Dollar Tree 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

Seasonality and Quarterly Fluctuations

We experience seasonal fluctuations in our net sales, comparable store net sales, operating income and net income and

expect this trend to continue. Our results of operations may also fluctuate significantly as a result of a variety of factors,

including:

• shifts in the timing of certain holidays, especially Easter;

• the timing of new store openings;

• the net sales contributed by new stores;

• changes in our merchandise mix; and

• competition.

Our highest sales periods are the Christmas and Easter seasons. Easter was observed on April 8, 2012, March 31, 2013,

and will be observed on April 20, 2014. We believe that the later Easter in 2014 could result in a $8.0 million increase in sales

in the first quarter of 2014 as compared to the first quarter of 2013. We generally realize a disproportionate amount of our net

sales and of our operating and net income during the fourth quarter. In anticipation of increased sales activity during these

months, we purchase substantial amounts of inventory and hire a significant number of temporary employees to supplement our

continuing store staff. Our operating results, particularly operating and net income, could suffer if our net sales were below

seasonal norms during the fourth quarter or during the Easter season for any reason, including merchandise delivery delays due

to receiving or distribution problems, changes in consumer sentiment or inclement weather.

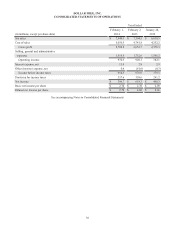

Our unaudited results of operations for the eight most recent quarters are shown in a table in Note 11 of the Consolidated

Financial Statements in Item 8 of this Form 10-K.

Inflation and Other Economic Factors

Our ability to provide quality merchandise at a fixed price and on a profitable basis may be subject to economic factors and

influences that we cannot control. Consumer spending could decline because of economic pressures, including unemployment

and rising fuel prices. Reductions in consumer confidence and spending could have an adverse effect on our sales. National or

international events, including war or terrorism, could lead to disruptions in economies in the United States or in foreign

countries. These and other factors could increase our merchandise costs, fuel costs and other costs that are critical to our

operations, such as shipping and wage rates.

Shipping Costs. Trans-Pacific shipping rates are negotiated with individual freight lines and are subject to fluctuation

based on shipping industry market conditions and fuel costs. We can give no assurances as to the final rate trends for 2014, as

we are in the early stages of our negotiations.

Minimum Wage. Multiple states and local jurisdictions passed legislation that increase their minimum wages in 2014 and

2015 and the federal government has made indications that it may consider increasing the federal minimum wage. As a result,

we believe our expenses could increase unless we are able to offset the increase in payroll costs by operating more effectively

or efficiently.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to various types of market risk in the normal course of our business, including the impact of interest rate

changes and diesel fuel cost changes. We may enter into interest rate or diesel fuel swaps to manage exposure to interest rate

and diesel fuel price changes. We do not enter into derivative instruments for any purpose other than cash flow hedging and we

do not hold derivative instruments for trading purposes.

Diesel Fuel Cost Risk

In order to manage fluctuations in cash flows resulting from changes in diesel fuel costs, we entered into fuel derivative

contracts with third parties. We hedged 2.8 million, 4.8 million and 3.5 million gallons of diesel fuel in 2013, 2012 and 2011,

respectively. These hedges represented approximately 20%, 35% and 31% of our total domestic truckload fuel needs in 2013,

2012 and 2011, respectively. Under these contracts, we pay the third party a fixed price for diesel fuel and receive variable

diesel fuel prices at amounts approximating current diesel fuel costs, thereby creating the economic equivalent of a fixed-rate

obligation. These derivative contracts do not qualify for hedge accounting and therefore all changes in fair value for these

derivatives are included in earnings. We did not have any active fuel derivative contracts as of February 1, 2014.