ComEd 2001 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

The agreements also provide for the option to purchase 2,698 megawatts of oil and gas-fired capacity, and 944 megawatts

of peaking capacity, subject to reduction.

Generation has entered into PPAs with AmerGen, under which it will purchase all the energy from Unit No. 1 at Three

Mile Island Nuclear Station (TMI) after December 31, 2001 through December 31, 2014. Under a 1999 PPA, Generation will

purchase from AmerGen all of the residual energy from the Clinton Nuclear Power Station (Clinton), through December 31,

2002. Currently, the residual output approximates 25% of the total output of the Clinton.

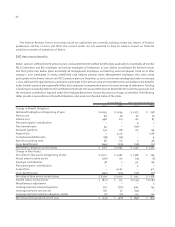

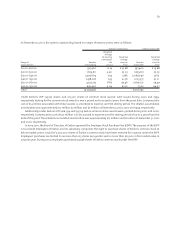

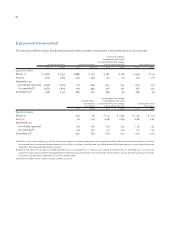

At December 31, 2001, Exelon had long-term commitments, relating to the purchase and sale of energy, capacity and

transmission rights from unaffiliated utilities and others, including the Midwest Generation and AmerGen contracts, as

expressed in the following tables:

Transmission

Capacity Rights Power Only Power Only

Purchases Purchases Purchases Sales

2002 $ 1,005 $ 139 $ 551 $ 1,803

2003 1,214 31 345 666

2004 1,222 15 346 219

2005 406 15 264 139

2006 406 5 250 58

Thereafter 3,657 – 2,321 22

Total $ 7,910 $ 205 $ 4,077 $ 2,907

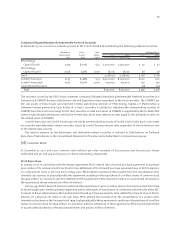

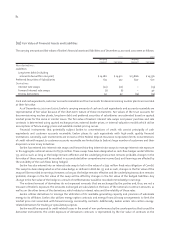

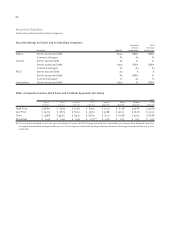

Environmental Issues

Exelon’s operations have in the past and may in the future require substantial capital expenditures in order to comply with

environmental laws. Additionally, under Federal and state environmental laws, Exelon, through its subsidiaries, is generally

liable for the costs of remediating environmental contamination of property now or formerly owned by Exelon and of

property contaminated by hazardous substances generated by Exelon. Exelon owns or leases a number of real estate

parcels, including parcels on which its operations or the operations of others may have resulted in contamination by

substances which are considered hazardous under environmental laws. Exelon has identified 72 sites where former

manufactured gas plant (MGP) activities have or may have resulted in actual site contamination. Exelon is currently

involved in a number of proceedings relating to sites where hazardous substances have been deposited and may be subject

to additional proceedings in the future.

As of December 31, 2001 and 2000, Exelon had accrued $156 million and $172 million, respectively, for environmental

investigation and remediation costs, including $127 million and $140 million, respectively, for MGP investigation and

remediation, that currently can be reasonably estimated. Included in the environmental investigation and remediation cost

obligation as of December 31, 2001 and 2000 is $100 million and $110 million, respectively, that has been recorded on a

discount basis, (reflecting discount rates of 5.5%). Such estimates, reflecting the effects of a 3% inflation rate before the

effects of discounting were $154 million and $170 million at December 31, 2001 and 2000, respectively. Exelon anticipates

that payments related to the discounted environmental investigation and remediation costs, recorded on an undiscounted

basis, of $68 million will be incurred for the five-year period through 2006. Exelon cannot reasonably estimate whether it

will incur other significant liabilities for additional investigation and remediation costs at these or additional sites

identified by Exelon, environmental agencies or others, or whether such costs will be recoverable from third parties.