Dollar Tree 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our stores are convenient, bright, fun, friendly and lled

with great merchandise at tremendous values.

Our merchandising model is powerful and exible.

Our product assortments are planned to oer the greatest

value to the customer for $1.00 and to do so at a cost that

meets our merchandise margin threshold. We utilize this

strategy of ever-changing assortments to our advantage.

Our customers have grown to expect that there is always

something new at Dollar Tree. Customers can nd a

balanced assortment of the high-value basics they need

and the fun, exciting discretionary merchandise they want

on each and every store visit. Seasonal assortments are

fresh and colorful, providing merchandise energy to the

customer’s shopping experience as they enter the front

door at the stores.

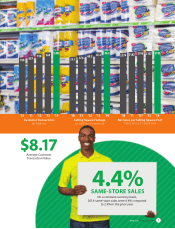

This strategic advantage has been validated by results

in varying consumer climates. History demonstrates

that we have increased our relevance throughout both

inationary and deationary cycles by leveraging our scale

and our exibility to change the product or the source

while maintaining our focus on providing surprising value

to our customers and achieving margin targets. We are

dierent. When faced with cost pressures, most retailers

“keep the item and change the price.” At Dollar Tree,

we “keep the price and change the item” to continue

delivering great values at our $1 price point. And our

customers love us for this approach.

Transformational Opportunity

I am extremely excited about the potential of our

combined organization. Adding the well-known and

established Family Dollar banner to our portfolio of brands

will be transformational to our business.

The strategic rationale for this combination is powerful:

• We are combining two very large companies with

more than 13,000 stores achieving almost $19 billion

in sales and more than $2 billion in adjusted EBITDA.

• We are combining two established and respected

brands in the most economically resilient sector of

retailing. The Discount Retail sector has ourished

through all economic cycles.

• We will operate and grow both banners, combining

two complementary business models across xed-

and multi-priced strategies with the ability to serve

a broader range of customers and geography. The

Dollar Tree target customer is largely a suburban

customer while the Family Dollar customer is largely

urban and rural.

• We are combining complementary merchandise

expertise, adding the Family Dollar expertise in

name brand consumable products to the Dollar

Tree variety, seasonal and discretionary product and

global sourcing power.

• This combination generates signicant and

immediate opportunities for operational

improvement and near-term opportunities for

synergies. We have identied the opportunity to

realize at least $300 million in annual run-rate hard-

cost synergies by the end of Year 3.

Our primary areas of initial focus regarding the integration

will include:

• The Customer – An intense focus on the value

customer and delivering the merchandise

assortment to serve their needs and wants. This

will include a mix of name-brand and private-label

basics alongside variety and seasonally relevant

product. We will continue the return to EDLP by

delivering everyday values at competitive prices.

• Improving sales per foot and inventory productivity

by expanding high-performing categories and

eliminating products that do not meet our sales and

protability thresholds.

• Enhancing the customer experience and improving

the table stakes by developing plans to consistently

deliver the promise of a bright, clean and friendly

store to shop. We will be tracking key metrics

closely to monitor progress.

• Increasing new store, remodel and expansion

performance with a keen focus on protability

improvement metrics and ROIC.

Dollar Tree Annual Report 2014 3

consecutive years of gross

margin exceeding 35%

consecutive years of

double-digit operating

margins

65