Dollar Tree 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

beginning January 15, 2014. The Notes are unsecured and rank pari passu in right of repayment with the Company's other

senior unsecured indebtedness. The Company may prepay some or all of the Notes at any time in an amount not less than 5% of

the original aggregate principal amount of the Notes to be prepaid, at a price equal to the sum of (a) 100% of the principal

amount thereof, plus accrued and unpaid interest, and (b) the applicable make-whole amount. In the event of a change in

control (as defined in the Note Purchase Agreement), the Company may be required to prepay the Notes. The Note Purchase

Agreement contains customary affirmative and restrictive covenants. The Company used the net proceeds of the Notes to

finance share repurchases.

Unsecured Credit Agreement

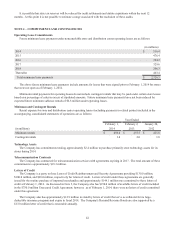

In 2012, the Company entered into an Unsecured Credit Agreement (the Agreement) which provides for a $750.0 million

revolving line of credit, including up to $150.0 million in available letters of credit. The interest rate on the facility is based, at

the Company’s option, on a LIBOR rate, plus a margin, or an alternate base rate, plus a margin. The revolving line of credit

also bears a facilities fee, calculated as a percentage, as defined, of the amount available under the line of credit, payable

quarterly. The Agreement, among other things, requires the maintenance of certain specified financial ratios, restricts the

payment of certain distributions and prohibits the incurrence of certain new indebtedness. As of February 1, 2014 no amount

was outstanding under the $750.0 million revolving line of credit.

On September 16, 2013, the Company amended the Agreement to enable the issuance of the Notes.

Demand Revenue Bonds

In 1998, the Company entered into an unsecured Loan Agreement with the Mississippi Business Finance Corporation

(MBFC) under which the MBFC issued Taxable Variable Rate Demand Revenue Bonds (the Bonds) in an aggregate principal

amount of $19.0 million to finance the acquisition, construction, and installation of land, buildings, machinery and equipment

for the Company's distribution facility in Olive Branch, Mississippi. The Bonds do not contain a prepayment penalty as long as

the interest rate remains variable. The Bonds contain a demand provision and, therefore, are classified as current liabilities.

On March 3, 2014, the Company repaid the $12.8 million outstanding under the Demand Revenue Bonds and the debt was

retired.

Forgivable Promissory Note

In 2012, the Company entered into a promissory note with the state of Connecticut under which the state loaned the

Company $7.0 million in connection with the Company's acquisition, construction and installation of land, building, machinery

and equipment for the Company's distribution facility in Windsor, Connecticut. If certain performance targets are met, the loan

and any accrued interest will be forgiven in fiscal 2017. If the performance targets are not met, the loan and accrued interest

must be repaid over a five-year period beginning in fiscal 2017.

NOTE 6 – DERIVATIVE FINANCIAL INSTRUMENTS

Hedging Derivatives

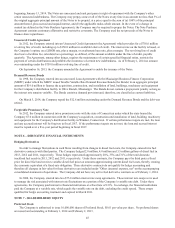

In order to manage fluctuations in cash flows resulting from changes in diesel fuel costs, the Company entered into fuel

derivative contracts with third parties. The Company hedged 2.8 million, 4.8 million and 3.5 million gallons of diesel fuel in

2013, 2012 and 2011, respectively. These hedges represented approximately 20%, 35% and 31% of the total domestic

truckload fuel needs in 2013, 2012 and 2011, respectively. Under these contracts, the Company pays the third party a fixed

price for diesel fuel and receives variable diesel fuel prices at amounts approximating current diesel fuel costs, thereby creating

the economic equivalent of a fixed-rate obligation. These derivative contracts do not qualify for hedge accounting and

therefore all changes in fair value for these derivatives are included under "Other (income) expense, net" on the accompanying

consolidated statements of operations. The Company did not have any active fuel derivative contracts as of February 1, 2014.

In 2008, the Company entered into two $75.0 million interest rate swap agreements. These interest rate swaps were used

to manage the risk associated with interest rate fluctuations on a portion of the Company’s variable rate debt. Under these

agreements, the Company paid interest to financial institutions at a fixed rate of 2.8%. In exchange, the financial institutions

paid the Company at a variable rate, which equals the variable rate on the debt, excluding the credit spread. These swaps

qualified for hedge accounting treatment and expired in March 2011.

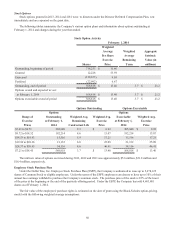

NOTE 7 - SHAREHOLDERS' EQUITY

Preferred Stock

The Company is authorized to issue 10,000,000 shares of Preferred Stock, $0.01 par value per share. No preferred shares

are issued and outstanding at February 1, 2014 and February 2, 2013.