Dollar Tree 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Technology Assets

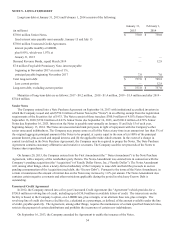

The Company has commitments totaling approximately $13.5 million to purchase primarily store technology assets and

maintenance for its stores during 2015.

Telecommunication Contracts

The Company has contracted for telecommunication services with agreements expiring in 2017. The total amount of these

commitments is approximately $16.8 million.

Letters of Credit

The Company is a party to three Letter of Credit Reimbursement and Security Agreements providing $110.0 million,

$100.0 million, and $20.0 million, respectively for letters of credit. Letters of credit under these agreements are generally

issued for the routine purchase of imported merchandise and approximately $162.9 million was committed to these letters of

credit at January 31, 2015. As discussed in Note 5, the Company also has $150.0 million of available letters of credit included

in the $750.0 million Unsecured Credit Agreement; however, as of January 31, 2015, there were no letters of credit committed

under this agreement.

The Company also has approximately $11.9 million in stand-by letters of credit that serve as collateral for its large-

deductible insurance programs and expire in fiscal 2015.

Surety Bonds

The Company has issued various surety bonds that primarily serve as collateral for utility payments at the Company’s

stores. These bonds total approximately $4.2 million and are committed through various dates through fiscal 2016.

Contingencies

Active

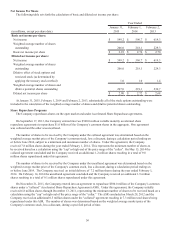

Winn-Dixie Stores instituted suit in federal court in Florida alleging that the Company sold products in 48 stores in

violation of a lease exclusive. In August 2012, the Court denied Winn-Dixie's claim for damages and granted Winn-Dixie’s

request for injunctive relief with respect to just one store. Winn-Dixie appealed to the U.S. Court of Appeals for the 11th

Circuit, which affirmed that Winn-Dixie is not entitled to damages. However, it also held that Winn-Dixie's restriction for 21 of

the Company's Florida stores required the Company to restrict its sales of food and "many household supplies" such as "soap,

matches and paper napkins" to 500 square feet of floor space for fixtures containing food and many household supplies plus a

portion of the surrounding aisle. The 11th Circuit remanded the case to the lower court for a new trial to determine the

definition of "many household supplies" and how much aisle space should be included. Additional Florida leases may be

impacted. The Company has previously restricted these 21 stores to 500 square feet of floor space for food, not including the

aisle and not including many household supplies. These stores must now restrict their sales of certain household supplies

further, but it is unclear how certain household products will be specifically defined and how much aisle space must be

included. These issues may be decided by the trial court in the near future.

In 2011, an assistant store manager and an hourly associate filed a collective action against the Company alleging they

were forced to work off the clock in violation of the Fair Labor Standards Act (FLSA) and state law. A federal judge in

Virginia ruled that all claims made on behalf of assistant store managers under both the FLSA and state law should be

dismissed. The court, however, certified an opt-in collective action under the FLSA on behalf of hourly sales associates.

Approximately 4,300 plaintiffs remain in the case. In March 2014, the court denied the Company's motion to decertify the

collective action and the case is now continuing.

In 2012, a former assistant store manager, on behalf of himself and those alleged to be similarly situated, filed a putative

class action in a California state court, alleging the Company failed to provide rest breaks to assistant store managers. The

alleged time period is July 13, 2008 to the present. Discovery is ongoing. The class has been certified and the case is

proceeding to the liability phase.

In 2013, a former assistant store manager on behalf of himself and others alleged to be similarly aggrieved filed a

representative Private Attorney General Act ("PAGA") claim under California law currently pending in federal court in

California. The suit alleges that the Company failed to provide uninterrupted meal periods and rest breaks; failed to pay

minimum, regular and overtime wages; failed to maintain accurate time records and wage statements; and failed to pay wages

due upon termination of employment. Discovery has not commenced. A trial date has been set for October 26, 2015.

In May 2014, a former assistant store manager filed a putative class action in a California state court for alleged failure to

provide meal periods, overtime, timely payment of wages during employment and upon termination, failure to provide accurate

wage statements, as well as for alleged failure to indemnify employees for business expenses in violation of California labor

laws. This matter is in early stages of litigation. Discovery has not commenced and no trial date has been set.