Dollar Tree 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

plaintiff for an immaterial amount. The Company prevailed at trial in November 2013 with the other plaintiff and is awaiting a

final order and a possible appeal by the plaintiff.

In 2013, a former assistant store manager on behalf of himself and others alleged to be similarly aggrieved filed a

representative PAGA claim under California law currently pending in federal court in California. The suit alleges that the

Company failed to provide uninterrupted meal periods and rest breaks; failed to pay minimum, regular and overtime wages;

failed to maintain accurate time records and wage statements; and failed to pay wages due upon termination of employment.

Discovery has not commenced and no trial date has been set.

In September 2013, district attorneys in California initiated an investigation of whether the Company properly disposed of

certain damaged retail products under Federal and California state environmental law, primarily the Resource Conservation and

Recovery Act. This matter is in early stages of investigation.

The Company will vigorously defend itself in these matters. The Company does not believe that any of these matters will,

individually or in the aggregate, have a material effect on its business or financial condition. The Company cannot give

assurance, however, that one or more of these lawsuits will not have a material effect on its results of operations for the period

in which they are resolved. Based on the information available to the Company, including the amount of time remaining before

trial, the results of discovery and the judgment of internal and external counsel, the Company is unable to express an opinion as

to the outcome of those matters which are not settled and cannot estimate a potential range of loss except as specified above.

When a range is expressed above, the Company is currently unable to determine the probability of loss within that range.

NOTE 5 - LONG-TERM DEBT

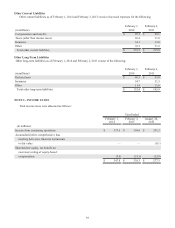

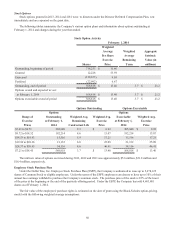

Long-term debt at February 1, 2014 and February 2, 2013 consists of the following:

February 1, February 2,

(in millions) 2014 2013

$750.0 million Senior Notes, $ 750.0 $ —

fixed rate interest payable semi-annually, January 15 and July 15

$750.0 million Unsecured Credit Agreement,

interest payable monthly at LIBOR,

plus 0.90%, which was 1.06% at

February 1, 2014, amounts outstanding payable upon

expiration of the facility in February 2017 — 250.0

Demand Revenue Bonds, interest payable monthly

at a variable rate which was 0.19% at

February 1, 2014, principal payable on

demand, maturing June 2018 12.8 14.3

$7.0 million Forgivable Promissory Note, interest payable

beginning in November 2017 at a rate of 1%,

principal payable beginning November 2017 7.0 7.0

Total long-term debt $ 769.8 $ 271.3

Less current portion 12.8 14.3

Long-term debt, excluding current portion $ 757.0 $ 257.0

Maturities of long-term debt are as follows: 2014 - $12.8 million, 2017 - $0.2 million, 2018 - $1.4 million and after 2018 -

$755.4 million

Senior Notes

The Company entered into a Note Purchase Agreement on September 16, 2013 with institutional accredited investors in

which the Company issued and sold $750.0 million of Senior Notes (the "Notes") in an offering exempt from the registration

requirements of the Securities Act of 1933. The Notes consist of three tranches: $300.0 million of 4.03% Senior Notes due

September 16, 2020; $350.0 million of 4.63% Senior Notes due September 16, 2023; and $100.0 million of 4.78% Senior

Notes due September 16, 2025. Interest on the Notes is payable semi-annually on January 15 and July 15 of each year,