Dollar Tree 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

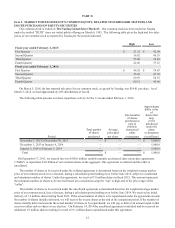

We also repurchased 2.4 million shares of common stock on the open market for $112.1 million in fiscal 2013.

In September 2013 our Board of Directors authorized the repurchase of an additional $2.0 billion of our common stock.

The authorization replaced all previously announced share repurchase authorizations. At February 1, 2014, we had $1.0 billion

remaining under Board repurchase authorization.

For further discussion of our ASRs during 2013, see Item 8 “Financial Statements and Supplementary Data - Note 7 to the

Consolidated Financial Statements” beginning on page 45 of this Form 10-K.

We anticipate that substantially all of our cash flow from operations in the foreseeable future will be retained for the

development and expansion of our business, the repayment of indebtedness and, as authorized by our Board of Directors, the

repurchase of stock. Management does not anticipate paying dividends on our common stock in the foreseeable future.

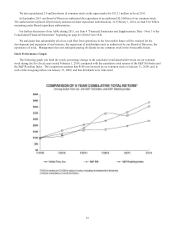

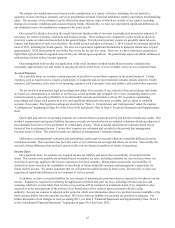

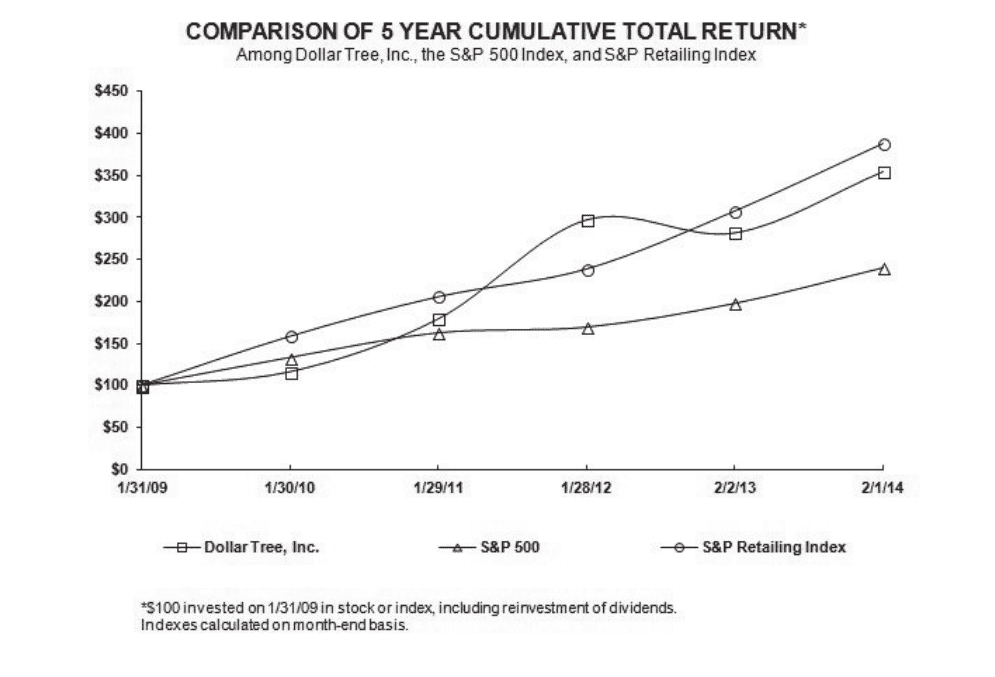

Stock Performance Graph

The following graph sets forth the yearly percentage change in the cumulative total shareholder return on our common

stock during the five fiscal years ended February 1, 2014, compared with the cumulative total returns of the S&P 500 Index and

the S&P Retailing Index. The comparison assumes that $100 was invested in our common stock on January 31, 2009, and, in

each of the foregoing indices on January 31, 2009, and that dividends were reinvested.