closing of the Acquisition. The New Term Loan Facilities also require mandatory prepayments in

connection with certain asset sales and out of excess cash flow, among other things, and subject in each case to certain

significant exceptions. The Company expects to pay certain commitment fees in connection with the New Revolving Credit

Facility. Additionally, the Term Loan B tranche of the New Term Loan Facilities will require the Company to pay a 1.00%

prepayment fee if the loans thereunder are subject to certain repricing transactions before March 9, 2016.

The New Senior Secured Credit Facilities contain representations and warranties, events of default and affirmative and

negative covenants that apply, in certain circumstances, before and after the closing of the Acquisition and are customary for

similar financings. These include, among other things and subject to certain significant exceptions, restrictions on the

Company's ability to declare or pay dividends, repay the acquisition notes, create liens, incur additional indebtedness, make

investments, dispose of assets and merge or consolidate with any other person. In addition, a financial maintenance covenant

based on the Company’s consolidated first lien secured net leverage ratio will apply to the New Revolving Credit Facility and

the Term Loan A tranche of the New Term Loan Facilities after the closing of the Acquisition.

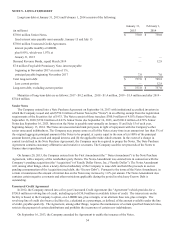

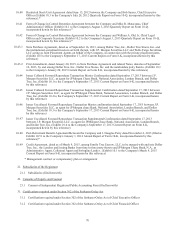

NOTE 12 - QUARTERLY FINANCIAL INFORMATION (Unaudited)

The following table sets forth certain items from the Company's unaudited consolidated income statements for each quarter

of fiscal year 2014 and 2013. The unaudited information has been prepared on the same basis as the audited consolidated

financial statements appearing elsewhere in this report and includes all adjustments, consisting only of normal recurring

adjustments, which management considers necessary for a fair presentation of the financial data shown. The operating results

for any quarter are not necessarily indicative of results for a full year or for any future period.

(dollars in millions, except diluted net income per share data)

First

Quarter (1)

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal 2014:

Net sales $ 2,000.3 $ 2,031.1 $ 2,095.2 $ 2,475.6

Gross profit $ 696.6 $ 694.1 $ 725.3 $ 918.1

Operating income $ 231.9 $ 205.0 $ 219.7 $ 383.6

Net income $ 138.3 $ 121.5 $ 133.0 $ 206.6

Diluted net income per share $ 0.67 $ 0.59 $ 0.64 $ 1.00

Stores open at end of quarter 5,080 5,166 5,282 5,367

Comparable store net sales change 1.9% 4.4% 5.9% 5.5%

Fiscal 2013:

Net sales $ 1,865.8 $ 1,854.9 $ 1,884.7 $ 2,234.9

Gross profit $ 656.0 $ 648.7 $ 659.9 $ 825.2

Operating income $ 216.6 $ 201.3 $ 204.3 $ 348.2

Net income $ 133.5 $ 124.7 $ 125.4 $ 213.0

Diluted net income per share $ 0.59 $ 0.56 $ 0.58 $ 1.02

Stores open at end of quarter 4,763 4,842 4,953 4,992

Comparable store net sales change 2.1% 3.7% 3.1% 1.2%

(1) Easter was observed on April 20, 2014 and March 31, 2013.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.