Dollar Tree 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report

T

h

e

P

O

W

E

R

o

f

Table of contents

-

Page 1

T h e P O W E R of 2014 Annual Report -

Page 2

... Tree has served North America for more than twenty-eight years. The Company's store support center is located in Chesapeake, Virginia. Dollar Tree continues to grow and is reaching new customers via the Internet at www.DollarTree.com. DOLLAR TREE, INC. IS THE WORLD'S LEADING OPERATOR OF $1 PRICE... -

Page 3

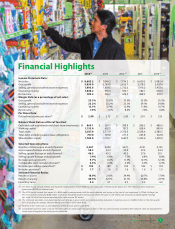

... capital lease obligations 757.0 Shareholders' equity 1,785.0 Selected Operating Data: Number of stores open at end of period Gross square footage at end of period Selling square footage at end of period Selling square footage annual growth Net sales annual growth Comparable store net sales increase... -

Page 4

... Dollar Tree stores. We are vigilant about understanding what our customers need, and we do our best to provide it to them. We strive to "Wow" every customer at every store, every day. 391 2 new stores opened in 2014 28 consecutive quarters of positive same-store sales Dollar Tree Annual Report... -

Page 5

... merchandise expertise, adding the Family Dollar expertise in name brand consumable products to the Dollar Tree variety, seasonal and discretionary product and global sourcing power. This combination generates significant and immediate opportunities for operational improvement and near-term... -

Page 6

...operations, merchandising, supply chain, back-o ce support and through our use of technology. We continue to be pleased with the development of and the growth in our on-line business at Dollar Tree Direct. Launched in 2009, our e-commerce platform provides an opportunity to broaden our customer base... -

Page 7

... business at a sustainable pace. In Closing Dollar Tree has a long record of consistent, profitable growth. This performance has been the result of the collaborative efforts of tens of thousands of Dollar Tree associates working together to deliver value to every customer at every store every day... -

Page 8

...both the sales and tra c growth of Dollar Tree Direct. In addition to selling product, we share gift and craft ideas, how-to videos, ratings, reviews and much more. Our Dollar Tree customers are crafty, savvy, frugal and connected. Whether customers prefer to reach us via their phones, their tablets... -

Page 9

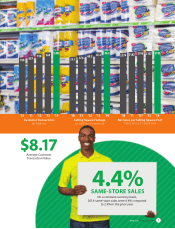

...Selling Square Footage (in Millions at year-end) Net Sales per Selling Square Foot *2012 was a 53-week year $8.17 Average Customer Transaction Value SAME-STORE SALES On a constant-currency basis, 2014 same-store sales were 4.4% compared to 2.4% in the prior year. 4.4% Dollar Tree Annual Report... -

Page 10

-

Page 11

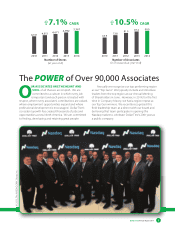

...2014, for the first time in Company history, we had a region repeat as our Top Gun winners. We recently recognized this field leadership team at a dinner with our board and by having that team participate in opening the Nasdaq market to celebrate Dollar Tree's 20th year as a public company. © 2015... -

Page 12

... Canadian Distribution Centers ibution Centers U.S. Distribution The POWER of Over 5,300 Stores URING 2014, DOLLAR TREE OPENED 391 STORES, creating more local jobs and providing great values to customers in the communities served by those stores. We ended the year with 5,367 stores in 48 states and... -

Page 13

-

Page 14

... base annually at approximately 7%, we are supporting our local communities through job creation and by helping our customers manage their household budgets through the great values we offer. Our plans for 2015 include opening 400 additional stores. The Company's corporate giving program benefits... -

Page 15

Dollar Tree, Inc. 2014 Form 10-K -

Page 16

[This page left blank intentionally] -

Page 17

... No.0-25464 DOLLAR TREE, INC. (Exact name of registrant as specified in its charter) Virginia (State or other jurisdiction of incorporation or organization) 26-2018846 (I.R.S. Employer Identification No.) 500 Volvo Parkway, Chesapeake, VA 23320 (Address of principal executive offices) Registrant... -

Page 18

... check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ( ) No (X) The aggregate market value of Common Stock held by non-affiliates of the Registrant on August 1, 2014, was $10,784,848,842, based on a $54.61 average of the high and low sales prices... -

