Dollar Tree 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

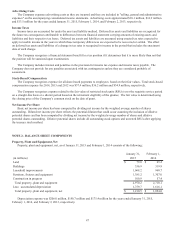

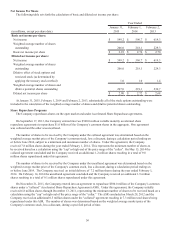

Other Assets

Other assets as of January 31, 2015 and February 1, 2014 consist of the following:

January 31, February 1,

(in millions) 2015 2014

Deferred financing costs, net $ 74.3 $ 4.3

Other intangible assets, net 1.5 2.5

Long-term federal income tax benefit 2.2 1.9

Restricted investments 78.9 87.9

Other long-term assets 9.8 9.4

Total other assets $ 166.7 $ 106.0

Other Current Liabilities

Other current liabilities as of January 31, 2015 and February 1, 2014 consist of accrued expenses for the following:

January 31, February 1,

(in millions) 2015 2014

Compensation and benefits $ 108.6 $ 95.3

Taxes (other than income taxes) 30.6 26.4

Insurance 42.7 34.1

Accrued deferred financing costs 58.4 —

Accrued interest 48.3 2.0

Other 96.7 74.5

Total other current liabilities $ 385.3 $ 232.3

Other Long-Term Liabilities

Other long-term liabilities as of January 31, 2015 and February 1, 2014 consist of the following:

January 31, February 1,

(in millions) 2015 2014

Deferred rent $ 91.9 $ 86.3

Insurance 51.8 54.7

Other 13.2 11.4

Total other long-term liabilities $ 156.9 $ 152.4

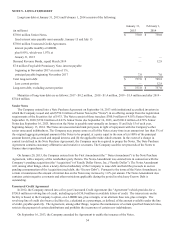

NOTE 3 - INCOME TAXES

Total income taxes were allocated as follows:

Year Ended

(in millions)

January 31,

2015

February 1,

2014

February 2,

2013

Income from continuing operations $ 355.0 $ 357.6 $ 359.6

Shareholders' equity, tax benefit on

exercises/vesting of equity-based

compensation (4.5)(9.8)(21.3)

$ 350.5 $ 347.8 $ 338.3