Dollar Tree 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

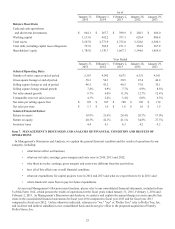

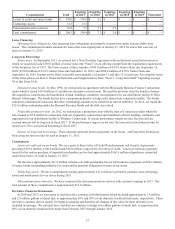

Net cash provided by operating activities increased $115.8 million in 2013 compared to 2012 due to a decrease in cash

used for prepaid rent and purchasing merchandise inventory partially offset by a decrease in income taxes payable.

Net cash used in investing activities decreased $10.0 million in 2014 compared with 2013 primarily due to reduced capital

expenditures, increased proceeds on fixed asset dispositions and reduced purchases of restricted investments.

Net cash used in investing activities increased $63.1 million in 2013 primarily due to the impact from $62.3 million in

proceeds from the sale of the investment in Ollie's Holdings, Inc. in 2012.

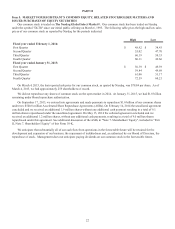

In 2014, net cash used in financing activities decreased $583.2 million compared to 2013 primarily due to $1.1 billion of

share repurchases and the repayment of $250.0 million in long-term debt in 2013 partially offset by the issuance of the $750.0

million of Senior Notes in 2013.

In 2013, net cash used in financing activities increased $294.4 million as a result of an increase in share repurchases in

2013 and the repayment of the $250.0 million outstanding on the revolving credit facility partially offset by $750.0 million of

proceeds from the issuance of the Senior Notes.

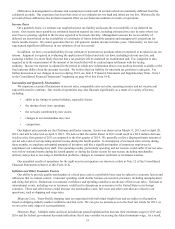

At January 31, 2015, our long-term borrowings were $757.0 million. We also have $110.0 million, $100.0 million and

$20.0 million Letter of Credit Reimbursement and Security Agreements, under which approximately $162.9 million were

committed to letters of credit issued for routine purchases of imported merchandise at January 31, 2015.

In September 2013, we entered into a Note Purchase Agreement with institutional accredited investors in which we issued

and sold $750.0 million of senior notes (the "Notes") in an offering exempt from the registration requirements of the Securities

Act of 1933. The Notes consist of three tranches: $300.0 million of 4.03% Senior Notes due September 16, 2020; $350.0

million of 4.63% Senior Notes due September 16, 2023; and $100.0 million of 4.78% Senior Notes due September 16, 2025.

Interest on the Notes is payable semi-annually on January 15 and July 15 of each year. The Notes are unsecured and rank pari

passu in right of repayment with our other senior unsecured indebtedness. We may prepay some or all of the Notes at any time

in an amount not less than 5% of the original aggregate principal amount of the Notes to be prepaid, at a price equal to the sum

of (a) 100% of the principal amount thereof, plus accrued and unpaid interest, and (b) the applicable make-whole amount. In

the event of a change in control (as defined in the Note Purchase Agreement), we may be required to prepay the Notes. The

Note Purchase Agreement contains customary affirmative and restrictive covenants. We used the net proceeds of the Notes to

finance share repurchases.

On January 20, 2015, we entered into the First Amendment (the “ Notes Amendment”) to the Note Purchase

Agreement, with a majority of the noteholders party thereto. The Notes Amendment was entered into in connection with our

pending acquisition (the “Acquisition”) of Family Dollar Stores, Inc. (“Family Dollar”). The Notes Amendment will, among

other things, allow a newly-formed subsidiary of Dollar Tree to issue debt and hold the proceeds in escrow pending

consummation of the Acquisition (such debt, the “Escrow Debt”). Pursuant to the terms of the Notes Amendment, in certain

circumstances the amount of interest due on the Notes may increase by 1.0% per annum. The Notes Amendment also contains

certain negative covenants and other restrictions applicable during the period in which any Escrow Debt is outstanding. Upon

closing of the Acquisition, we expect to fully repay the Notes which will result in the repayment of the $750.0 million

outstanding and the payment of approximately $121.2 million of prepayment fees.

In June 2012, we entered into a five-year $750.0 million unsecured Credit Agreement (the Agreement). The Agreement

provides for a $750.0 million revolving line of credit, including up to $150.0 million in available letters of credit. The interest

rate on the Agreement is based, at our option, on a LIBOR rate, plus a margin, or an alternate base rate, plus a margin. The

Agreement also bears a facilities fee, calculated as a percentage, as defined, of the amount available under the line of credit,

payable quarterly. The Agreement also bears an administrative fee payable annually. The Agreement, among other things,

requires the maintenance of certain specified financial ratios, restricts the payment of certain distributions and prohibits the

incurrence of certain new indebtedness. As of January 31, 2015, no amount was outstanding under the $750.0 million

revolving line of credit.

In September 2013, we amended the Agreement to enable the issuance of the Notes.

On August 15, 2014, we entered into an amendment (the "Credit Amendment") to the Agreement. The Credit Amendment

further amends the Agreement to facilitate the issuance and/or borrowings of certain third-party debt financing that we may use

to finance the Acquisition. The Credit Amendment also facilitates escrow arrangements related to the Acquisition.

On February 23, 2015, our wholly owned subsidiary completed the offering of $750,000,000 aggregate principal amount

of 5.250% senior notes due 2020 (the “2020 notes”) and $2,500,000,000 aggregate principal amount of 5.750% senior notes