Page 19

DOLLAR TREE, INC. TABLE OF CONTENTS Page PART I Item 1. BUSINESS 6 10 18 19 20 21 PART II Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES SELECTED FINANCIAL DATA MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND ... -

Page 20

...existing store locations; the average size of our stores to be added in 2015 and beyond; the effect on merchandise mix of consumables and the increase in the number of our stores with freezers and coolers on gross profit margin and sales; the net sales per square foot, net sales and operating income... -

Page 21

... 2014", "2013" or "fiscal 2013", and "2012" or "fiscal 2012", relate to as of or for the years ended January 30, 2016, January 31, 2015, February 1, 2014 and February 2, 2013, respectively. AVAILABLE INFORMATION Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form... -

Page 22

... revenue and assets in Canada are not material. Our selling square footage increased from approximately 35.1 million square feet in January 2011 to 46.5 million square feet in January 2015. Our store growth has resulted primarily from opening new stores. Business Strategy Value Merchandise Offering... -

Page 23

... us to ship the appropriate product to stores at the quantities commensurate with selling patterns. Using this point-of-sale data to plan purchases of inventory has helped us manage our inventory levels. Corporate Culture and Values. We believe that honesty and integrity, doing the right things for... -

Page 24

...-price point model in our Dollar Tree stores. We operated 219 Deals stores as of January 31, 2015. In addition to new store openings, we plan to continue our store expansion program to increase our net sales per store and take advantage of market opportunities. We target stores for expansion based... -

Page 25

...additional 0.4 million square feet at our San Bernardino, California distribution center in 2013. We believe our distribution center network is currently capable of supporting approximately $10.5 billion in annual sales in the United States. New distribution sites are strategically located to reduce... -

Page 26

... our comparable store sales growth rate, earnings and earnings per share or new store openings, could cause the market price of our stock to decline. You should carefully consider the specific risk factors listed below together with all other information included or incorporated in this report. Any... -

Page 27

..., 2014, and will be observed on April 5, 2015. Expanding our square footage profitably depends on a number of uncertainties, including our ability to locate, lease, build out and open or expand stores in suitable locations on a timely basis under favorable economic terms. In addition, our expansion... -

Page 28

...we are able to maintain our current merchandise cost sufficiently to offset any decrease in our product margin percentage. We can give no assurance that we will be able to do so. Pressure from competitors may reduce our sales and profits. The retail industry is highly competitive. The marketplace is... -

Page 29

... our associates, executives and key personnel. Various factors, including overall labor availability, wage rates, regulatory or legislative impacts, and benefit costs could impact the ability to attract and retain qualified associates at our stores, distribution centers and corporate office. Certain... -

Page 30

... of whom intend to operate these divested locations as dollar stores to address the FTC's concerns. We will work to secure FTC approval and finalize divestiture agreements with the selected bidder(s) as soon as practical. We are working to close the proposed merger as early as April, 2015, but it is... -

Page 31

... employees, higher than expected costs, litigation relating to the proposed merger, diversion of management attention of both Dollar Tree and Family Dollar, increased competition, the disruption of either company's ongoing businesses or inconsistencies in standards, controls, procedures and policies... -

Page 32

...an adverse ruling in such lawsuits may prevent the proposed merger from becoming effective or from becoming effective within the expected timeframe. Family Dollar, its directors, Dollar Tree, and one of Dollar Tree's subsidiaries are named as defendants in three putative class action lawsuits, which... -

Page 33

... or to pursue our business strategies, and could adversely affect our capital resources, financial condition and liquidity. The agreements that will govern the indebtedness to be incurred or assumed in connection with the proposed merger are expected to contain a number of restrictive covenants that... -

Page 34

... or grow at a reduced rate. Sales of shares of our common stock before and after the completion of the proposed Family Dollar merger may cause the market price of our common stock to fall. Based on the number of outstanding shares of our common stock and Family Dollar common stock as of January 31... -

Page 35

..., with options to extend, however in some cases we have initial lease terms of seven to ten years. We believe this leasing strategy enhances our flexibility to pursue various expansion opportunities resulting from changing market conditions. As current leases expire, we believe that we will be able... -

