Dollar Tree 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Senior Secured Credit Facilities will be secured by a security interest in substantially all the assets of Dollar Tree and the Credit

Agreement Guarantors, subject to certain exceptions.

The loans under the Term Loan A tranche and the New Revolving Credit Facility will bear interest at LIBOR plus 2.25%

per annum (or a base rate plus 1.25%), and the Term Loan B tranche of the New Senior Secured Credit Facilities will bear

interest at LIBOR plus 3.50% per annum (or a base rate plus 2.50%). The Term Loan B tranche will be subject to a “LIBOR

floor” of 0.75%. The Term Loan A tranche of the New Term Loan Facilities will require quarterly amortization payments of

1.25% of the original principal amount thereof in the first year following the consummation of the Acquisition, 2.5% of the

original principal amount thereof in the second year following the Acquisition, and 3.75% of the original principal amount

thereof thereafter and the Term Loan B tranche requires quarterly amortization payments of 0.25% of the original principal

amount thereof after the closing of the Acquisition. The New Term Loan Facilities also require mandatory prepayments in

connection with certain asset sales and out of excess cash flow, among other things, and subject in each case to certain

significant exceptions. We expect to pay certain commitment fees in connection with the New Revolving Credit Facility.

Additionally, the Term Loan B tranche of the New Term Loan Facilities will require us to pay a 1.00% prepayment fee if the

loans thereunder are subject to certain “repricing” transactions before March 9, 2016.

The New Senior Secured Credit Facilities contain representations and warranties, events of default and affirmative and

negative covenants that apply, in certain circumstances, before and after the closing of the Acquisition and are customary for

similar financings. These include, among other things and subject to certain significant exceptions, restrictions on our ability to

declare or pay dividends, repay the acquisition notes, create liens, incur additional indebtedness, make investments, dispose of

assets and merge or consolidate with any other person. In addition, a financial maintenance covenant based on our consolidated

first lien secured net leverage ratio will apply to the New Revolving Credit Facility and the Term Loan A tranche of the New

Term Loan Facilities after the closing of the Acquisition.

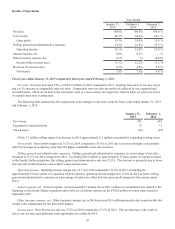

Historically we have used cash to repurchase shares but we did not repurchase any shares in fiscal 2014. We repurchased

17.4 million shares for $1,112.1 million in fiscal 2013. We repurchased 8.1 million shares for $340.2 million in fiscal 2012. At

January 31, 2015, we have $1.0 billion remaining under Board repurchase authorization.

Funding Requirements

Overview, Including Off-Balance Sheet Arrangements

We expect our cash needs for opening new stores and expanding existing stores in fiscal 2015 to total approximately

$290.7 million, which includes capital expenditures, initial inventory and pre-opening costs.

Our estimated capital expenditures for fiscal 2015 are between $465.0 million and $475.0 million, including planned

expenditures for our new and expanded stores, the addition of freezers and coolers to approximately 320 stores, the initial

phases of work on our eleventh distribution center and the expansion of our Olive Branch, Mississippi distribution center. We

believe that we can adequately fund our working capital requirements and planned capital expenditures for the next few years

from net cash provided by operations and potential borrowings under our existing credit facility.

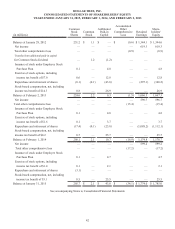

The following tables summarize our material contractual obligations at January 31, 2015, including both on- and off-

balance sheet arrangements, and our commitments, including interest on long-term borrowings (in millions):

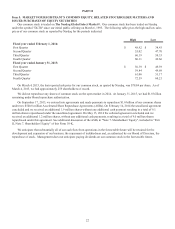

Contractual Obligations Total 2015 2016 2017 2018 2019 Thereafter

Lease Financing

Operating lease obligations $ 2,622.5 $ 558.6 $ 521.8 $ 469.8 $ 335.7 $ 244.1 $ 492.5

Long-term Borrowings

Senior notes 750.0—————750.0

Forgivable promissory note 7.0 — — 0.2 1.4 1.4 4.0

Interest on long-term borrowings 261.6 33.1 33.1 33.1 33.1 33.1 96.1

Total obligations $ 3,641.1 $ 591.7 $ 554.9 $ 503.1 $ 370.2 $ 278.6 $ 1,342.6