Dollar Tree 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

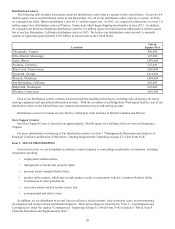

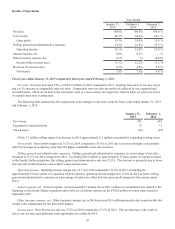

Results of Operations

Year Ended

January 31,

2015

February 1,

2014

February 2,

2013

Net sales 100.0% 100.0% 100.0 %

Cost of sales 64.7% 64.4% 64.1 %

Gross profit 35.3% 35.6% 35.9 %

Selling, general and administrative expenses 23.2% 23.2% 23.5 %

Operating income 12.1% 12.4% 12.4 %

Interest expense, net 0.9% 0.2% — %

Other (income) expense, net 0.1% —% (0.8)%

Income before income taxes 11.1% 12.2% 13.2 %

Provision for income taxes 4.1% 4.6% 4.8 %

Net income 7.0% 7.6% 8.4 %

Fiscal year ended January 31, 2015 compared to fiscal year ended February 1, 2014

Net sales. Net sales increased 9.7%, or $761.9 million, in 2014 compared to 2013, resulting from sales in our new stores

and a 4.3% increase in comparable store net sales. Comparable store net sales are positively affected by our expanded and

relocated stores, which we include in the calculation, and, to a lesser extent, are negatively affected when we open new stores

or expand stores near existing ones.

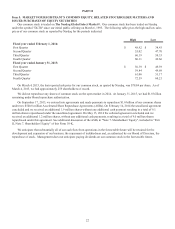

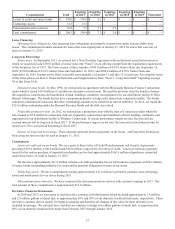

The following table summarizes the components of the changes in our store count for fiscal years ended January 31, 2015

and February 1, 2014.

January 31,

2015

February 1,

2014

New stores 391 343

Expanded or relocated stores 72 71

Closed stores (16)(22)

Of the 3.2 million selling square foot increase in 2014 approximately 0.2 million was added by expanding existing stores.

Gross profit. Gross profit margin was 35.3% in 2014 compared to 35.6% in 2013 due to increased freight costs partially

offset by leverage in occupancy costs from the higher comparable store sales increase.

Selling, general and administrative expenses. Selling, general and administrative expenses, as a percentage of net sales,

remained at 23.2% for 2014 compared to 2013. Excluding $28.5 million or approximately 35 basis points of expenses related

to the Family Dollar acquisition, the selling, general and administrative rate was 22.9%. The decrease is primarily due to lower

store payroll, health insurance and workers' compensation costs.

Operating income. Operating income margin was 12.1% in 2014 compared to 12.4% in 2013. Excluding the

approximately 35 basis points of acquisition-related expenses, operating income margin was 12.4% in 2014 as lower selling,

general and administrative expenses as a percentage of sales were offset by lower gross profit margin for the reasons noted

above.

Interest expense, net. Interest expense, net increased $64.7 million due to $46.7 million of commitment fees related to the

financing of the Family Dollar acquisition and a full year of interest expense on the $750.0 million of senior notes issued in

September 2013.

Other (income) expense, net. Other (income) expense, net in 2014 increased $5.6 million primarily due to unfavorable fair

market value adjustments for our diesel fuel hedges.

Income taxes. Our effective tax rate was 37.2% in 2014 compared to 37.5% in 2013. The rate decrease is the result of

lower state tax rates and additional work opportunity tax credits in 2014.