Page 36

...center in 2013. We believe our distribution center network is currently capable of supporting approximately $10.5 billion in annual sales in the United States. Size in Square Feet 400,000 425,000 1,470,000 525,000 1,003,000 1,014,000 1,004,000 802,000 665,000 1,001,000 Location Chesapeake, Virginia... -

Page 37

... on our business or financial condition. We cannot give assurance, however, that one or more of these lawsuits will not have a material effect on our results of operations for the period in which they are resolved. Based on the information available, including the amount of time remaining before... -

Page 38

... last reported sale price for our common stock, as quoted by Nasdaq, was $78.84 per share. As of March 4, 2015, we had approximately 259 shareholders of record. We did not repurchase any shares of common stock on the open market in 2014. At January 31, 2015, we had $1.0 billion remaining under Board... -

Page 39

... in the cumulative total shareholder return on our common stock during the five fiscal years ended January 31, 2015, compared with the cumulative total returns of the S&P 500 Index and the S&P Retailing Index. The comparison assumes that $100 was invested in our common stock on January 30, 2010, and... -

Page 40

...per share data, number of stores data, net sales per selling square foot data and inventory turns. Year Ended February 2, 2013 $ 7,394.5 2,652.7 1,732.6 920.1 619.3 35.9% 23.5% 12.4% 8.4% 2.68 $ 33.3% January 31, 2015 Income Statement Data: Net sales Gross profit Selling, general and administrative... -

Page 41

... footage annual growth Net sales annual growth Comparable store net sales increase Net sales per selling square foot Net sales per store Selected Financial Ratios: Return on assets Return on equity Inventory turns February 1, 2014 Year Ended February 2, 2013 January 28, 2012 January 29, 2011... -

Page 42

... store size is our optimal size operationally and that this size also gives our customers an ideal shopping environment that invites them to shop longer and buy more. Fiscal 2014 and Fiscal 2013 which ended on January 31, 2015, and February 1, 2014, respectively, each included 52 weeks. Fiscal 2012... -

Page 43

... distribution and store operations. We must continue to control our merchandise costs, inventory levels and our general and administrative expenses as increases in these line items could negatively impact our operating results. Pending Acquisition On July 27, 2014, we executed an Agreement and Plan... -

Page 44

... approximately 35 basis points of expenses related to the Family Dollar acquisition, the selling, general and administrative rate was 22.9%. The decrease is primarily due to lower store payroll, health insurance and workers' compensation costs. Operating income. Operating income margin was 12.1% in... -

Page 45

... foot increase in 2013 approximately 0.2 million was added by expanding existing stores. Gross profit. Gross profit margin was 35.6% in 2013 compared to 35.9% in 2012 due to loss of leverage in occupancy and distribution cost from the 53rd week of sales in 2012. Selling, general and administrative... -

Page 46

... of credit, payable quarterly. The Agreement also bears an administrative fee payable annually. The Agreement, among other things, requires the maintenance of certain specified financial ratios, restricts the payment of certain distributions and prohibits the incurrence of certain new indebtedness... -

Page 47

... as of 91 days prior to their stated maturity, in which case the New Revolving Credit Facility and the borrowings under the Term Loan A tranche will mature at such time. The borrowings under the Term Loan B tranche will mature seven years after the closing of the Acquisition. Annual interest expense... -

Page 48

... in fiscal 2013. We repurchased 8.1 million shares for $340.2 million in fiscal 2012. At January 31, 2015, we have $1.0 billion remaining under Board repurchase authorization. Funding Requirements Overview, Including Off-Balance Sheet Arrangements We expect our cash needs for opening new stores and... -

Page 49

... each year. For complete terms of the Notes please see Item 8. Financial Statements and Supplementary Data, "Note 5 - Long-Term Debt" beginning on page 54 of this Form 10-K. Demand revenue bonds. In May 1998, we entered into an agreement with the Mississippi Business Finance Corporation under which... -

Page 50

... in Item 8. Financial Statements and Supplementary Data, "Note 1 - Summary of Significant Account Policies" under the caption "Merchandise Inventories" beginning on page 44 of this Form 10-K, inventories at the distribution centers are stated at the lower of cost or market with cost determined... -

Page 51

... of certain holidays, especially Easter; the timing of new store openings; the net sales contributed by new stores; changes in our merchandise mix; and competition. Our highest sales periods are the Christmas and Easter seasons. Easter was observed on March 31, 2013 and on April 20, 2014, and will... -

