Dollar Tree 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

As a result of these restrictions, we may be:

• limited in how we conduct our business;

• unable to raise additional debt or equity financing to operate during general economic or business downturns; or

• unable to compete effectively, take advantage of new business opportunities or grow in accordance with our plans.

Our variable-rate indebtedness subjects us to interest rate risk, which could cause our annual debt service obligations to

increase significantly.

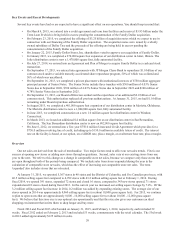

Certain of our indebtedness, including borrowings under our new revolving credit facility and our existing credit

facility, is or is expected to be subject to variable rates of interest and expose us to interest rate risk. If interest rates increase,

our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained

the same, and our net income would decrease. An increase (decrease) of 0.25% on the estimated interest rate on debt to

finance the proposed merger would result in an increase (decrease) of $20.5 million in annual interest expense. Although we

may enter into interest rate swaps, involving the exchange of floating- for fixed-rate interest payments, to reduce interest

rate volatility, we cannot assure you we will be able to do so.

The proposed merger may not be accretive, and may be dilutive, to our earnings per share, which may negatively

affect the market price of our common stock.

Because shares of our common stock would be issued in the proposed merger, it is possible that the merger will be

dilutive to our earnings per share, which could negatively affect the market price of shares of our common stock.

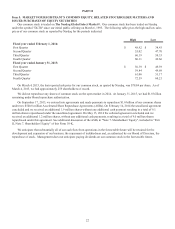

In connection with the completion of the proposed merger, based on the number of issued and outstanding shares of our

common stock and Family Dollar common stock as of January 31, 2015, we would issue approximately 28.5 million shares

of our common stock. The issuance of these new shares of our common stock could have the effect of depressing the market

price of shares of our common stock, through dilution of earnings per share or otherwise.

In addition, future events and conditions could increase the dilution that is currently projected, including adverse

changes in market conditions, additional transaction and integration related costs and other factors such as the failure to

realize some or all of the benefits anticipated in the merger. Any dilution of, or delay of any accretion to, our earnings per

share could cause the price of shares of our common stock to decline or grow at a reduced rate.

Sales of shares of our common stock before and after the completion of the proposed Family Dollar merger may cause

the market price of our common stock to fall.

Based on the number of outstanding shares of our common stock and Family Dollar common stock as of January 31,

2015, we would issue approximately 28.5 million shares of our common stock in connection with the proposed Family

Dollar merger. The issuance of these new shares of our common stock could have the effect of depressing the market price

for our common stock.

In addition, many Family Dollar stockholders may decide not to hold the shares of our common stock they will receive

in the proposed merger. Other Family Dollar stockholders, such as funds with limitations on their permitted holdings of

stock in individual issuers, may be required to sell the shares of our common stock that they receive in the proposed merger.

Such sales of our common stock could have the effect of depressing the market price for our common stock and may take

place promptly following consummation of the proposed merger.

Item 1B. UNRESOLVED STAFF COMMENTS

None.