Dollar Tree 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

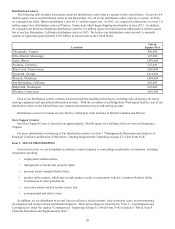

In fiscal 2014, comparable store net sales increased by 4.3%. The comparable store net sales increase was the result of a

3.4% increase in the number of transactions and a 0.9% increase in average ticket. We believe comparable store net sales

continued to be positively affected by a number of our initiatives, as debit and credit card penetration continued to increase in

2014, and we continued the roll-out of frozen and refrigerated merchandise to more of our stores. At January 31, 2015 we had

frozen and refrigerated merchandise in approximately 3,620 stores compared to approximately 3,160 stores at February 1,

2014. We believe that the addition of frozen and refrigerated product enables us to increase sales and earnings by increasing

the number of shopping trips made by our customers. In addition, we accept food stamps (under the Supplemental Nutrition

Assistance Program (“SNAP”)) in approximately 5,000 qualified stores compared to 4,620 at the end of 2013.

Our point-of-sale technology provides us with valuable sales and inventory information to assist our buyers and improve

our merchandise allocation to our stores. We believe that this has enabled us to better manage our inventory flow resulting in

more efficient distribution and store operations.

We must continue to control our merchandise costs, inventory levels and our general and administrative expenses as

increases in these line items could negatively impact our operating results.

Pending Acquisition

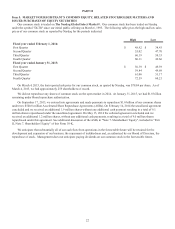

On July 27, 2014, we executed an Agreement and Plan of Merger (the "Merger Agreement") to acquire Family Dollar in a

cash and stock transaction (the “Acquisition”). Under the Acquisition, which was approved by Family Dollar shareholders on

January 22, 2015, the Family Dollar shareholders will receive $59.60 in cash plus no more than 0.3036 and no less than 0.2484

shares of our common stock for each share of Family Dollar common stock they own. On January 31, 2015, Family Dollar had

approximately 114.5 million outstanding shares of common stock. Due to the vesting of outstanding equity awards, Family

Dollar is expected to have up to an additional 2.0 million shares of common stock outstanding at closing in connection with the

Acquisition. Family Dollar stock options and RSUs will convert into options and RSUs in our common stock. After the

Acquisition, we expect that former Family Dollar stockholders will own no more than 15.1% and no less than 12.7% of the

outstanding shares of Dollar Tree common stock.

The transaction is subject to expiration or termination of the applicable waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act ("HSR Act") and satisfaction or waiver of the other customary closing conditions.

On or before closing, we expect to incur approximately $210.0 million in acquisition-related expenses, of which $75.2

million were incurred in 2014 including $33.5 million that was paid in 2014. During 2014, $28.5 million of acquisition-related

expenses were recorded in "selling, general and administrative expenses" and $46.7 million related to commitment fees were

recorded in "interest expense, net." We expect to incur an additional $22.6 million in commitment fees in the first quarter of

fiscal 2015. We also expect to expend approximately $174.0 million in capitalizable debt issuance costs related to the financing

of the Acquisition.

In connection with the Acquisition, we expect to pay off most of our and Family Dollar's existing debt, and obtain

approximately $9.5 billion in bank and bond financing to recapitalize the combined company and finance the Acquisition and

ongoing operations. On February 23, 2015 we completed the offering of $3.25 billion of acquisition notes and on March 9,

2015 we received funding under the $3.95 billion Term Loan B in connection with the financing. The proceeds of the

acquisition notes and Term Loan B are being held in escrow pending consummation of the Acquisition. Please see "Note 11 -

Pending Acquisition and Related Debt" beginning on Page 61 of this Form 10-K included in "Part II. Item 8. Financial

Statements and Supplementary Data" for more information on the financing.

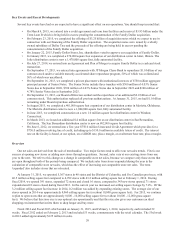

We expect to achieve approximately $300 million in annual cost savings synergies by the end of the third year after

closing, and that we will incur $300 million in one-time costs to achieve those synergies. We project that the Acquisition will be

dilutive to earnings per share in the first twelve months following closing on a GAAP basis; however, we expect it will be

accretive excluding the one-time costs to achieve synergies.