Page 52

... We are exposed to various types of market risk in the normal course of our business, including the impact of interest rate changes and diesel fuel cost changes. We may enter into interest rate or diesel fuel swaps to manage exposure to interest rate and diesel fuel price changes. We do not enter... -

Page 53

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Index to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Consolidated Income Statements for the years ended January 31, 2015, February 1, 2014 and February 2, 2013 Consolidated Statements of Comprehensive ... -

Page 54

... Registered Public Accounting Firm The Board of Directors and Shareholders Dollar Tree, Inc.: We have audited the accompanying consolidated balance sheets of Dollar Tree, Inc. (the Company) as of January 31, 2015 and February 1, 2014, and the related consolidated income statements, and statements of... -

Page 55

DOLLAR TREE, INC. CONSOLIDATED INCOME STATEMENTS Year Ended February 1, 2014 $ 7,840.3 5,050.5 2,789.8 1,819.5 970.3 15.4 0.6 954.3 357.6 596.7 2.74 2.72 (in millions, except per share data) Net sales Cost of sales Gross profit Selling, general and administrative expenses Operating income Interest ... -

Page 56

DOLLAR TREE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Ended (in millions) Net income Foreign currency translation adjustments Total comprehensive income $ January 31, 2015 $ 599.2 (17.2) 582.0 $ February 1, 2014 $ 596.7 (15.4) 581.3 $ February 2, 2013 $ 619.3 (0.9) 618.4 See ... -

Page 57

DOLLAR TREE, INC. CONSOLIDATED BALANCE SHEETS (in millions, except share and per share data) ASSETS Current assets: Cash and cash equivalents Merchandise inventories, net Current deferred tax assets, net Prepaid expenses and other current assets Total current assets Property, plant and equipment, ... -

Page 58

... 1, 2014 Net income Total other comprehensive loss Issuance of stock under Employee Stock Purchase Plan Exercise of stock options, including income tax benefit of $1.4 Repurchase and retirement of shares Stock-based compensation, net, including income tax benefit of $3.1 Balance at January 31, 2015... -

Page 59

... favorable lease rights Net cash used in investing activities Cash flows from financing activities: Principal payments for long-term debt Proceeds from long-term debt Debt issuance costs Payments for share repurchases Proceeds from stock issued pursuant to stock-based compensation plans Tax benefit... -

Page 60

...form of a 100% common stock dividend. New shares were distributed on June 26, 2012 to shareholders of record as of the close of business on June 12, 2012. Segment Information The Company's retail stores represent a single operating segment based on the way the Company manages its business. Operating... -

Page 61

... a component of "selling, general and administrative expenses" in the accompanying consolidated income statements. Financial Instruments The Company utilizes derivative financial instruments to reduce its exposure to market risks from changes in interest rates and diesel fuel costs. By entering into... -

Page 62

... (i.e., sales tax) on a net (excluded from revenue) basis. Cost of Sales The Company includes the cost of merchandise, warehousing and distribution costs, and certain occupancy costs in cost of sales. Pre-Opening Costs The Company expenses pre-opening costs for new, expanded and relocated stores, as... -

Page 63

... for any penalties associated with tax contingencies unless they are considered probable of assessment. Stock-Based Compensation The Company recognizes expense for all share-based payments to employees based on their fair values. Total stock-based compensation expense for 2014, 2013 and 2012 was $37... -

Page 64

...-term liabilities NOTE 3 - INCOME TAXES Total income taxes were allocated as follows: Year Ended February 1, 2014 $ 357.6 (in millions) Income from continuing operations Shareholders' equity, tax benefit on exercises/vesting of equity-based compensation January 31, 2015 $ 355.0 February 2, 2013... -

Page 65

... tax positions associated with temporary differences, in accordance with ASC 740. A reconciliation of the statutory federal income tax rate and the effective rate follows: Year Ended February 1, 2014 35.0% Statutory tax rate Effect of: State and local income taxes, net of federal income tax benefit... -

Page 66

... Revenue Service ("IRS") Compliance Assurance Program ("CAP") for the 2014 fiscal year and will participate in the program for fiscal year 2015. This program accelerates the examination of key transactions with the goal of resolving any issues before the tax return is filed. Our federal tax returns... -

