DHL 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

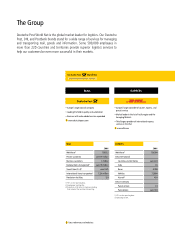

Source: Thomson Financial, December 2006

21% United Kingdom

6% France

4% Switzerland

20% Germany

9% Other

3% Italy

1%

Netherlands

36% USA

Regional distribution of identified

institutional investors

Share of foreign investors growing

Our shareholder structure underwent a signicant change in . Free oat rose

again as a result of the disposal of further shares by KfW. e regional distribution

also changed: e share of investors in English-speaking countries rose signicantly,

both as a percentage and in absolute terms. of institutional investors are now

from the United States and the United Kingdom, with Germany only accounting

for .

Targeted communication with capital markets

As in previous years, we kept up our intensive communication with the capital

markets in . Attention in the second half of the year focused on the EXPRESS

and LOGISTICS Divisions, for each of which we held an investors’ day in December.

A year aer the Exel takeover, John Murray Allan and his team presented themselves,

their strategy and achievements to date. John P. Mullen outlined his expanded area

of responsibility, encompassing the entire EXPRESS segment. Both events were

broadcast live and are available in recorded form on our website.

Change in reporting

We have restructured our report this year in line with new statutory requirements.

Information on dividend and equity changes and on our ownership structure is now

contained in the Group Management Report. e outcomes of this year’s Annual

General Meeting are covered in the Corporate Governance section.

18

19

20

21

22

23

24

25

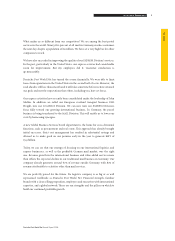

€

30-day moving average

Nov. 2006Oct. 2006Sept. 2006Aug. 2006July 2006June 2006May 2006April 2006March 2006Feb. 2006Jan. 2006

the highest price for the week

the lowest price for the week

opening or closing price

opening or closing price

body is black if stock closed lower,

body is white if it closed higher

Dec. 2006

Candlestick graph/30-day moving average

Pages 43 and 53

Page 94f

9

Deutsche Post World Net Annual Report 2006

The Group

Deutsche Post Stock