Dollar Tree 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

policy for all associates. Our distribution centers are operated based on objective measures of performance and virtually

everyone in our store support center is available to assist associates in the stores and distribution centers.

Our disclosure committee meets at least quarterly and monitors our internal controls over financial reporting to ensure that

our public filings contain discussions about the risks our business faces. We believe that we have the controls in place to be

able to certify our financial statements. Additionally, we have complied with the listing requirements for the Nasdaq Stock

Market.

Seasonality. For information on the impact of seasonality, see Item 1A. "Risk Factors" beginning on page 10 of this Form

10-K and Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on

page 25 of this Form 10-K.

Growth Strategy

Store Openings and Square Footage Growth. The primary factors contributing to our net sales growth have been new store

openings, an active store expansion and remodel program, and selective mergers and acquisitions. In the last five years, net

sales increased at a compound annual growth rate of 10.0%. We expect that the majority of our future sales growth will come

primarily from new store openings and from our store expansion and relocation program.

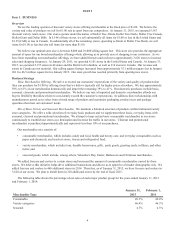

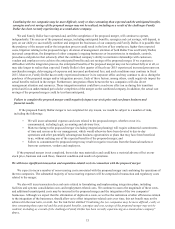

The following table shows the average selling square footage of our stores and the selling square footage per new store

opened over the last five years. Our growth and productivity statistics are reported based on selling square footage because our

management believes the use of selling square footage yields a more accurate measure of store productivity.

Year Number of Stores

Average Selling Square

Footage Per Store

Average Selling Square

Footage Per New Store

Opened

2010 4,101 8,570 8,400

2011 4,351 8,640 8,360

2012 4,671 8,660 8,060

2013 4,992 8,660 8,020

2014 5,367 8,660 8,060

We expect to increase the selling square footage in our Dollar Tree stores in the future by opening new stores in

underserved markets and strategically increasing our presence in our existing markets via new store openings and store

expansions (expansions include store relocations). In fiscal 2015 and beyond, we plan to predominantly open Dollar Tree

stores that are approximately 8,000 - 10,000 selling square feet and we believe this size allows us to achieve our objectives in

the markets in which we plan to expand. At January 31, 2015, approximately 2,974 of our stores, totaling 65% of our selling

square footage, were 8,000 selling square feet or larger.

Our Deals stores, which offer an expanded assortment of merchandise including items that sell for more than $1.00,

provide us an opportunity to leverage our Dollar Tree infrastructure in different merchandise concepts, including higher price

points, without disrupting the single-price point model in our Dollar Tree stores. We operated 219 Deals stores as of

January 31, 2015.

In addition to new store openings, we plan to continue our store expansion program to increase our net sales per store and

take advantage of market opportunities. We target stores for expansion based on the current sales per selling square foot and

changes in market opportunities. Stores targeted for expansion are generally less than 6,000 selling square feet in size. Store

expansions generally increase the existing store size by approximately 2,750 selling square feet.

Since 1995, we have added a total of 695 stores through several mergers and acquisitions. Our acquisition strategy has

been to target companies that have a similar single-price point concept that have shown success in operations or companies that

provide a strategic advantage. We evaluate potential acquisition opportunities as they become available. On July 27, 2014, we

executed an Agreement and Plan of Merger to acquire Family Dollar Stores, Inc. For more information regarding the pending

acquisition, see "Family Dollar Acquisition" below and Item 8. "Financial Statements and Supplementary Data, Note 11 -

Pending Acquisition and Related Debt" beginning on page 61 of this Form 10-K.

From time to time, we also acquire the rights to store leases through bankruptcy or other proceedings. We will continue to

take advantage of these opportunities as they arise depending upon several factors including their fit within our location and

selling square footage size parameters.