Dollar Tree 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

As of

January 31,

2015

February 1,

2014

February 2,

2013

January 28,

2012

January 29,

2011

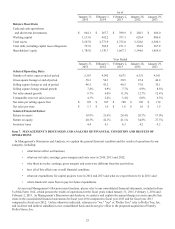

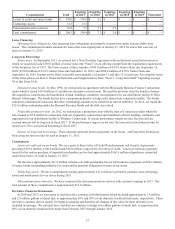

Balance Sheet Data:

Cash and cash equivalents

and short-term investments $ 864.1 $ 267.7 $ 399.9 $ 288.3 $ 486.0

Working capital 1,133.0 692.2 797.3 628.4 800.4

Total assets 3,567.0 2,771.9 2,752.0 2,328.6 2,380.5

Total debt, including capital lease obligations 757.0 769.8 271.3 265.8 267.8

Shareholders' equity 1,785.0 1,170.7 1,667.3 1,344.6 1,459.0

Year Ended

January 31,

2015

February 1,

2014

February 2,

2013

January 28,

2012

January 29,

2011

Selected Operating Data:

Number of stores open at end of period 5,367 4,992 4,671 4,351 4,101

Gross square footage at end of period 58.3 54.3 50.9 47.4 44.4

Selling square footage at end of period 46.5 43.2 40.5 37.6 35.1

Selling square footage annual growth 7.4% 6.9% 7.7% 6.9% 8.8%

Net sales annual growth 9.7% 6.0% 11.5% 12.7% 12.4%

Comparable store net sales increase 4.3% 2.4% 3.4% 6.0% 6.3%

Net sales per selling square foot $ 192 $ 187 $ 190 $ 182 $ 174

Net sales per store $ 1.7 $ 1.6 $ 1.6 $ 1.6 $ 1.5

Selected Financial Ratios:

Return on assets 18.9% 21.6% 24.4% 20.7% 17.0%

Return on equity 40.5% 42.1% 41.1% 34.8% 27.5%

Inventory turns 4.4 4.1 4.3 4.2 4.2

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

In Management’s Discussion and Analysis, we explain the general financial condition and the results of operations for our

company, including:

• what factors affect our business;

• what our net sales, earnings, gross margins and costs were in 2014, 2013 and 2012;

• why those net sales, earnings, gross margins and costs were different from the year before;

• how all of this affects our overall financial condition;

• what our expenditures for capital projects were in 2014 and 2013 and what we expect them to be in 2015; and

• where funds will come from to pay for future expenditures.

As you read Management’s Discussion and Analysis, please refer to our consolidated financial statements, included in Item

8 of this Form 10-K, which present the results of operations for the fiscal years ended January 31, 2015, February 1, 2014 and

February 2, 2013. In Management’s Discussion and Analysis, we analyze and explain the annual changes in some specific line

items in the consolidated financial statements for fiscal year 2014 compared to fiscal year 2013 and for fiscal year 2013

compared to fiscal year 2012. Unless otherwise indicated, references to "we," "our" or "Dollar Tree" refer to Dollar Tree, Inc.

and its direct and indirect subsidiaries on a consolidated basis and do not give effect to the proposed acquisition of Family

Dollar Stores, Inc.