Page 67

...store and distribution center operating leases (including payments to related parties) included in the accompanying consolidated income statements are as follows: Year Ended February 1, 2014 $ 496.4 1.8 (in millions) Minimum rentals Contingent rentals January 31, 2015 $ 536.5 1.8 February 2, 2013... -

Page 68

... the case is now continuing. In 2012, a former assistant store manager, on behalf of himself and those alleged to be similarly situated, filed a putative class action in a California state court, alleging the Company failed to provide rest breaks to assistant store managers. The alleged time period... -

Page 69

... Family Dollar's CEO and board members alleging breach of fiduciary duty. Dollar Tree and Family Dollar were also named as defendants for allegedly aiding and abetting the other defendants. The claimed breach derives from the execution of the merger agreement dated July 27, 2014, between Dollar Tree... -

Page 70

... line of credit, payable quarterly. The Agreement, among other things, requires the maintenance of certain specified financial ratios, restricts the payment of certain distributions and prohibits the incurrence of certain new indebtedness. On September 16, 2013, the Company amended the Agreement to... -

Page 71

... as current liabilities. On March 3, 2014, the Company repaid the $12.8 million outstanding under the Demand Revenue Bonds and the debt was retired. Forgivable Promissory Note In 2012, the Company entered into a promissory note with the state of Connecticut under which the state loaned the Company... -

Page 72

... was determined based on the weighted average market price of the Company's common stock, less a discount, during a calculation period ending on or before June 2014, subject to a minimum and maximum number of shares. Under this agreement, the Company received 7.8 million shares during the year ended... -

Page 73

... open market in fiscal 2013 and 7.7 million shares for $340.2 million on the open market in fiscal 2012. At January 31, 2015, the Company had $1.0 billion remaining under Board repurchase authorization. NOTE 8 - EMPLOYEE BENEFIT PLANS Profit Sharing and 401(k) Retirement Plan The Company maintains... -

Page 74

... vest over a three-year period with a maximum term of 10 years. Restricted Stock The Company granted 0.5 million, 0.5 million and 0.5 million service-based RSUs, net of forfeitures in 2014, 2013 and 2012, respectively, from the Omnibus Plan to the Company's employees and officers. The fair value of... -

Page 75

... RSUs in 2014, 2013 and 2012, respectively. The estimated fair value of these RSUs was determined using the Company's closing stock price on the grant date. In 2012, the Company granted 0.2 million RSUs with a fair value of $10.0 million from the Omnibus Plan to the Chief Executive Officer of the... -

Page 76

... in 2014, 2013 and 2012 were to directors under the Director Deferred Compensation Plan, vest immediately and are expensed on the grant date. The following tables summarize information about options outstanding at January 31, 2015 and changes during the year then ended. Stock Option Activity January... -

Page 77

... consolidated income statements. The gain, net of tax, was $38.1 million and increased earnings per diluted share for 2012 by $0.16. NOTE 11 - PENDING ACQUISITION AND RELATED DEBT Pending Acquisition On July 27, 2014, the Company executed an Agreement and Plan of Merger to acquire Family Dollar in... -

Page 78

... remain outstanding as of 91 days prior to their stated maturity, in which case the New Revolving Credit Facility and the borrowings under the Term Loan A tranche will mature at such time. The borrowings under the Term Loan B tranche will mature seven years after the closing of the Acquisition. The... -

Page 79

... the Term Loan A tranche of the New Term Loan Facilities after the closing of the Acquisition. NOTE 12 - QUARTERLY FINANCIAL INFORMATION (Unaudited) The following table sets forth certain items from the Company's unaudited consolidated income statements for each quarter of fiscal year 2014 and 2013... -

Page 80

... audited Dollar Tree Inc.'s (the Company) internal control over financial reporting as of January 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management... -

Page 81

...13, 2015 Item 9B. OTHER INFORMATION None. PART III Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE The information concerning our Directors and Executive Officers required by this Item is incorporated by reference in Dollar Tree, Inc.'s Proxy Statement relating to our Annual Meeting... -

Page 82

...Dollar Tree Stores, Inc., Dollar Tree, Inc. and Dollar Tree Merger Sub, Inc., dated February 27, 2008 (Exhibit 2.1 to the Company's February 27, 2008 Current Report on Form 8-K, incorporated herein by this reference). Agreement and Plan of Merger, dated as of July 27, 2014 among Family Dollar Stores... -

