Dollar Tree 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

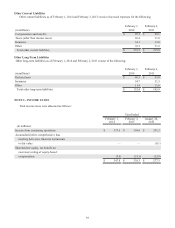

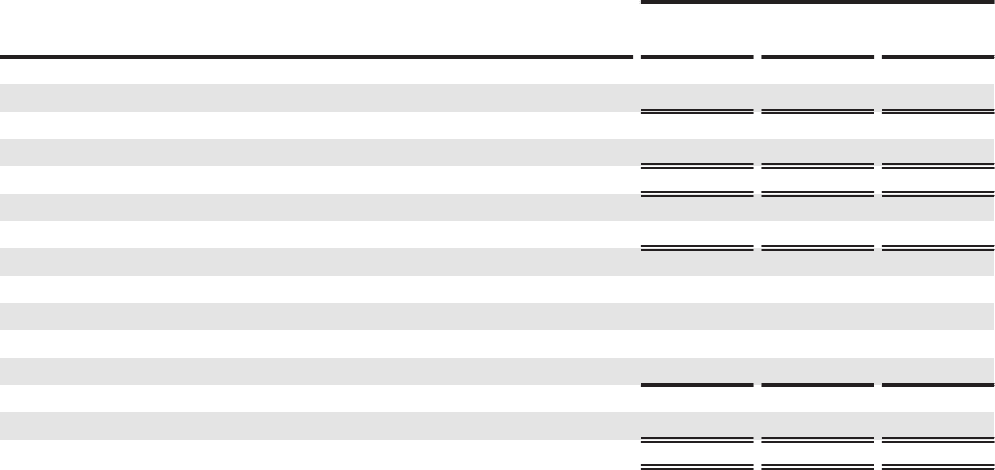

Net Income Per Share

The following table sets forth the calculation of basic and diluted net income per share:

Year Ended

February 1, February 2, January 28,

(in millions, except per share data) 2014 2013 2012

Basic net income per share:

Net income $ 596.7 $ 619.3 $ 488.3

Weighted average number of shares

outstanding 218.1 229.3 240.6

Basic net income per share $ 2.74 $ 2.70 $ 2.03

Diluted net income per share:

Net income $ 596.7 $ 619.3 $ 488.3

Weighted average number of shares

outstanding 218.1 229.3 240.6

Dilutive effect of stock options and

restricted stock (as determined by

applying the treasury stock method) 1.0 1.4 1.8

Weighted average number of shares and

dilutive potential shares outstanding 219.1 230.7 242.4

Diluted net income per share $ 2.72 $ 2.68 $ 2.01

At February 1, 2014, February 2, 2013 and January 28, 2012, substantially all of the stock options outstanding were

included in the calculation of the weighted average number of shares and dilutive potential shares outstanding.

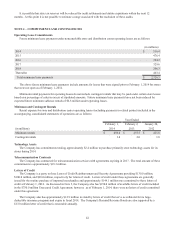

Share Repurchase Programs

The Company repurchases shares on the open market and under Accelerated Share Repurchase agreements.

On September 17, 2013, the Company entered into two $500.0 million variable maturity accelerated share

repurchase agreements to repurchase $1.0 billion of the Company’s common shares in the aggregate. One agreement is

collared and the other is uncollared.

The number of shares to be received by the Company under the collared agreement is determined based on the

weighted average market price of the Company’s common stock, less a discount, during a calculation period ending on

or before June 2014, subject to a minimum and maximum number of shares. Under this agreement, the Company

received 7.8 million shares during the year ended February 1, 2014. This represents the minimum number of shares to

be received based on a calculation using the "cap" or high-end of the price range of the "collar".

The number of shares to be received by the Company under the uncollared agreement is determined based on the

weighted average market price of the Company's common stock, less a discount, during a calculation period ending on

or before June 2014. The Company received an initial delivery of 7.2 million shares during the year ended February

1, 2014. If the actual number of shares to be repurchased under the agreement exceeds the number of shares initially

delivered, the Company will receive the excess shares at the end of the calculation period. If the number of shares

initially delivered exceeds the actual number of shares to be repurchased, the Company will pay or deliver an amount

equal to that excess in either cash or shares at the Company's election. On February 14, 2014 the uncollared agreement

concluded and the Company received an additional 1.9 million shares resulting in a total of 9.1 million shares

repurchased under this agreement.

On November 21, 2011, the Company entered into an agreement to repurchase $300.0 million of the Company’s common

shares under a “collared” Accelerated Share Repurchase Agreement (ASR). Under this agreement, the Company initially

received 6.8 million shares through December 13, 2011, representing the minimum number of shares to be received based on a

calculation using the “cap” or high-end of the price range of the “collar.” The ASR concluded on March 28, 2012 and the

Company received an additional 0.5 million shares under the "collared" agreement resulting in 7.3 million total shares being

repurchased under this ASR. The number of shares is determined based on the weighted average market price of the

Company's common stock, less a discount, during a specified period of time.