Dollar Tree 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

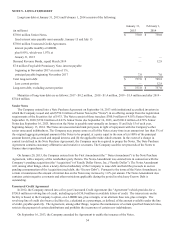

value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of the fair value

hierarchy are as follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in

markets that are not active; and

Level 3 - Unobservable inputs in which there is little or no market data which require the reporting entity to develop its

own assumptions.

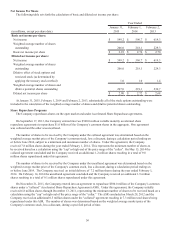

The Company’s cash and cash equivalents, restricted investments and diesel fuel swaps represent the financial assets and

liabilities that were accounted for at fair value as of January 31, 2015 and February 1, 2014. As required, financial assets and

liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The

Company's assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect

the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels. The fair value of the

Company’s cash and cash equivalents was $864.1 million and $267.7 million as of January 31, 2015 and February 1, 2014,

respectively. The fair value of the Company's restricted investments was $78.9 million and $87.9 million as of January 31,

2015 and February 1, 2014, respectively. These fair values were determined using Level 1 measurements in the fair value

hierarchy. The fair value of the diesel fuel swaps was a liability of $5.7 million as of January 31, 2015. The Company did not

have any active fuel derivative contracts as of February 1, 2014. The fair values of the swaps were estimated using Level 2

measurements in the fair value hierarchy. These estimates used discounted cash flow calculations based upon forward interest-

rate yield and diesel cost curves. The curves were obtained from independent pricing services reflecting broker market quotes.

The estimated fair value of the Company’s long-term debt was $700.9 million as of January 31, 2015 and $769.8 million

as of February 1, 2014 . The fair value of the Senior Notes is determined through the use of a discounted cash flow analysis

using Level 3 inputs as there are no quoted prices in active markets for these notes. The discount rate used in the analysis was

based on borrowing rates available to the Company for debt of the same remaining maturities, issued in the same private

placement debt market. The carrying value of the Company's Demand Revenue Bonds at February 1, 2014 approximates its fair

value because the debt's interest rate varies with market interest rates.

Certain assets and liabilities are measured at fair value on a nonrecurring basis; that is, the assets and liabilities are not

measured at fair value on an ongoing basis but are subject to fair value adjustments in certain circumstances (e.g., when there is

evidence of impairment). The Company recorded impairment charges of $1.5 million, $0.5 million, and $0.5 million in fiscal

2014, 2013 and 2012, respectively, to reduce certain store assets to their estimated fair values. The fair values were determined

based on the income approach, in which the Company utilized internal cash flow projections over the life of the underlying

lease agreements discounted based on a risk-free rate of return. These measures of fair value, and related inputs, are considered

a level 3 approach under the fair value hierarchy. There were no other changes related to level 3 assets.

Lease Accounting

The Company leases almost all of its retail locations under operating leases. The Company recognizes minimum rent

expense beginning when possession of the property is taken from the landlord, which normally includes a construction period

prior to store opening. When a lease contains a predetermined fixed escalation of the minimum rent, the Company recognizes

the related rent expense on a straight-line basis and records the difference between the recognized rental expense and the

amounts payable under the lease as deferred rent. The Company also receives tenant allowances, which are recorded in

deferred rent and are amortized as reductions of rent expense over the terms of the leases.

Revenue Recognition

The Company recognizes sales revenue at the time a sale is made to its customer.

Taxes Collected

The Company reports taxes assessed by a governmental authority that are directly imposed on revenue-producing

transactions (i.e., sales tax) on a net (excluded from revenue) basis.

Cost of Sales

The Company includes the cost of merchandise, warehousing and distribution costs, and certain occupancy costs in cost of

sales.

Pre-Opening Costs

The Company expenses pre-opening costs for new, expanded and relocated stores, as incurred.