Page 83

... the initial purchasers, relating to the 5.250% senior notes due 2020. (Exhibit 4.3 to the Company's February 23, 2015 Current Report on Form 8-K, incorporated herein by this reference). Registration Rights Agreement, dated as of February 23, 2015, by and among Dollar Tree, Inc., Family Tree Escrow... -

Page 84

... Benefit Agreement Between the Company and H. Ray Compton dated October 10, 2013 (filed herewith).* Amendments to the Company's Stock Plans (Exhibit 10.5 to the Company's January 16, 2008 Current Report on Form 8-K, incorporated herein by this reference).* New policy for director compensation... -

Page 85

....1 to the Company's August 15, 2014 Current Report on Form 8-K, incorporated herein by this reference). Form of change in Control Retention Agreement between the Company and David Jacobs, Chief Strategy Officer (Exhibit 10.2 to the Company's July 28, 2012 Quarterly Report on Form 10-Q, incorporated... -

Page 86

...and William A. Old, Jr, Chief Legal Officer and Corporate Secretary (Exhibit 10.2 to the Company's August 3, 2013 Quarterly Report on Form 10-Q, incorporated herein by this reference).* Note Purchase Agreement, dated as of September 16, 2013, among Dollar Tree, Inc., Dollar Tree Stores, Inc. and the... -

Page 87

... under Section 906 of the Sarbanes-Oxley Act 32.1 Statement under Section 906 of the Sarbanes-Oxley Act of Chief Executive Officer 32.2 Statement under Section 906 of the Sarbanes-Oxley Act of Chief Financial Officer 101.0 Interactive Data Files 101.INS XBRL Instance Document 101.SCH XBRL Taxonomy... -

Page 88

... to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. DOLLAR TREE, INC. DATE: March 13, 2015 By: /s/ Bob Sasser Bob Sasser Chief Executive Officer 72 -

Page 89

...Bob Sasser Bob Sasser Title Date Chairman; Director March 13, 2015 Director, Chief Executive Officer (principal executive officer) March 13, 2015 /s/ Thomas A. Saunders, III Thomas A. Saunders, III /s/ J. Douglas Perry J. Douglas Perry /s/ Arnold S. Barron Arnold S. Barron /s/ Mary Anne Citrino... -

Page 90

... a management services company, is a subsidiary of Dollar Tree Stores, Inc. Dollar Tree Stores, Inc., Dollar Tree Distribution, Inc. and Dollar Tree Management, Inc. are Virginia companies. Greenbrier International, Inc. is a Delaware company. The registrant also is the parent company of Dime Merger... -

Page 91

...Form S-8 and registration statement (number 333-61139) on Form S-4 of Dollar Tree, Inc. of our reports dated March 13, 2015, with respect to the consolidated balance sheets of Dollar Tree, Inc. as of January 31, 2015 and February 1, 2014, and the related consolidated income statements and statements... -

Page 92

EXHIBIT 31.1 Chief Executive Officer Certification I, Bob Sasser, certify that: 1. I have reviewed this annual report on Form 10-K of Dollar Tree, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make... -

Page 93

EXHIBIT 31.2 Chief Financial Officer Certification I, Kevin S. Wampler, certify that: 1. I have reviewed this annual report on Form 10-K of Dollar Tree, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary ... -

Page 94

...respects, the financial condition and results of operations of the Company. March 13, 2015 Date /s/ Bob Sasser Bob Sasser Chief Executive Officer A signed original of this written statement required by Section 906 has been furnished to Dollar Tree, Inc. and will be retained by Dollar Tree, Inc. and... -

Page 95

... Exchange Act of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. March 13, 2015 Date /s/ Kevin S. Wampler Kevin S. Wampler Chief Financial Officer A signed original of this written... -

Page 96

[This page left blank intentionally] -

Page 97

[This page left blank intentionally] -

Page 98

-

Page 99

.../investor Investors' Inquiries Requests for interim and annual reports, Forms 10-K, or more information should be directed to: Randy Guiler VP, Investor Relations Dollar Tree, Inc. 500 Volvo Parkway Chesapeake, VA 23320 (757) 321-5284 Or from the Investor Relations section of our Company web site... -

Page 100

500 Volvo Parkway Chesapeake, Virginia 23320 Phone (757) 321-5000 www.DollarTree.com