Dollar Tree 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

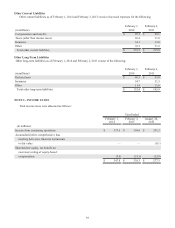

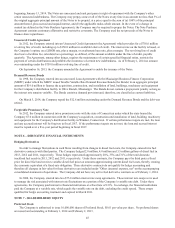

February 1,

2014

February 2,

2013

(in millions)

Deferred tax assets:

Deferred rent $ 38.2 $ 35.6

Accrued expenses 34.2 32.6

Net operating losses and credit carryforwards 19.3 14.4

Accrued compensation expense 29.5 28.2

Other 0.6 0.8

Total deferred tax assets 121.8 111.6

Valuation allowance (6.0)(4.3)

Deferred tax assets, net 115.8 107.3

Deferred tax liabilities:

Property and equipment (46.6)(32.8)

Goodwill (16.9)(15.9)

Prepaid expenses (3.7)(4.0)

Inventory (5.6)(3.8)

Total deferred tax liabilities (72.8)(56.5)

Net deferred tax asset $ 43.0 $ 50.8

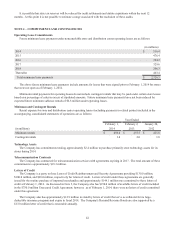

A valuation allowance of $6.0 million, net of federal tax benefits, has been provided principally for certain state credit

carryforwards and net operating loss carryforwards. In assessing the realizability of deferred tax assets, the Company considers

whether it is more likely than not that some portion or all of the deferred taxes will not be realized. Based upon the availability

of carrybacks of future deductible amounts to the past two years’ taxable income and the Company's projections for future

taxable income over the periods in which the deferred tax assets are deductible, the Company believes it is more likely than not

the remaining existing deductible temporary differences will reverse during periods in which carrybacks are available or in

which the Company generates net taxable income.

The company is participating in the Internal Revenue Service (“IRS”) Compliance Assurance Program (“CAP”) for the

2013 fiscal year and has applied to participate for fiscal year 2014. This program accelerates the examination of key

transactions with the goal of resolving any issues before the tax return is filed. Our federal tax returns have been examined and

all issues have been settled through our fiscal 2012 tax year. In addition, several states completed their examination during

fiscal 2013. In general, fiscal years 2010 and forward are within the statute of limitations for state tax purposes. The statute of

limitations is still open prior to 2010 for some states.

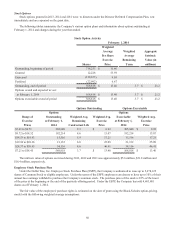

The balance for unrecognized tax benefits at February 1, 2014, was $5.5 million. The total amount of unrecognized tax

benefits at February 1, 2014, that, if recognized, would affect the effective tax rate was $3.6 million (net of the federal tax

benefit). The following is a reconciliation of the Company’s total gross unrecognized tax benefits for the year ended

February 1, 2014:

February 1,

2014

February 2,

2013

Beginning Balance $ 5.6 $ 15.5

Additions, based on tax positions related to current year 0.2 2.5

Additions for tax positions of prior years 0.8 2.1

Reductions for tax positions of prior years (0.2) (3.1)

Settlements (0.3) (1.9)

Lapses in statutes of limitation (0.6) (9.5)

Ending balance $ 5.5 $ 5.6

During fiscal 2013, the Company accrued potential interest of $0.3 million, related to these unrecognized tax benefits. As

of February 1, 2014, the Company has recorded a liability for potential interest of $0.5 million.