Dollar Tree 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

In 2011, the Company granted 0.3 million RSUs from the EIP and the EOEP to certain officers of the Company, contingent

on the Company meeting certain performance targets in 2011 and future service of these officers through March 2014. The

Company met these performance targets in fiscal 2011; therefore, the fair value of these RSUs of $7.3 million is being

expensed over the service period or a shorter period based on the retirement eligibility of the grantee. The Company

recognized $0.8 million, $0.9 million and $5.4 million of expense related to these RSUs in 2013, 2012 and 2011,

respectively. The fair value of these RSUs was determined using the Company’s closing stock price on the grant date.

In 2013, the Company granted RSUs with an estimated value of $1.7 million from the Omnibus Plan to certain officers of

the Company. Each officer has the opportunity to earn an amount between zero percent (0%) and two hundred percent (200%)

of the individual target award contingent on the Company meeting certain performance targets for the period beginning on

February 3, 2013 and ending on January 30, 2016. Providing the vesting conditions are satisfied, the awards will vest at the

end of the performance period. The estimated value is being expensed over the performance period or a shorter period based

on the retirement eligibility of the grantee. The Company recognized $1.0 million of expense related to these RSUs in 2013.

The estimated value of these RSUs was determined using the Company's closing stock price on the grant date.

In 2012, the Company granted RSUs with an estimated value of $1.7 million from the Omnibus Plan to certain officers of

the Company. Each officer has the opportunity to earn an amount between zero percent (0%) and two hundred percent (200%)

of the individual target award contingent on the Company meeting certain performance targets for the period beginning on

January 29, 2012 and ending on January 31, 2015. Providing the vesting conditions are satisfied, the awards will vest at the

end of the performance period. The estimated value is being expensed over the performance period or a shorter period based

on the retirement eligibility of the grantee. The Company recognized $0.2 million and $1.0 million of expense related to these

RSUs in 2013 and 2012. The estimated value of these RSUs was determined using the Company's closing stock price on the

grant date.

In 2011, the Company granted RSUs with an estimated value of $0.7 million from the Omnibus Plan to certain officers of

the Company. Each officer has the opportunity to earn an amount between zero percent (0%) and two hundred percent (200%)

of the individual target award contingent on the Company meeting certain performance targets for the period beginning on

January 30, 2011 and ending on February 1, 2014. The estimated value is being expensed over the performance period or a

shorter period based on the retirement eligibility of the grantee. The Company recognized $0.1 million, $0.2 million and $0.4

million of expense related on these RSUs in 2013, 2012 and 2011, respectively. The estimated value of these RSUs was

determined using the Company’s closing stock price on the grant date.

In 2012, the Company granted 0.2 million RSUs with a fair value of $10.0 million from the Omnibus Plan to the Chief

Executive Officer of the Company, contingent on the Company meeting certain performance targets for the period beginning

July 29, 2012 and ending on August 3, 2013 and the grantee completing a five-year service requirement. The fair value of

these RSUs is being expensed ratably over the five-year vesting period. The Company recognized $2.0 million and $1.3

million of expense related to these RSUs in 2013 and 2012. The fair value of these RSUs was determined using the

Company's closing stock price on the grant date.

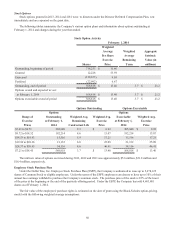

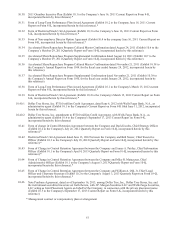

The following table summarizes the status of RSUs as of February 1, 2014, and changes during the year then ended:

Shares

Weighted

Average

Grant

Date Fair

Valu e

Nonvested at February 2, 2013 2,054,173 $ 35.37

Granted 781,883 47.24

Vested (1,026,993) 28.87

Forfeited (85,429) 41.63

Nonvested at February 1, 2014 1,723,634 $ 41.64

In connection with the vesting of RSUs in 2013, 2012 and 2011, certain employees elected to receive shares net of

minimum statutory tax withholding amounts which totaled $18.6 million, $22.1 million and $13.2 million, respectively. The

total fair value of the restricted shares vested during the years ended February 1, 2014, February 2, 2013 and January 28, 2012

was $29.7 million, $26.6 million and $20.9 million, respectively.