Dollar Tree 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

future. There are no significant economic barriers for others to enter our retail sector. Some of our current or potential

competitors have greater financial resources than we do. We cannot guarantee that we will continue to be able to compete

successfully against existing or future competitors. Please see Item 1, “Business” beginning on page 6 of this Form 10-K for

further discussion of the effect of competition on our operations.

Litigation may adversely affect our business, financial condition and results of operations.

Our business is subject to the risk of litigation involving employees, consumers, suppliers, competitors, shareholders,

government agencies, or others through private actions, class actions, governmental investigations, administrative

proceedings, regulatory actions or other litigation. Our products could also cause illness or injury, harm our reputation, and

subject us to litigation. We are currently defendants in several employment-related class and collective actions, litigation

concerning leases, several occupational safety proceedings, and a governmental investigation concerning retail hazardous

waste. The outcome of litigation is difficult to assess or quantify. Plaintiffs in these types of lawsuits may seek recovery of

very large or indeterminate amounts, and the magnitude of the potential loss may remain unknown for substantial periods of

time. In addition, certain of these matters, if decided adversely to us or settled by us, may result in an expense that may be

material to our financial statements as a whole or may negatively affect our operating results if changes to our business

operation are required. The cost to defend current and future litigation may be significant. There also may be adverse

publicity associated with litigation, including litigation related to product safety, customer information and environmental or

safety requirements, which could negatively affect customer perception of our business, regardless of whether the allegations

are valid or whether we are ultimately found liable.

For a discussion of current legal matters, please see Item 3, “Legal Proceedings” beginning on page 20 of this Form 10-K

and Item 8, “Financial Statements and Supplementary Data, Note 4 Commitments and Contingencies” under the caption

“Contingencies” beginning on page 51 of this Form 10-K. Resolution of these matters, if decided against the Company, could

have a material adverse effect on our results of operations, accrued liabilities or cash flows.

Changes in federal, state or local law, or our failure to comply with such laws, could increase our expenses and expose

us to legal risks.

Our business is subject to a wide array of laws and regulations. Significant legislative changes, such as the health-care

legislation, that impact our relationship with our workforce could increase our expenses and adversely affect our operations.

The minimum wage has increased or is scheduled to increase in multiple states and local jurisdictions and there is a

possibility that Congress will increase the federal minimum wage. Changes in other regulatory areas, such as consumer credit,

privacy and information security, product safety, worker safety or environmental protection, among others, could cause our

expenses to increase. In addition, if we fail to comply with applicable laws and regulations, particularly wage and hour laws,

we could be subject to legal risk, including government enforcement action and class action civil litigation, which could

adversely affect our results of operations. Changes in tax laws, the interpretation of existing laws, or our failure to sustain our

reporting positions on examination could adversely affect our effective tax rate.

Our business could be adversely affected if we fail to attract and retain qualified associates and key personnel.

Our growth and performance is dependent on the skills, experience and contributions of our associates, executives

and key personnel. Various factors, including overall labor availability, wage rates, regulatory or legislative impacts, and

benefit costs could impact the ability to attract and retain qualified associates at our stores, distribution centers and

corporate office.

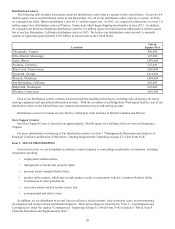

Certain provisions in our Articles of Incorporation and Bylaws could delay or discourage a change of control

transaction that may be in a shareholder’s best interest.

Our Articles of Incorporation and Bylaws currently contain provisions that may delay or discourage a takeover

attempt that a shareholder might consider in his best interest. These provisions, among other things:

• provide that only the Board of Directors, chairman or president may call special meetings of the shareholders;

• establish certain advance notice procedures for nominations of candidates for election as directors and for

shareholder proposals to be considered at shareholders’ meetings; and

• permit the Board of Directors, without further action of the shareholders, to issue and fix the terms of preferred

stock, which may have rights senior to those of the common stock.