Dollar Tree 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

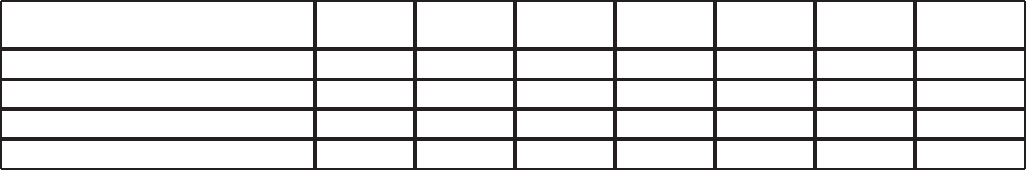

33

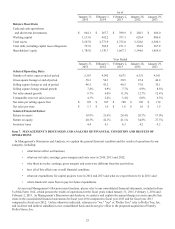

Commitments Total

Expiring

in 2015

Expiring

in 2016

Expiring

in 2017

Expiring

in 2018

Expiring

in 2019 Thereafter

Letters of credit and surety bonds $ 179.0 $ 178.8 $ 0.2 $ — $ — $ — $ —

Technology assets 13.5 13.5———— —

Telecommunication contracts 16.8 7.1 7.1 2.6 — — —

Total commitments $ 209.3 $ 199.4 $ 7.3 $ 2.6 $ — $ — $ —

Lease Financing

Operating lease obligations. Our operating lease obligations are primarily for payments under noncancelable store

leases. The commitment includes amounts for leases that were signed prior to January 31, 2015 for stores that were not yet

open on January 31, 2015.

Long-term Borrowings

Senior notes. In September 2013, we entered into a Note Purchase Agreement with institutional accredited investors in

which we issued and sold $750.0 million of senior notes (the "Notes") in an offering exempt from the registration requirements

of the Securities Act of 1933. The Notes consist of three tranches: $300.0 million of 4.03% Senior Notes due September 16,

2020; $350.0 million of 4.63% Senior Notes due September 16, 2023; and $100.0 million of 4.78% Senior Notes due

September 16, 2025. Interest on the Notes is payable semi-annually on January 15 and July 15 of each year. For complete terms

of the Notes please see Item 8. Financial Statements and Supplementary Data, "Note 5 - Long-Term Debt" beginning on page

54 of this Form 10-K.

Demand revenue bonds. In May 1998, we entered into an agreement with the Mississippi Business Finance Corporation

under which it issued $19.0 million of variable-rate demand revenue bonds. We used the proceeds from the bonds to finance

the acquisition, construction and installation of land, buildings, machinery and equipment for our distribution facility in Olive

Branch, Mississippi. The bonds did not have a prepayment penalty as long as the interest rate remained variable. The bonds

contained a demand provision and, therefore, outstanding amounts were classified as current liabilities. In 2014, we repaid the

$12.8 million outstanding under the Demand Revenue Bonds and the debt was retired.

Forgivable promissory note. In 2012, we entered into a promissory note with the state of Connecticut under which the

state loaned us $7.0 million in connection with our acquisition, construction and installation of land, building, machinery and

equipment for our distribution facility in Windsor, Connecticut. If certain performance targets are met, the loan and any

accrued interest will be forgiven in fiscal 2017. If the performance targets are not met, the loan and accrued interest must be

repaid over a five-year period beginning in fiscal 2017.

Interest on long-term borrowings. These amounts represent interest payments on the Notes, and Forgivable Promissory

Note using the interest rates for each at January 31, 2015.

Commitments

Letters of credit and surety bonds. We are a party to three Letter of Credit Reimbursement and Security Agreements

providing $110.0 million, $100.0 million and $20.0 million, respectively for letters of credit. Letters of credit are generally

issued for the routine purchase of imported merchandise and we had approximately $162.9 million of purchases committed

under these letters of credit at January 31, 2015.

We also have approximately $11.9 million of letters of credit outstanding for our self-insurance programs and $4.2 million

of surety bonds outstanding primarily for certain utility payment obligations at some of our stores.

Technology assets. We have commitments totaling approximately $13.4 million to primarily purchase store technology

assets and maintenance for our stores during 2015.

Telecommunication contracts. We have contracted for telecommunication services with contracts expiring in 2017. The

total amount of these commitments is approximately $16.8 million.

Derivative Financial Instruments

In 2014 and 2013, we were party to fuel derivative contracts with third parties which included approximately 1.6 million

and 2.8 million gallons of diesel fuel, or approximately 10% and 20% of our domestic truckload fuel needs, respectively. These

derivative contracts did not qualify for hedge accounting and therefore all changes in fair value for these derivatives are

included in earnings. We currently have fuel derivate contracts to hedge 6.6 million gallons of diesel fuel, or approximately

40% of our domestic truckload fuel needs from February 2015 through January 2016.