ComEd 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

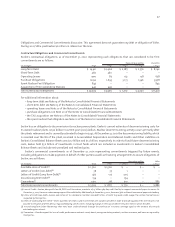

The 2001 common stock dividend payments of $583 million cover the period from October 20, 2000, the date of the Merger,

through November 15, 2001. On January 29, 2002, the Board of Directors of Exelon declared a quarterly dividend of $0.44 per

share of Exelon’s common stock. This increase of $0.07 per share annually, will result in an annual dividend rate of $1.76 per

share. The new dividend rate reflects Exelon’s vertically integrated business portfolio and its focus on total return to

shareholders. The new dividend rate represents about a 50% payout of the expected 2002 earnings per share from Exelon’s

regulated electricity delivery businesses. Exelon intends to grow the dividend to about a 60% payout of earnings from

regulated operations based on cash flow and earnings growth prospects for Energy Delivery. The payment of future

dividends is subject to approval and declaration by the Board of Directors each quarter.

Credit Issues

Exelon meets its short-term liquidity requirements primarily through the issuance of commercial paper by Exelon, ComEd

and PECO. Exelon, along with ComEd,PECO and Generation entered into a $1.5 billion unsecured revolving credit facility with

a group of banks. Generation currently cannot borrow under the credit agreement until it has delivered audited financial

statements to the banks, which is expected to occur in the first quarter of 2002. This credit facility is used principally to

support the commercial paper program of Exelon, ComEd and PECO.

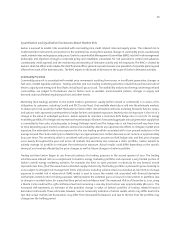

At December 31, 2001, Exelon had outstanding $360 million of notes payable consisting principally of commercial paper.

For 2001, the average interest rate on notes payable was approximately 2.63%. Certain of the credit agreements to which

Exelon, ComEd,PECO and Generation are parties require each of them to maintain a debt to total capitalization ratio of 65%

or less, excluding securitization debt (and for PECO, excluding the receivable from parent recorded in PECO’s shareholders’

equity). At December 31, 2001, the debt to total capitalization ratios on that basis for Exelon, ComEd, PECO and Generation

were 47%, 45%, 38% and 26%, respectively.

Exelon and its subsidiaries’ access to the capital markets, including the commercial paper market,and their financing costs

in those markets are dependent on their respective securities ratings. None of Exelon’s or its subsidiaries’ borrowings are

subject to default or prepayment as a result of a downgrading of securities ratings although such a downgrading could

increase interest charges under Exelon’s bank credit facility. Exelon and its subsidiaries from time to time enter into interest

rate swap and other derivatives that require the maintenance of investment grade ratings. Failure to maintain investment

grade ratings would allow the counterparty to terminate the derivative and settle the transaction on a net present value basis.

Exelon has obtained an order from the Securities and Exchange Commission (SEC) under the Public Utility Holding

Company Act of 1935 (PUHCA) authorizing financing transactions, including the issuance of common stock, preferred

securities, long-term debt and short-term debt in an aggregate amount not to exceed $4 billion. As of December 31, 2001

$3.0 billion of financing authority is available under the SEC order. Exelon requested, and the SEC reserved jurisdiction over,

an additional $4 billion in financing authorization. Exelon agreed to limit its short-term debt outstanding to $3 billion of

the $4 billion total financing authority. Exelon has asked the SEC to eliminate the short-term debt restriction. The SEC order

also authorized Exelon to issue guarantees of up to $4.5 billion outstanding at any one time. At December 31, 2001, Exelon

had provided $1.4 billion of guarantees. See Contractual Obligations and Commercial Commitments in this section. The SEC

order requires Exelon to maintain a ratio of common equity to total capitalization (including securitization debt) on and

after June 30, 2002 of not less than 30%. At December 31, 2001, Exelon’s common equity to total capitalization was 35%.

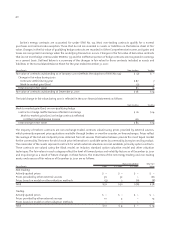

Under PUHCA and the Federal Power Act, Exelon, ComEd, PECO and Generation can pay dividends only from retained or

current earnings. However, the SEC order granted permission to Exelon and ComEd to pay up to $500 million in dividends

out of additional paid-in capital, provided that Exelon agreed not to pay dividends out of paid-in capital after December 31,

2002 if its common equity is less than 30% of its total capitalization. At December 31, 2001, Exelon had retained earnings of

$1.2 billion, which includes ComEd retained earnings of $257 million, PECO retained earnings of $270 million and Generation

retained earnings of $471 million. Exelon is also limited by order of the SEC under PUHCA to an aggregate investment of $4

billion in exempt wholesale generators (EWGs) and foreign utility companies (FUCOs). Exelon requested, and the SEC

reserved jurisdiction over, an additional $1.5 billion in EWGs and FUCOs.

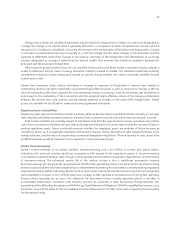

During 2001, Exelon loaned Sithe $150 million, which was repaid by Sithe in December of 2001 from the proceeds of

a bank borrowing. In connection with that bank borrowing, Exelon provided the lenders with a support letter confirming

its investment in Sithe and Exelon’s agreement to maintain a positive net worth of Sithe. Sithe’s net worth is expected

to remain positive for the foreseeable future and accordingly this agreement is not reflected in the following Contractual